We turn complex earnings reports into clear SWOT insights—so you instantly see a company’s strengths, risks, and valuation outlook. No jargon. No hype. Just the facts that matter.

At SWOTstock, we decode every earnings season using the SWOT framework—Strengths, Weaknesses, Opportunities, and Threats—highlighting what’s working, what’s not, and what could change a stock’s future. Whether you’re tracking tech innovation, searching for undervalued opportunities, or just want to invest with confidence, you’ll get concise, fact-based analysis built directly from company reports and earnings calls.

- Based 100% on official filings and transcripts

- SWOT + valuation for every stock we cover

- Updated quarterly

Our goal is to give you transparent, structured analysis. So you can make smarter decisions—and avoid emotional investing.

See our latest posts

NVIDIA Q4 FY2026 Earnings: AI Dominance Intact — Is the Stock Still Underpricing the Cycle?

TL;DR Summary NVIDIA (NVDA:NASDAQ) delivered another explosive quarter, with Q4 revenue up 73% year-over-year and Data Center revenue surging 75%. Gross margins remain near 75%, and management guided to $78B in next-quarter revenue — even excluding China data center compute revenue. The AI infrastructure cycle is clearly not over. Based on official financials and management guidance,…

Berkshire Hathaway FY2025: Still a Compounding Machine — But Is There Enough Margin of Safety?

Berkshire Hathaway’s FY2025 results showed a slight decline in operating earnings and increased insurance volatility, yet the company holds a record cash position of over $370B. With disciplined capital allocation under CEO Greg Abel, the stock trades near its intrinsic value at around $500 per share, offering limited margin of safety for value investors.

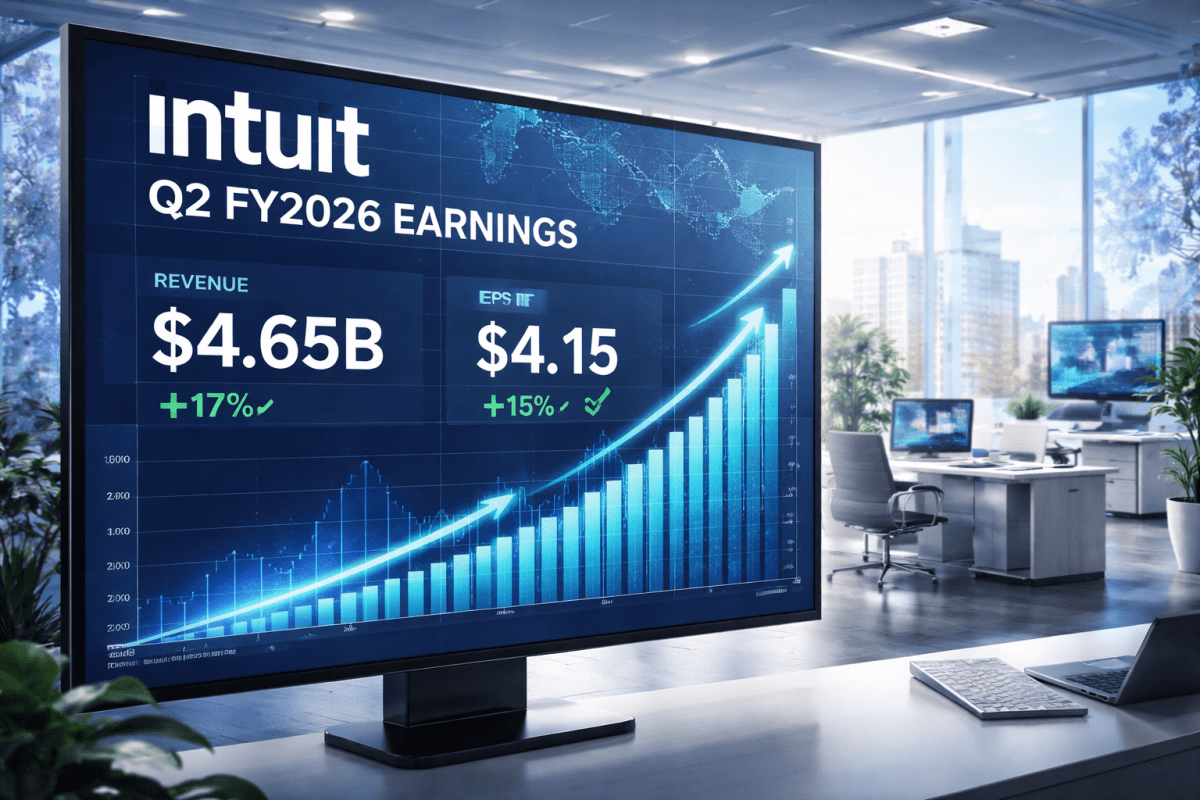

Intuit Q2 FY2026 Earnings: Strong Growth, Softer Guidance — Is the AI Tax Giant Mispriced?

Intuit reported a strong Q2 FY2026 with 17% revenue growth, meeting full-year guidance despite weakened near-term profit expectations affecting stock prices. Trading around $400 per share, its valuation is considered low for its growth potential. Analysts are debating whether market fears over AI disruptions are warranted or an overreaction.