TL;DR Summary

Apple finally broke its flat-growth streak.

Revenue climbed 8 % y/y to $102.5 billion, EPS reached $1.85 (+9 %), and Services hit a record $28.75 billion.

Guidance for the holiday quarter calls for +10–12 % growth, reigniting belief that Apple Intelligence is more than a buzzword.

For growth investors, this quarter marks Apple’s return to the AI-led expansion narrative.

Quarter Recap

After four quarters of muted growth, Apple delivered what Tim Cook called “our strongest lineup ever.”

The iPhone 17 launch, deeper ecosystem engagement, and record Services revenue lifted results well above expectations.

Gross margin expanded to 47.2 %, net income rose to $24.2 billion, and Apple declared another $0.26 dividend while continuing aggressive buybacks.

Beyond the numbers, the tone of the call signaled confidence: management expects the December quarter to be the best holiday season in Apple’s history.

That optimism—and the 6 % share-price jump that followed—suggests investors finally see Apple’s AI strategy taking shape.

Key Highlights

- Services: $28.75 B (+15 %) — now 28 % of total revenue and driving margin expansion.

- iPhone: $49.0 B (+6 %) — AI-capable models leading upgrade cycle.

- Mac / iPad: Flat to down slightly as users wait for AI refreshes.

- Geography: Greater China $14.5 B (+3 %) — showing early stabilization.

- Guidance: Revenue +10–12 %, gross margin 47–48 % next quarter.

(Note: Apple’s 8 % revenue growth trails Microsoft’s +12 % and Google’s +10 %, but represents its strongest acceleration since 2022.)

How Apple Intelligence Actually Creates Value

For now, “Apple Intelligence” isn’t a separate subscription—it’s a device-pull engine.

AI-driven features such as natural-language photo search, cross-app summaries, and on-device personal assistance require the latest hardware chips (A18, M4).

That design forces upgrades and feeds Services usage. Apple plans to layer paid tiers later, turning AI into a recurring revenue lever by FY 2026.

