TL;DR Summary

CoreWeave (CRWE:NASDAQ) third-quarter report confirms explosive growth—but also exposes a balance sheet running hot.

Revenue doubled year-on-year to $1.36 billion, backlog swelled to $55.6 billion, and adjusted EBITDA hit $838 million(61 % margin).

Yet the company is now carrying $8.7 billion in debt and paying $310 million in quarterly interest, revealing that CoreWeave has become a capital-heavy AI-infrastructure utility rather than a lightweight cloud startup.

At $CRWV ≈ $105, the stock already prices in a near-bull scenario; our fair-value model centers near $90 per share.

Quarter Recap

For the quarter ended September 30 2025:

- Revenue: $1.364 billion (+134 % YoY)

- Adj. EBITDA: $838 million (61 % margin)

- Net loss: $110 million (–$0.22 EPS)

- Interest expense: $310 million

- CapEx: $1.85 billion

- Backlog: $55.6 billion (+271 % YoY)

Management reiterated that “demand for CoreWeave’s platform continues to exceed available capacity,” but acknowledged construction delays at a third-party facility that could push revenue into Q1 2026.

Key Highlights

- 💾 Scale: 590 MW active / 2.9 GW contracted capacity

- 🤝 Clients: OpenAI, Meta, Anthropic—anchor AI tenants

- 💰 Financing: ≈ $14 billion secured debt + equity to date

- 🏗️ CapEx run-rate: ≈ $7 billion annualized

- 📊 Backlog visibility: multi-year revenue coverage through 2027

Updated SWOT Analysis & Price Impact

🧠 Updated SWOT

Strengths (+10 – 20 %)

- Massive $55 B backlog, 61 % EBITDA margin, and first-mover advantage in AI-optimized cloud.

Weaknesses (–15 – 25 %)

- $8 B debt load and $300 M quarterly interest burn.

- Persistent capex drag limits near-term free cash flow.

Opportunities (+20 – 35 %)

- Secular AI-compute demand and long-term contracts with OpenAI, Meta, and Anthropic.

- Potential shift from training spikes to recurring inference workloads.

Threats (–20 – 30 %)

- Execution risk from data-center delays.

- Refinancing or rate exposure.

- Hyperscaler competition as NVIDIA supply normalizes.

Overall, CoreWeave remains the purest listed proxy for AI-compute demand, but its financial structure now demands operational precision rather than just growth.

⚖️ The investment picture

At around $105 per share, $CRWV trades near 11 times enterprise value to sales — a premium multiple that assumes smooth execution and sustained GPU scarcity.

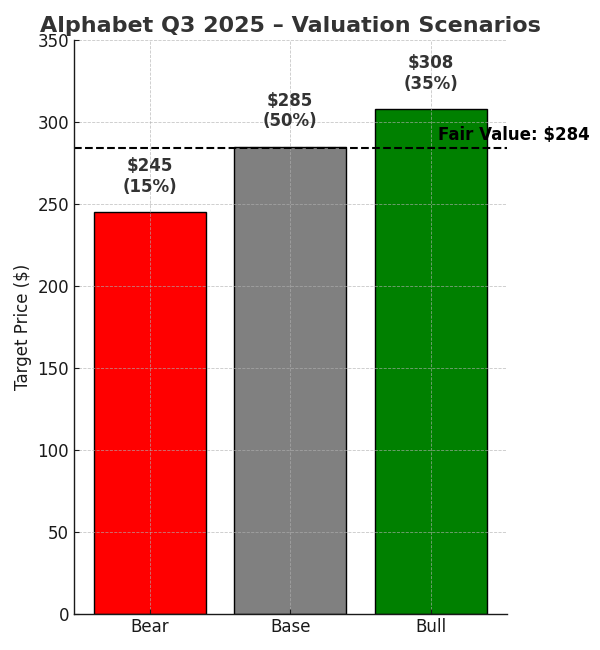

Based on confirmed data and realistic assumptions:

- In a bull case, where demand stays hot and margins expand, the stock could approach $135 a share.

- In a base case, assuming balanced growth and slower capex, fair value sits around $90 a share.

- In a bear case, where delays and refinancing pressure bite, the price could compress toward $50 a share.

Our probability-weighted fair value lands near $90 per share, suggesting the stock is already priced for near-best-case outcomes.

Verdict

CoreWeave has evolved from a nimble startup into a capital-intensive AI utility—and markets are treating it as such.

The company’s operating performance is stellar, but $8 B of debt and $300 M per-quarter interest make flawless execution non-negotiable.

At $105, CRWV is already priced for near-bull outcomes; our base-case fair value around $90 suggests a balanced risk/reward rather than deep undervaluation.

Upside to $130 requires both smooth facility ramp-up and sustained AI compute scarcity through 2026.

Call to Action

Growth-oriented investors should monitor:

- Q4 delivery timelines for the delayed data centers.

- Refinancing terms & interest coverage as rates stay high.

- Utilization rates > 90 % as the key profitability signal.

For indirect exposure, consider NVIDIA, Vertiv, or Super Micro Computer as liquid public proxies for the AI-infrastructure theme.

Disclaimer

This analysis uses only CoreWeave’s official Q3 2025 financial release, filings, and management commentary.

It is not investment advice and is for educational purposes only.

All price targets and valuations are illustrative and subject to change as new data emerges.

Leave a comment