TL;DR Summary

NVIDIA (NASDAQ: NVDA) delivered record-breaking Q1 revenue powered by AI infrastructure demand, but a $4.5B China-related inventory charge exposed its vulnerability to export regulations. Strong outlook continues, but geopolitical risks cap near-term upside.

Quarter Recap

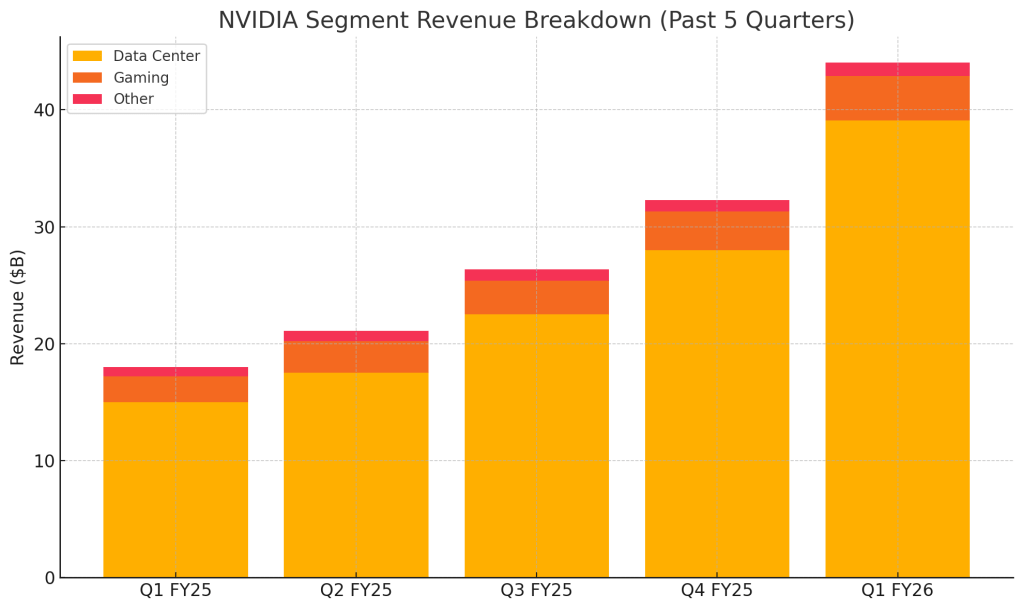

NVIDIA reported a stellar Q1 FY2026 with $44.06 billion in revenue, up 69% year-over-year, driven primarily by its Data Center segment which surged to $39.1 billion. The company’s full-stack AI platform, from Blackwell GPUs to CUDA software, continues to lead the industry.

However, a $4.5 billion inventory charge—triggered by U.S. export restrictions on H20 chips to China—cut into GAAP gross margin, bringing it down to 61.0%. Without this one-off, margins would have reached 71.3%.

CEO Jensen Huang maintained a confident tone, citing global momentum for AI compute and strong enterprise demand. Q2 guidance sits at $45 billion in revenue, despite an expected $8 billion China shortfall.

What Changed Since Last Quarter

- Revenue jumped 18% from Q4 FY2025’s $37.98B

- China export losses increased and led to a $4.5B inventory charge

- Blackwell ramp-up continued, now complemented by global AI partnerships

- Margins would have improved sequentially if not for the export charge

Key Highlights

- Revenue: $44.06B (+69% YoY, +18% QoQ)

- Data Center Revenue: $39.1B (+73% YoY)

- Gaming Revenue: $3.8B (+42% YoY)

- Gross Margin (ex. H20 charge): 71.3%

- Inventory Charge: $4.5B related to H20 China restrictions

- Q2 Outlook: $45B revenue, ~$8B loss from China bans

Segment Revenue Breakdown

NVIDIA’s Q1 FY2026 results show that its Data Center business has become the overwhelming growth engine, with Gaming rebounding and smaller segments contributing steadily.