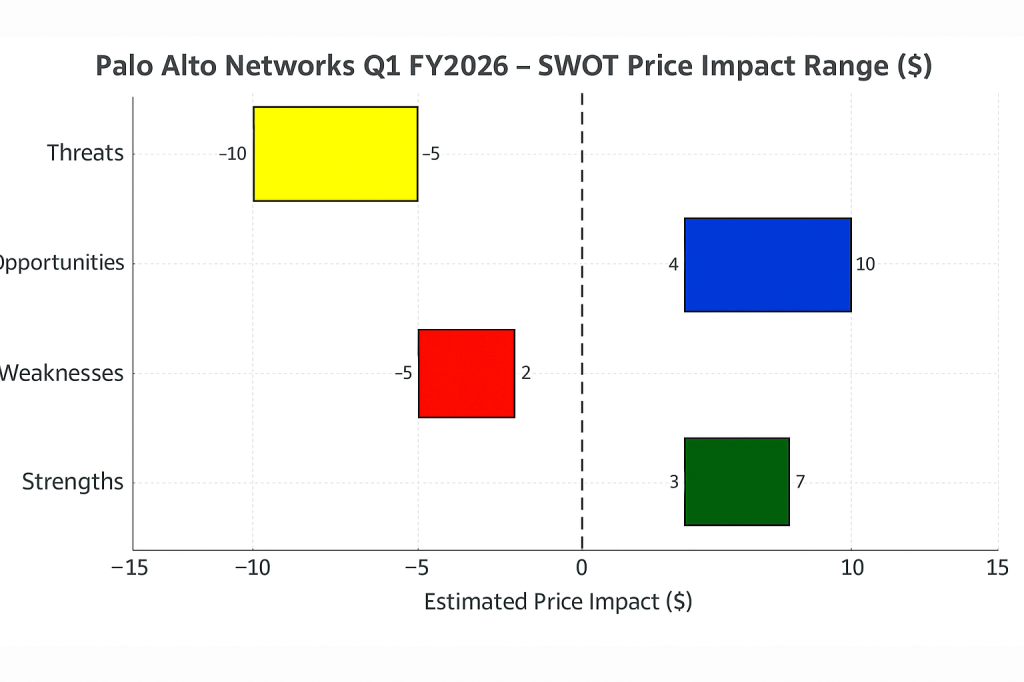

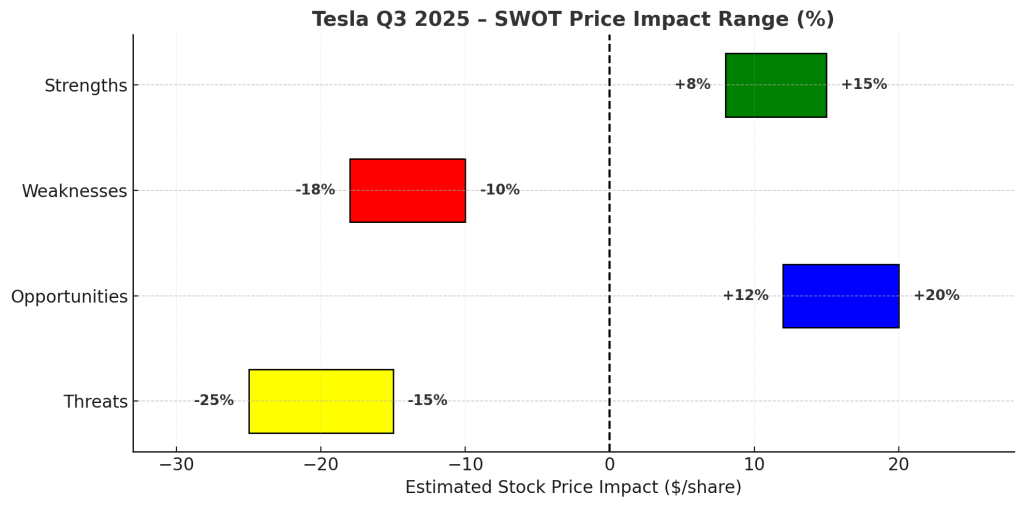

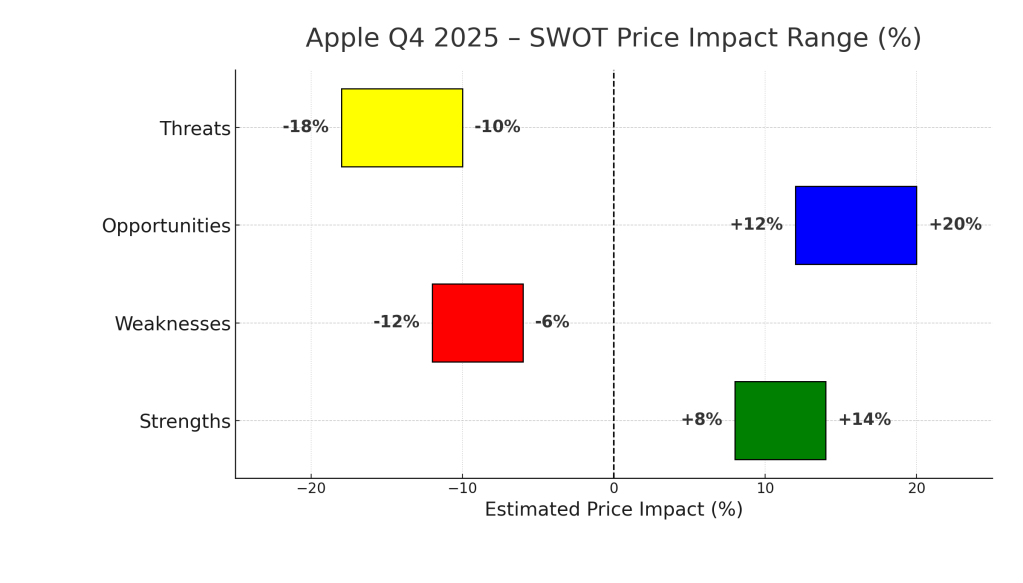

SWOT Analysis — Estimated Price Impact

Strengths (+6 to +12 %)

A 2.2 billion-device installed base and record Services margin growth create durable pricing power.

AI-ready devices expand average selling prices and lift gross margin.

→ + $15 – $30 per share

Weaknesses (–5 to –10 %)

Hardware still ≈ 48 % of sales; tariffs and China competition pressure margins.

AI monetization lag keeps near-term EPS growth modest.

