TL;DR Summary

NVIDIA delivered another explosive quarter, with Q3 FY2026 revenue hitting $57.0 billion, up 62% year-over-year and 22% sequentially, fueled by a massive surge in demand for Blackwell-based data center GPUs. Gross margins held at 73.4%, and management guided Q4 revenue to $65 billion, signaling confidence that AI infrastructure demand continues to rise faster than supply. The key question for investors is whether this momentum is sustainable — or if the supercycle is nearing a peak.

Quarter Recap

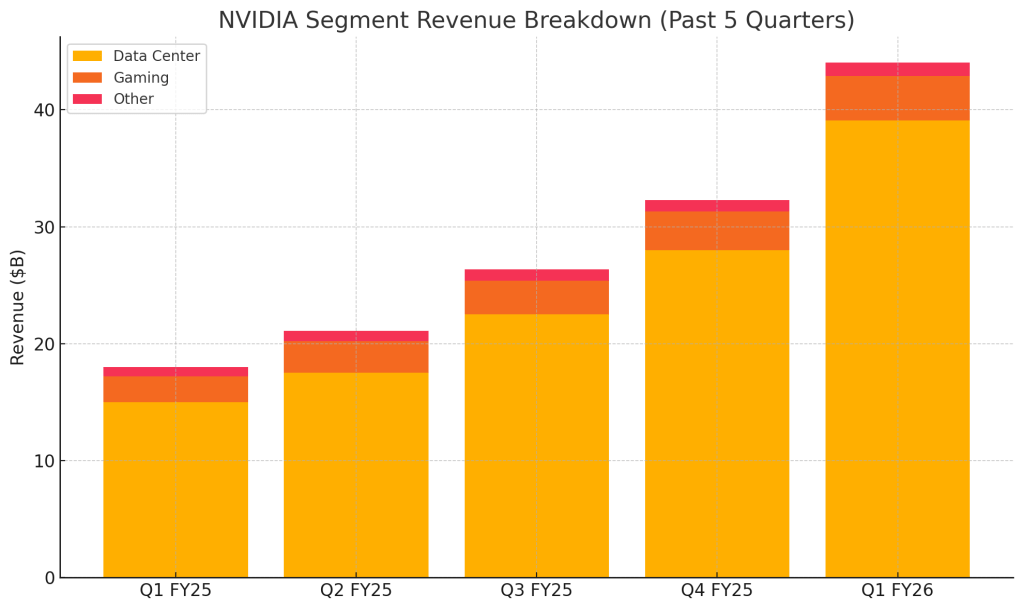

NVIDIA posted a record quarter driven overwhelmingly by its data center franchise. Revenue came in at $57.0 billion, up sharply from last year, with the data center business alone contributing $51.2 billion. Growth remained broad and robust across cloud providers, enterprise customers, and AI platform deployments. Gross margins stayed very strong at 73.4%, reflecting favorable product mix and pricing power.

GAAP diluted EPS was $1.30, supported by scale efficiency and tight expense control. During the earnings call, management noted that demand for the new Blackwell architecture remains “off the charts,” with cloud GPU capacity effectively sold out. NVIDIA also emphasized that its Q3 results and Q4 guidance exclude shipments of the H20 GPU to China, meaning the company is operating at record levels without one of its formerly significant regions.

Key Highlights

- Record Revenue: $57.0B (+62% YoY, +22% QoQ)

- Data Center Strength: $51.2B (+66% YoY, +25% QoQ)

