🧭 TL;DR Summary

Cisco (CSCO:NASDAQ) delivered a strong start to fiscal 2026: revenue rose 8 % to $14.9 billion and non-GAAP EPS jumped 10 % to $1.00. Management raised full-year guidance on accelerating AI-network orders and early progress integrating Splunk. Yet, after the 6 – 8 % post-earnings surge, Cisco trades well above its historic valuation range. For value investors, it remains a reliable dividend engine—but hardly a bargain at $74.

📅 Quarter Recap

- Revenue: $14.9 billion (+8 % YoY)

- GAAP EPS: $0.72 (+6 %) Non-GAAP EPS: $1.00 (+10 %)

- Gross Margin: 65.5 % (GAAP) / 68.1 % (non-GAAP)

- Operating Cash Flow: $3.2 billion (–12 % YoY)

- Shareholder Returns: $2 billion buybacks + $0.41 dividend

- Guidance: FY 2026 revenue ≈ $60.6 billion; non-GAAP EPS $4.08 – 4.14

AI-driven switching orders, stronger software renewals, and Splunk integration boosted confidence, while recurring subscription revenue rose to 44 % of total sales—proof that Cisco’s transformation is gaining traction.

🔍 Key Highlights

- AI Infrastructure Momentum: Backlog > $1 billion in AI network orders.

- Subscription Strength: Security + observability software sustain recurring growth.

- Margin Discipline: Gross margins above 65 % despite input inflation.

- Capital Returns: Consistent buybacks and ~2 % dividend yield signal balance-sheet strength.

- Execution Watch: Operating cash flow fell 12 %, and analysts seek clearer AI-revenue disclosure before assigning higher multiples.

💪 SWOT Analysis (with estimated price impact ranges)

Strengths (+8 % to +12 %)

Cisco’s expanding recurring-revenue base and tight cost control anchor earnings stability. Its balance sheet is debt-light and supports steady buybacks and dividends—attributes valued by income investors.

Weaknesses (–5 % to –8 %)

Hardware still drives over 40 % of sales, leaving results exposed to ordering cycles. Operating cash flow slid 12 %, reflecting inventory timing and working-capital drag. Without transparent AI-revenue reporting and faster cash-conversion, valuation upside is hard to justify.

Opportunities (+10 % to +15 %)

AI-infrastructure spending offers a fresh growth lane. The Silicon One platform and Splunk integration can unlock new data and security use cases, while Hypershield subscriptions could lift software margins 1 – 2 points. Execution on these fronts may re-rate Cisco toward 15× earnings.

Threats (–7 % to –10 %)

Rivals such as Arista, Palo Alto Networks, and Juniper’s Mist unit are capturing AI-network share faster. Cisco’s portfolio breadth can appear complex to customers seeking simpler cloud-native solutions. Macro slowdown or AI-capex pause would test both hardware and optics segments.

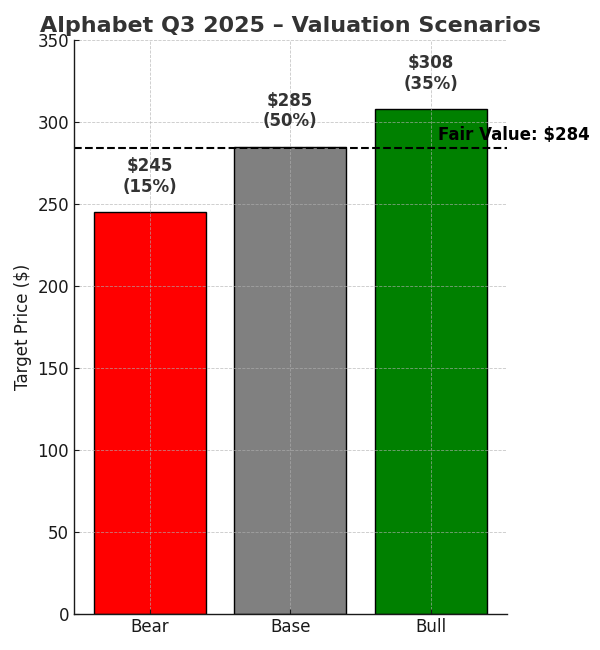

📈 Valuation Scenarios (Based on FY 2026 Guidance)

Bull Case (~30 % probability)

- AI network revenue grows +10 %, software margins expand 100 bps.

- EPS ≈ $4.20, 15× multiple → fair value ≈ $63.

- Requires strong backlog conversion and clear AI execution proof.

Base Case (~50 %)

- 6 % steady growth, EPS ≈ $4.10, 14× multiple → fair value ≈ $57.

- Most probable path given guidance and macro conditions.

Bear Case (~20 %)

- Flat revenue and AI order delays, EPS ≈ $3.80, 12× multiple → fair value ≈ $46.

- Reflects execution or macro slippage.

Weighted Fair Value: ≈ $58 per share (~8 % below current $74 price).

🔭 Forward Checkpoints to Monitor

- Q2 AI-network bookings growth and conversion rate.

- Recurring revenue as % of total (45 % target watch).

- Cash-flow recovery trend and Splunk synergy delivery.

- Competitive pricing in Ethernet and optics segments.

💡 Verdict

Cisco’s AI story is credible but largely priced in. At ~18× forward earnings, shares sit above their five-year average. Cash generation remains solid and the dividend safe, yet the margin of safety is thin after the rally.

- Fair Price: ≈ $58 / share

- Buy-Under Level: ≈ $55

- Action: Hold for income; wait for a pullback before adding.

📣 Call to Action

Dividend investors should keep Cisco on their watchlist but avoid chasing momentum. Add on weakness below $55 to lock in a better yield and valuation margin.

⚖️ Disclaimer

This analysis is based solely on Cisco Systems’ official Q1 FY 2026 financial report and earnings call materials. It is for informational purposes only and not investment advice. Always verify figures with official sources and consider personal risk tolerance before investing.

Leave a comment