→ – $13 – $26 per share

Opportunities (+10 to +18 %)

AI integration across devices and services bundles can boost ARPU by 5–8 %.

Emerging-market FinTech and subscriptions expand TAM.

→ + $20 – $36 per share

Threats (–8 to –15 %)

Regulation (EU DMA, App Store fees), supply-chain relocation costs, and AI competition remain real headwinds.

→ – $18 – $32 per share

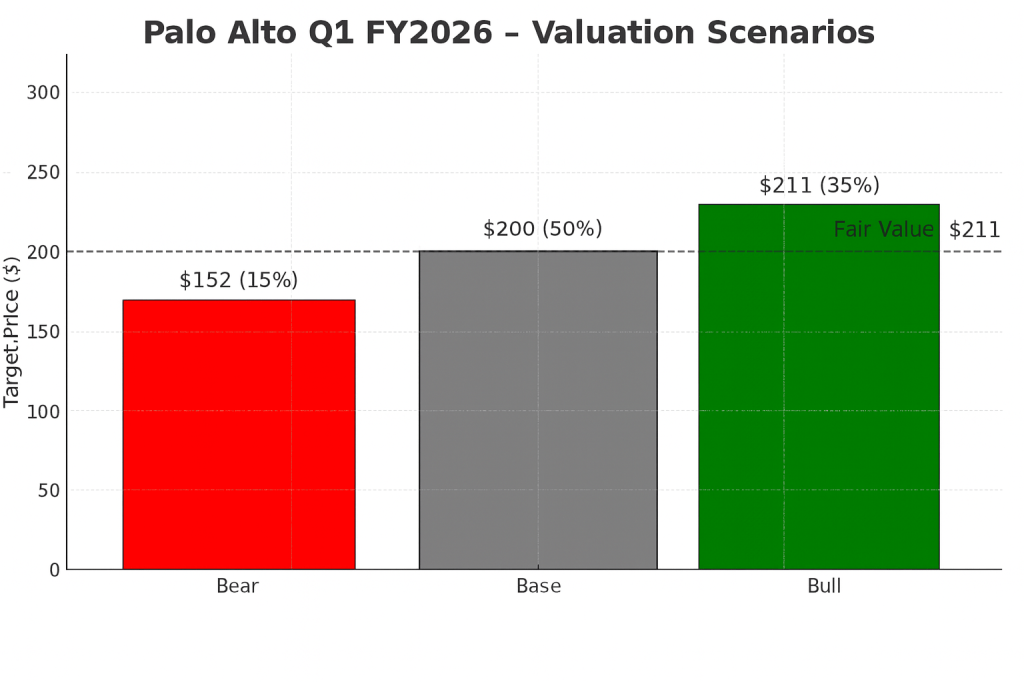

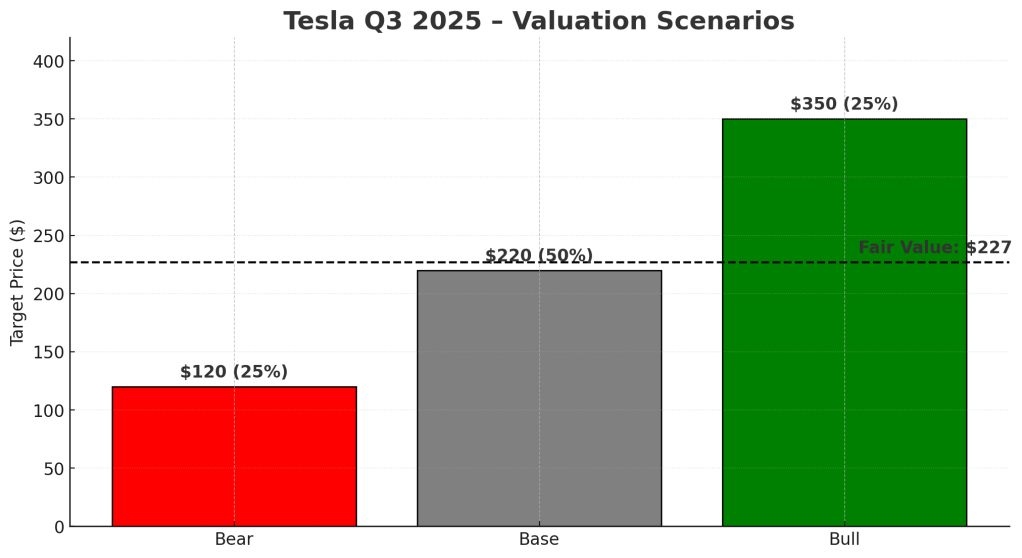

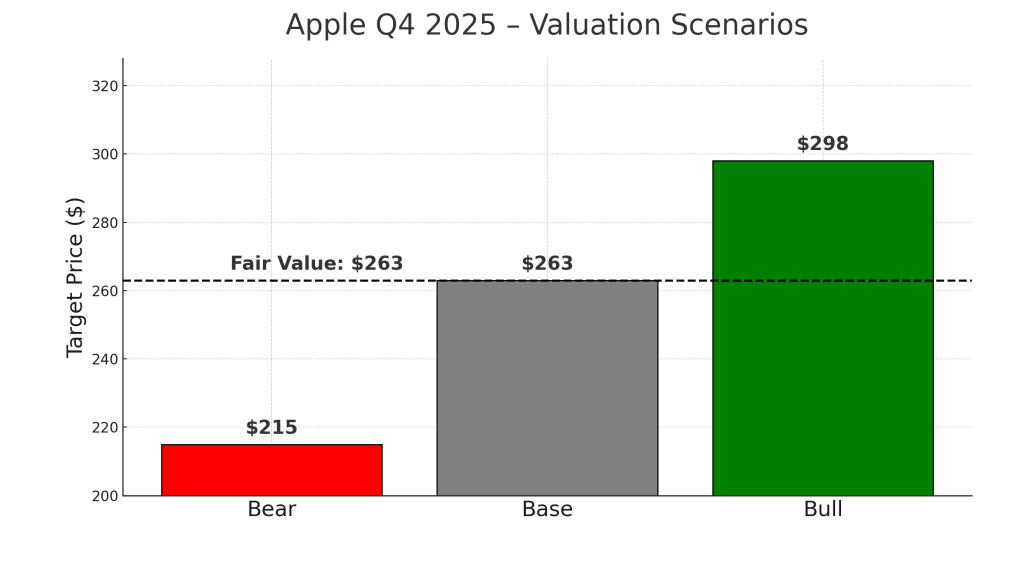

Valuation Scenarios

Apple’s fair value clusters around $270, but outcomes vary depending on how quickly its AI ecosystem monetizes.

Here’s how the road ahead could play out:

- Bull Case ($305, ~30 % probability):

Apple executes on AI integration, driving 12 % EPS growth and pushing Services beyond 30 % of total revenue.

The market rewards it with a premium multiple near 32×. - Base Case ($270, ~50 % probability):

EPS grows about 8 % as AI demand builds gradually.

The stock trades around 29× earnings — roughly where it sits today. - Bear Case ($230, ~20 % probability):

China softness, regulation, and muted AI monetization limit EPS to +3 %.

Multiple compresses to 25× as investors rotate to faster-growing peers.

➡️ Fair Value Estimate: ≈ $272.5 per share, balancing these three outcomes.

Verdict

At ≈ $270, Apple is fairly valued with a clear path to earnings expansion.

Growth investors should hold core positions and add on dips near $230–240.

The next inflection point arrives mid-2026, when AI features begin contributing revenue and Apple could justify a re-rating to 32–34× P/E ($285–295 target).

If Apple proves that Intelligence sells devices — not just headlines — $300 may come sooner than bears expect.

What to Watch Next

- Adoption metrics for Apple Intelligence features in real-world use.

- Services ARPU growth and subscription renewal rates.

- China unit sales momentum post-holiday quarter.

- Margin management as $1.4 B tariff cost hits Q1.

(Visual Placeholder #5 – Peer Comparison Table: Apple vs Microsoft vs Alphabet Growth and Margins)

Call to Action

Follow SWOTstock for AI-era earnings analysis of Amazon, Microsoft, and Tesla as we track how AI execution reshapes Big Tech leadership.

Subscribe for alerts when next-quarter AI scorecards drop.

Disclaimer

This analysis uses only Apple Inc.’s official Q4 FY 2025 financial report and earnings call.

It is for informational purposes only and not investment advice.