TL;DR

Bank of America reported a steady and resilient Q3 2025: EPS came in at $1.06, net interest income rose to $15.2 billion, and investment-banking fees jumped 43%. Management also raised Q4 NII guidance, signaling confidence heading into year-end. After the release, the stock traded roughly 2–3% higher, reflecting a market that values stability in a choppy macro environment. For DIY value investors, this quarter underscores BofA’s role as a dividend-reliable, moderately undervalued financial anchor rather than a high-beta trade.

Quarter Recap

Bank of America delivered a steady and confident performance in Q3 2025, leaning more on disciplined execution than dramatic surprises. Net income reached $8.5 billion, translating to $1.06 per share, comfortably above expectations and supported by $15.2 billion in net interest income that remained resilient despite shifting rate dynamics. Management emphasized that positive operating leverage reflected tighter cost control and continued investment in risk management and technology. Capital markets activity added a welcome boost, with investment-banking fees rising 43% as dealmaking and underwriting improved from last year’s lows. Importantly for long-term investors, the bank’s CET1 ratio stayed above 12%, reinforcing its capacity to maintain dividends and pursue selective buybacks even in a more uncertain macro backdrop. Overall, the quarter underscored BofA’s ability to produce stable, repeatable earnings at a time when many peers are navigating more uneven conditions.

Key Highlights

- EPS: $1.06, above internal targets and analyst expectations.

- Net Interest Income: $15.2B, maintaining upward momentum.

- Investment-Banking Fees: +43% YoY, continued rebound in capital markets.

- Operating Leverage: Positive, reflecting disciplined expense control.

- Credit Costs: Stable, no significant deterioration in consumer or commercial books.

- Capital Position: CET1 above 12%, supporting sustained shareholder returns.

- Guidance: Q4 NII raised to $15.6–15.7B, signaling management confidence.

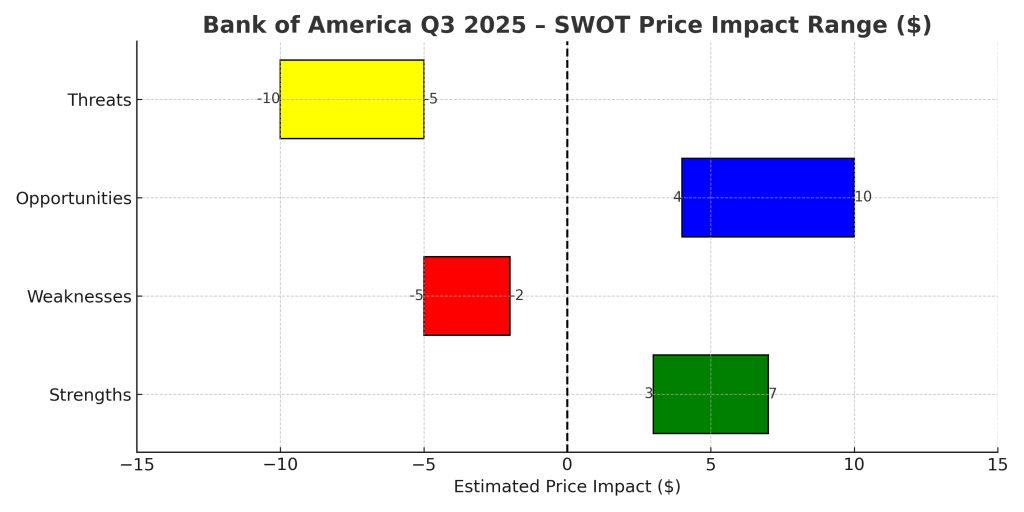

SWOT Analysis

Strengths (+3% → +7%)

• Strong NII performance and EPS beat

• Well-managed expenses and positive operating leverage

• Dividend raised earlier this year, supported by capital strength

Weaknesses (–5% → –2%)

• Slower loan growth compared to peers

• Slight margin compression in wealth management

• Tech and compliance investments increasing non-interest expense

Opportunities (+4% → +10%)

• Investment-banking recovery (+43% YoY)

• Stable credit trends with room for normalization upside

• Rate-cycle normalization in 2026 may boost loan demand

Threats (–10% → –5%)

• CRE and credit-card segments remain watch-list risks

• Potential capital-rule tightening limiting buybacks

• Prolonged macro uncertainty affecting NII trajectory

Valuation Scenarios (12-Month Outlook)

Using official Q3 performance, NII guidance, and credit commentary:

Bull Case – $56 (+15%)

• Sustained NII strength

• Continued recovery in investment banking

• Flat credit losses into 2026

Base Case – $51.3 (+5%)

• Stable NII

• Moderate fee growth

• Expense discipline maintained

Bear Case – $44 (–10%)

• Margin compression from declining rates

• Credit costs rise toward the historical mean

• CRE pockets worsen

Probability-Weighted Fair Value:

(0.3 x 56) + (0.5 x 51.3) + (0.2 x 44) = approx. $51.1

Verdict

Bank of America continues to deliver what value-focused investors want: predictable earnings, conservative capital management, and a stable dividend.

This quarter didn’t redefine the company—but it didn’t need to.

Instead, it reinforced that BofA’s risk-reward profile is built on durability rather than excitement.

At around $50–51 post-earnings, shares sit close to their $51 fair value, leaving modest upside but strong downside support. For long-term investors comfortable with financial-cycle volatility, BofA remains a hold with opportunistic accumulation on dips below $48.

Call to Action

If you find this style of earnings-driven, valuation-based analysis helpful, follow SWOTstock for more breakdowns across banks, tech, and industrials—always grounded in official filings and management commentary.

Disclaimer

This article is for informational and educational purposes only. It does not constitute investment advice or a recommendation to buy or sell any securities. All analysis is based solely on Bank of America’s official Q3 2025 financial results and publicly available management commentary. Investors should conduct their own research or consult a licensed advisor before making investment decisions.