- Margins: GAAP gross margin of 73.4%

- EPS: GAAP diluted EPS of $1.30

- Guidance: Q4 revenue expected at $65.0B ± 2%

- Demand Update: Blackwell GPUs remain supply-constrained

- China: No H20 shipments included in guidance; China remains upside optionality

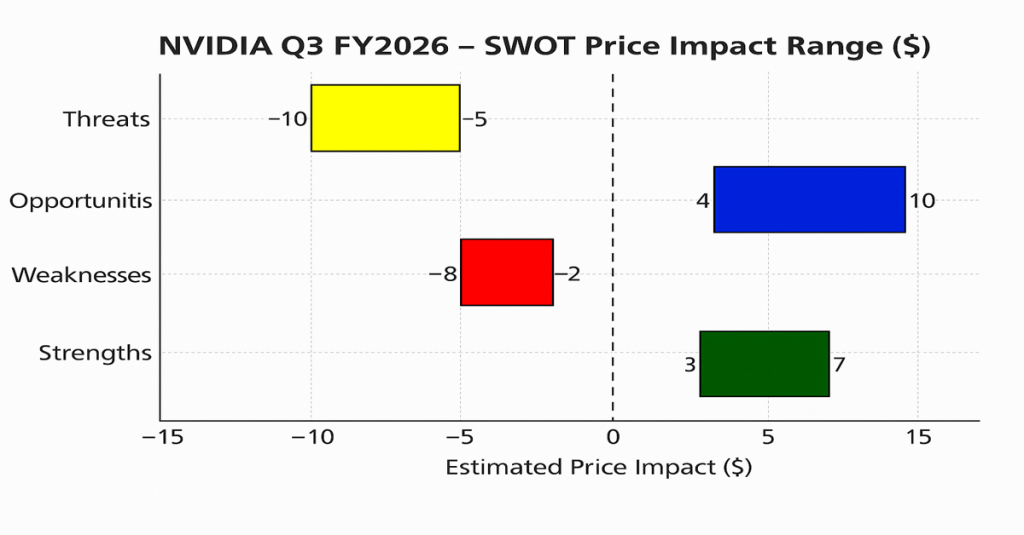

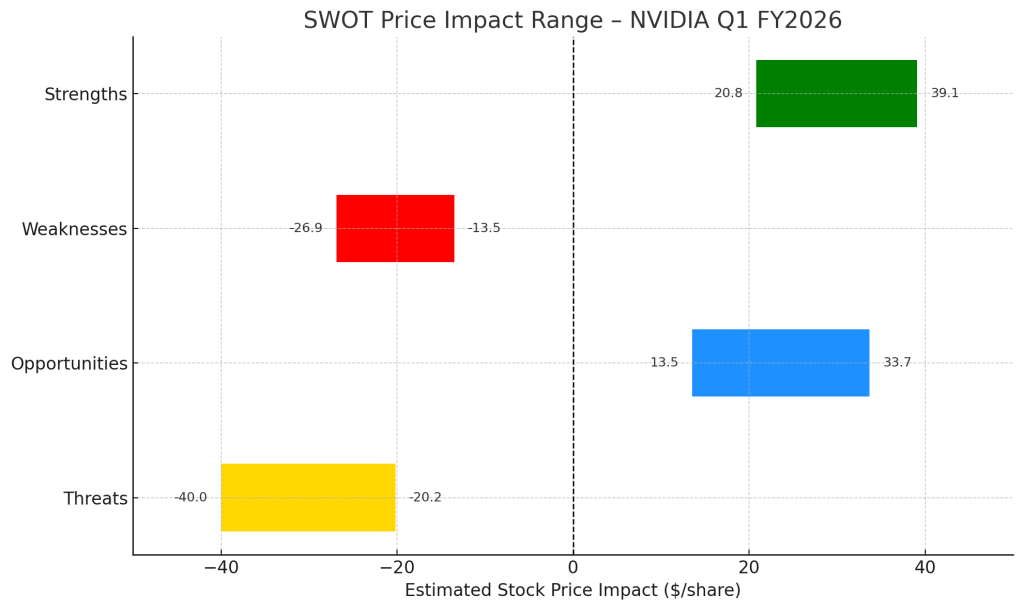

SWOT Analysis

Strengths (+12% to +22%)

NVIDIA’s leadership in AI infrastructure was reinforced by the rapid adoption of Blackwell, which pushed data center revenue to new highs. Margins remain exceptional, and demand continues to exceed supply.

Weaknesses (–8% to –14%)

Revenue is heavily concentrated in the data center segment, increasing sensitivity to a slowdown. Supply constraints and regulatory uncertainties around China limit near-term visibility.

Opportunities (+15% to +28%)

Guidance for Q4 implies another major step-up in revenue. Any resumption of shipments to China, as well as expansion into new AI computing platforms, provides further upside.

