TL;DR Summary

Netflix’s (NASDAQ: NFLX) Q3 2025 results delivered record revenue of $9.62 billion (+12.6 % YoY) and operating income of $2.27 billion (+18 %), but a $619 million tax expense in Brazil clipped EPS to $4.25, below expectations.

Despite a 6 % after-hours drop, management reaffirmed margin and cash-flow guidance, and the ad-tier business is scaling faster than expected. The fundamentals remain strong — the market reaction was all sentiment.

Quarter Recap

- Revenue: $9.62 B (+12.6 % YoY)

- Operating Margin: 23.6 % (up 1.1 pts)

- Net Income: $1.94 B (+15 %)

- EPS: $4.25 (+14 %)

- Free Cash Flow: $1.7 B (slightly lower on $18 B content spend)

- Paid Memberships: 282 M (+9 %)

- Ad-tier Share: ≈ 16 % of new sign-ups (vs 9 % in Q2)

- Regional Growth: APAC +22 %, LATAM +18 %, EMEA +10 %, UCAN +8 %

Key Highlights and Management Comments

Greg Peters (Co-CEO):

“Our ad-supported plan is scaling faster than expected. We’re now live in 15 markets, and we expect this to be a multi-billion-dollar business by 2026.”

Spencer Neumann (CFO):

“We’re on track for roughly $7 billion in free cash flow this year, even after increasing content investment to $18 billion.”

Ted Sarandos (Co-CEO):

“AI is improving localization, dubbing, and recommendations — helping creators reach global audiences, not replacing them.”

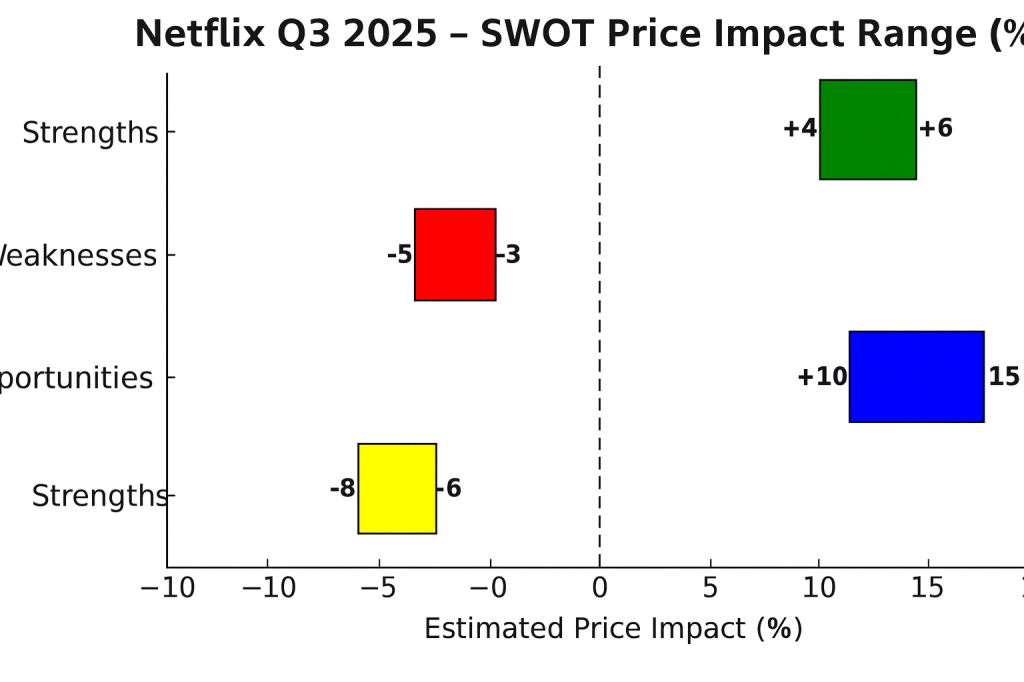

SWOT Analysis

Before breaking down Netflix’s quarter into strengths, weaknesses, opportunities, and threats, it’s useful to step back and look at what really moved the numbers this time. Q3 2025 wasn’t a story about subscriber growth or content costs alone — it was about a business transitioning into a more diversified, margin-focused platform. The sudden tax hit added noise, but underneath, Netflix is shaping a clearer long-term trajectory.

The SWOT framework highlights how each of these forces may translate into real price impact for investors.

Strengths

- Ad-tier scaling ahead of plan (+8 – 12 %)

- Operating margin expanding (+4 – 6 %)

- Solid subscriber growth (+3 – 5 %)

Weaknesses

- Heavy content spend pressures FCF (–3 – 5 %)

- UCAN saturation limits pricing (–2 – 3 %)

Opportunities

- Global ad expansion (15 markets, 16 % of sign-ups) (+10 – 15 %)

- AI-powered localization & discovery (+4 – 6 %)

- Gaming and live content diversification (+2 – 3 %)

Threats

- Brazil tax dispute (–6 – 8 %)

- Streaming competition (–4 – 6 %)

- FX headwinds in LATAM (–2 – 3 %)

Net Impact: ≈ +1.5 – 2 % upside vs current price.

SWOT Price Impact Chart for Netflix Q3 2025 showing estimated price impact ranges for each SWOT factor.

Valuation Scenarios (Q4 2025 – Mid 2026 Horizon)

With the SWOT picture in place, the next step is understanding how these drivers translate into valuation. Netflix is no longer purely a high-growth streaming play; it’s a hybrid model balancing global expansion, ad monetization, and AI-driven efficiency. Each scenario—bull, base, and bear—reflects a different path the company could take depending on execution, competitive pressure, and regulatory risks.

The following valuation scenarios show how those paths map to price targets and a probability-weighted fair value.

Bull Case (35 %)

- Ad-tier accelerates; margin 25 % +; EPS >$6 → Target $1,450 (+17 %)

Base Case (45 %)

- Stable 7 % subscriber growth; margin 24 % → Target $1,250 (+1 %)

Bear Case (20 %)

- Tax drag repeats; churn rises; cost inflation → Target $1,000 (–19 %)

Fair Value: Weighted Average ≈ $1,270

Current Price: ≈ $1,240 → +2.4 % Upside

Valuation Scenarios Chart for Netflix Q3 2025 displaying Bear, Base, and Bull targets with a fair-value line at $1,270.

Verdict

Netflix is shifting from a subscriber-growth story to a profit-platform narrative.

The 6 % post-earnings drop looks more like a valuation reset than a fundamental issue.

If the Brazil tax charge proves one-off, Q3 2025 may mark the start of a more sustainable, AI-enhanced growth chapter.

Short-term: Hold / Accumulate on weakness

Medium-term: Attractive for growth investors eyeing AI and ad-tier upside

Call to Action

👉 Follow SWOTstock for AI-driven SWOT analyses of top global companies.

📈 Stay ahead of the market with data-driven insights simplified for retail investors.

Disclaimer

This analysis is based solely on Netflix’s official Q3 2025 financial statements and earnings call materials. It is for educational and informational purposes only and does not constitute investment advice.

Leave a comment