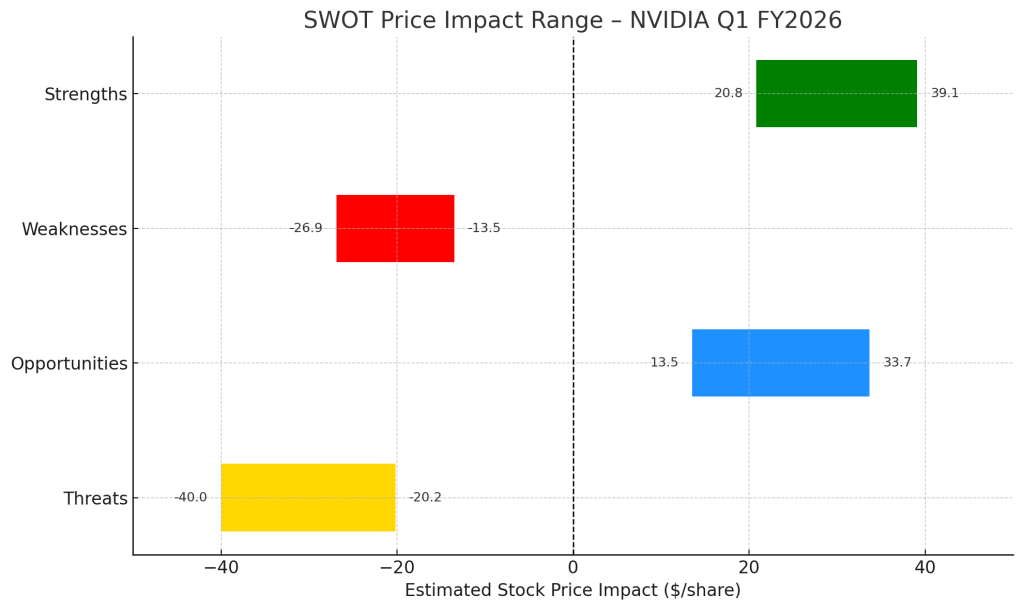

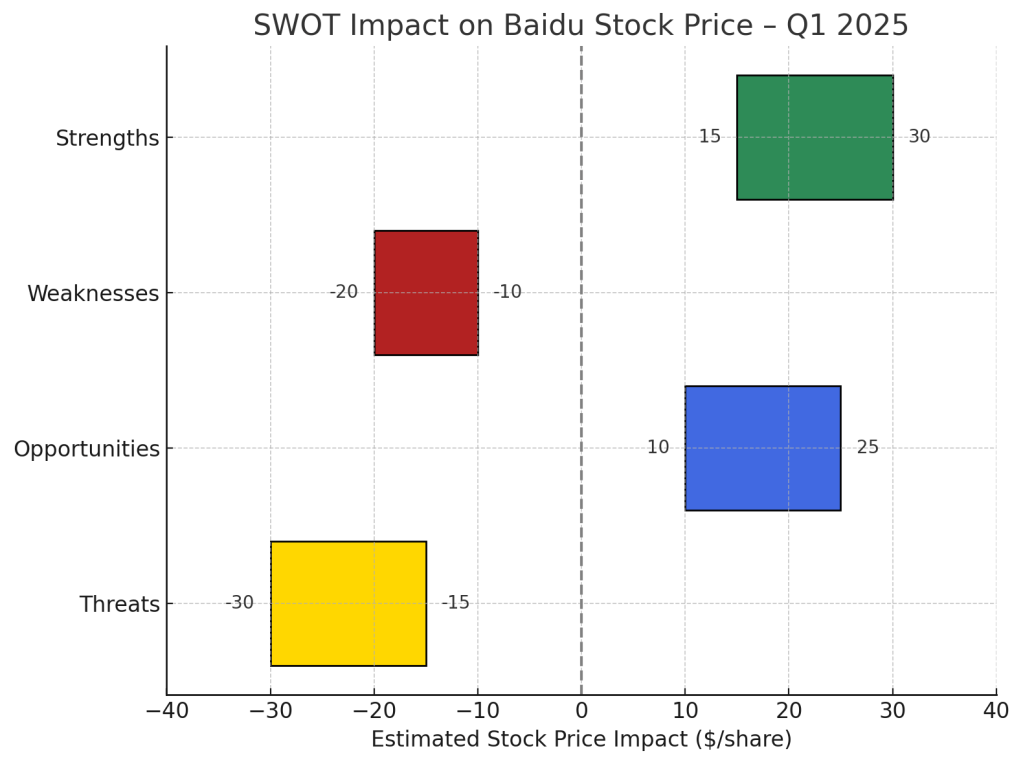

SWOT Analysis with Price Impact

Strengths

NVIDIA’s dominance in AI infrastructure remains unchallenged. Its platform—from Blackwell chips to CUDA and software libraries—continues to see record enterprise demand.

Price Impact: +15% to +30%

Weakness

The $4.5B write-down tied to H20 inventory for China highlights dependency on export-sensitive products.

Price Impact: –10% to –20%

Opportunities

New AI alliances with Saudi Arabia, UAE, and Taiwan, along with platform expansion via NIM (Inference Microservices), open large future markets.

Price Impact: +10% to +25%

Threats

China restrictions are set to cost $8B in Q2 revenue. Further geopolitical escalation may erode future sales or strain global operations.