Threats (–12% to –20%)

Export controls remain a material risk. Competition from custom silicon and hyperscaler in-house chips could eventually pressure margins. NVIDIA’s premium valuation makes the stock more vulnerable to sharp reactions if growth moderates.

SWOT Table

Strengths: +12% to +22%

Weaknesses: –8% to –14%

Opportunities: +15% to +28%

Threats: –12% to –20%

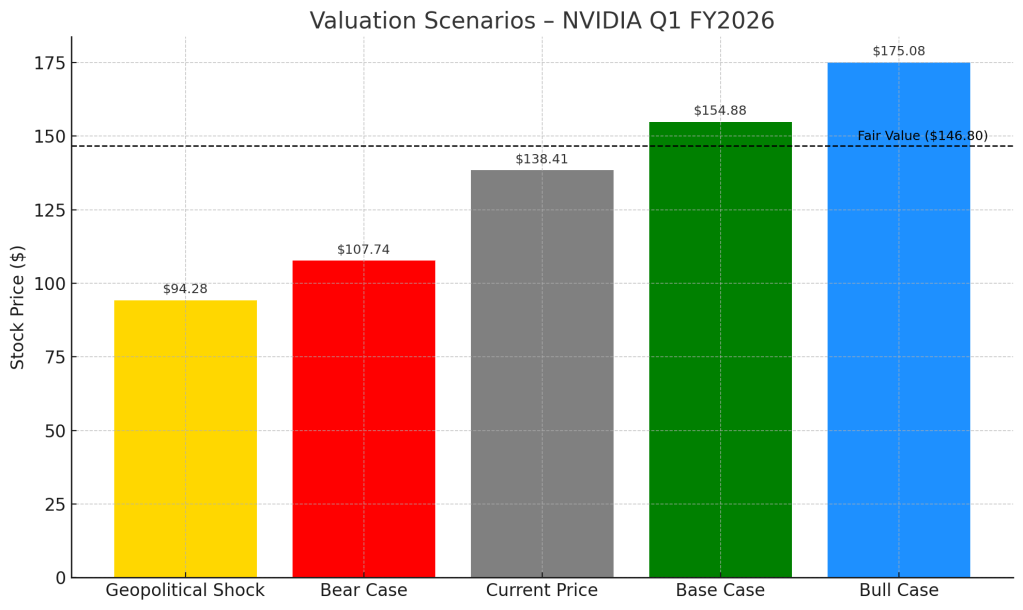

Valuation Scenarios

Using only NVIDIA’s Q3 FY2026 report and Q4 guidance:

Bull Case — $450 (30% probability)

- Q4 revenue lands above the top end of guidance

- Margins track toward the high end of expectations

- Some China shipments resume

- Forward EPS: ~$6.00

- P/E: 75×

Base Case — $325 (50% probability)

- Q4 meets the midpoint of guidance

- Margins remain stable near Q3 levels

- No China upside

- Forward EPS: ~$5.40

- P/E: 60×

Bear Case — $215 (20% probability)

- Q4 hits the lower end of guidance

- Supply bottlenecks linger

- Export restrictions tighten

- Forward EPS: ~$4.80

- P/E: 45×

Probability-Weighted Fair Value

= $340–$345 per share

Verdict

NVIDIA’s Q3 results confirm that the AI infrastructure cycle is still extending, not slowing. The company continues to execute exceptionally well, with demand for Blackwell far outstripping supply and Q4 shaping up to be another record quarter.

For growth-oriented investors, the setup remains compelling: official guidance alone justifies a fair value well above the current trading price. However, the stock’s trajectory will remain sensitive to export-control developments and any sign that hyperscalers may shift more workloads to in-house silicon.

Call to Action

If you’re a long-term growth investor who believes the AI compute buildout remains in its early stages, NVIDIA still represents one of the clearest large-cap plays on that trend. Use earnings revisions, regulatory headlines, and market volatility to your advantage — and consider staging entries rather than chasing peaks.

Disclaimer

This analysis is for informational purposes only and is based solely on NVIDIA’s official Q3 FY2026 earnings release, earnings call transcript, and management commentary. It is not investment advice. Please conduct your own research or consult a financial professional before making investment decisions.

Leave a comment