Price Impact: –15% to –30%

SWOT Summary

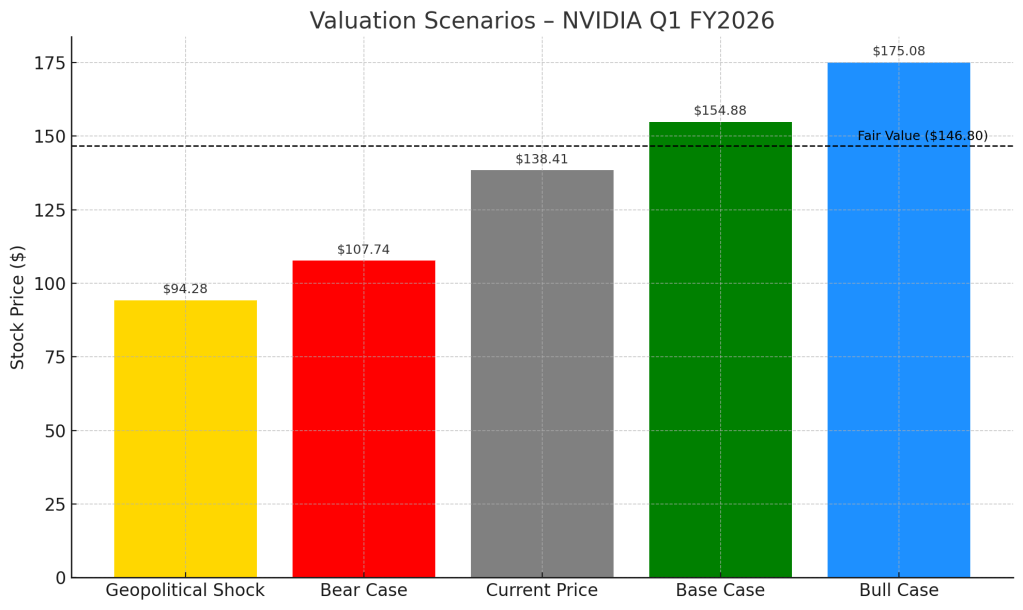

What’s NVIDIA Worth After Q1 FY2026?

To value NVIDIA after its blockbuster Q1 FY2026 earnings, we consider three realistic scenarios for its forward earnings power—each reflecting a different blend of AI infrastructure growth, export risks, and margin execution.

Bull Case – $412.50/share (25% probability)

In the most optimistic scenario, NVIDIA ramps Blackwell faster than expected and U.S. export restrictions ease, allowing China sales to partially recover. Enterprise demand for generative AI compute remains red-hot globally, lifting both volumes and pricing. If earnings rise to $7.50 per share and the market awards a 55x multiple (consistent with high-growth AI comps), the stock could reach $412.50. While aggressive, this case reflects NVIDIA’s AI platform expanding into global infrastructure—and we assign it a 25% probability.

Base Case – $307.20/share (60% probability)

The base case assumes NVIDIA continues executing well, with growth sustained in the U.S., Middle East, and Asia-Pacific (excluding China). Blackwell adoption progresses on schedule, but China restrictions persist. Margins remain strong, but headline volatility lingers. We estimate forward EPS at $6.40 and apply a P/E of 48x—slightly below peak valuation—yielding a $307.20 price target. This scenario reflects the most likely outcome given current guidance and market conditions.

Bear Case – $200.00/share (15% probability)

In a downside case, AI capex moderates, China-related risks escalate, and competitors gain share in inference or custom silicon. NVIDIA faces pricing pressure or slower enterprise uptake. If forward EPS falls to $5.00 and valuation compresses to 40x, the stock could be re-rated to $200. While less likely in the near term, we assign this outcome a 15% probability due to macro and geopolitical uncertainties.

Valuation Scenarios Summary

Fair Value Estimate: $308.95

Weighted across all three outcomes, our fair value estimate for NVIDIA is $308.95 per share—more than double its current price of ~$133.59 (as of June 2025). That implies significant long-term upside, especially if export risks stabilize and Blackwell adoption broadens globally.

(0.25 × $412.50) + (0.60 × $307.20) + (0.15 × $200.00) = $308.95

What to Watch Next Quarter

- Ramp-up of Blackwell shipments outside China

- Progress on AI factory partnerships in UAE and Saudi Arabia

- Margin recovery trends

- Policy developments in U.S.-China tech export restrictions

Verdict

NVIDIA remains the cornerstone of AI infrastructure. Q1 FY2026 reaffirms its growth engine, but investors should watch for regulatory headwinds. For growth stock investors, it’s a strong hold and a potential buy on dips.

Call to Action

📬 Like this kind of breakdown?

Subscribe to SWOTstock for clear, official-report-based earnings breakdown.

Disclaimer

This article is based entirely on NVIDIA’s Q1 FY2026 financial report, earnings call transcript, and management statements. It does not constitute investment advice.

Leave a comment