TL;DR Summary

Oracle (NYSE: ORCL) reported mixed Q2 FY2026 results: revenue came in slightly below expectations, adjusted EPS beat but was boosted by a one-time gain, and OCI continued strong but not hyper-scale acceleration. The standout metric was a massive $523B RPO backlog, signaling powerful long-term demand for AI and cloud infrastructure. Yet the stock still dropped over 10% after hours to ~$199 as investors recalibrated near-term profitability, cloud CapEx intensity, and the quality of earnings. Our fair value stands at $210–$215, with the pullback offering a more reasonable entry point for value-oriented investors who can tolerate AI-cycle volatility.

Quarter Recap

Oracle released its Q2 FY2026 results on December 10. Total revenue reached $16.06B, a modest YoY increase but a slight miss versus expectations. Adjusted EPS beat estimates at $2.26; however, the strength was driven by a $2.7B pretax gain from selling Oracle’s stake in Ampere Computing. OCI remained a bright spot, growing roughly 68% YoY and supported by AI training and inference demand, although growth did not exceed bullish expectations.

The biggest surprise came from Remaining Performance Obligations (RPO), which surged to $523B — one of the highest forward-demand indicators in enterprise tech. Despite this, the stock sold off sharply as investors focused more on margin pressure, heavy CapEx needs, and the softer revenue print. By late after-hours trading, Oracle shares had fallen to around $199, down more than 10%.

Key Highlights

- Revenue: $16.06B, slightly below consensus

- Adjusted EPS: $2.26, aided by a one-time Ampere stake sale

- OCI: ~68% YoY growth, strong but not accelerating beyond expectations

- RPO: Jumped to $523B, signaling multi-year cloud and AI demand

- CapEx & Debt: Rising commitments for cloud infrastructure expansion

- Market Reaction: Stock dropped from ~$230 to ~$199 after hours

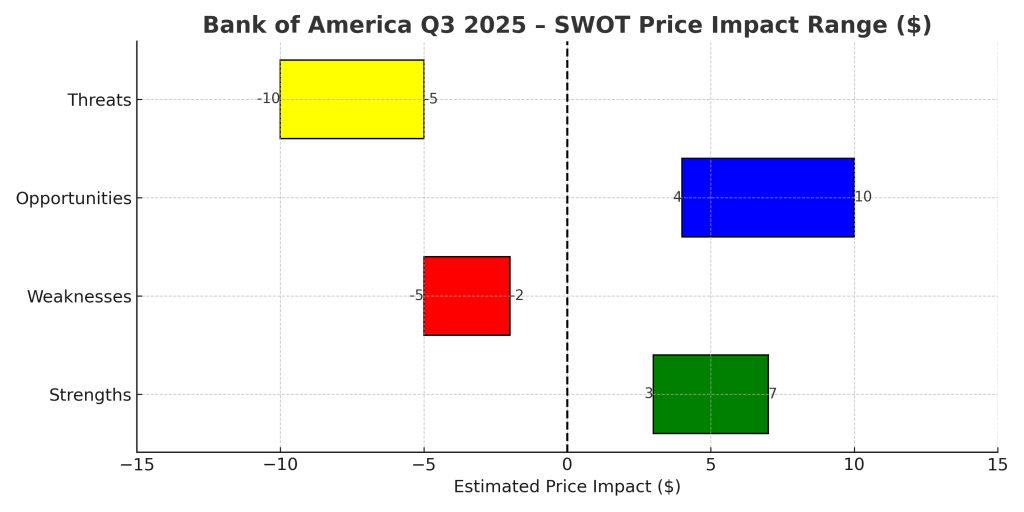

SWOT Analysis

Oracle’s Q2 results highlight a company balancing immense long-term opportunity with near-term financial strain. While the AI infrastructure cycle is driving unprecedented backlog levels, the path to monetizing this demand profitably remains uncertain. The sell-off reflects this tension: long-term durable demand on one side, and rising costs, slower revenue, and an inflated EPS figure on the other.

Strengths (Price Impact: +6% to +12%)

- Massive RPO backlog of $523B supporting multi-year revenue visibility (+3% to +5%)

- Highly sticky database and support revenue base anchoring cash flow (+2% to +4%)

- Strong OCI growth of ~68% YoY securing relevance in AI infrastructure (+3% to +5%)

- Consistent capital returns through buybacks and dividends (+1% to +2%)

Weaknesses (Price Impact: –6% to –12%)

- Revenue miss relative to AI-fueled expectations (–3% to –5%)

- EPS beat driven by one-time Ampere stake sale (–2% to –4%)

- Near-term margin pressure from heavy cloud infrastructure investments (–3% to –5%)

- Elevated debt profile reducing financial flexibility (–1% to –2%)

Opportunities (Price Impact: +10% to +18%)

- Multi-year AI infrastructure demand cycle boosting OCI adoption (+5% to +8%)

- Database migration to OCI offering structural margin lift (+3% to +5%)

- Cerner modernization creating long-term operating leverage (+2% to +4%)

- Enterprise consolidation driving large, integrated cloud modernization deals (+2% to +3%)

Threats (Price Impact: –12% to –20%)

- CapEx requirements rising to fulfill massive AI/cloud backlog (–5% to –8%)

- Fierce competition from AWS, Azure, and Google Cloud (–3% to –6%)

- AI contract profitability still unclear and may dilute margins (–2% to –4%)

- Macro slowdown could hit enterprise IT spending (–2% to –3%)

Valuation Scenarios

With shares falling to ~$199, Oracle now trades below our intrinsic value range. The key valuation driver is how quickly OCI can scale profitably relative to the heavy CapEx needed to support long-term AI demand. Below are three scenarios based on earnings normalization, cloud margin trajectories, and the appropriate earnings multiple for a hybrid software + cloud infrastructure business.

Bear Case — $175

- OCI slows to 40–50%

- CapEx stays elevated for multiple years

- Core EPS normalizes lower after removing one-time gains

- Multiple compresses to 15× forward EPS

- Price Target: ~$175

Base Case — $215

- OCI grows 55–65%

- Revenue normalizes to mid-single digits

- CapEx moderates by FY2027

- Margins expand gradually

- Valuation at ~17.5× forward EPS

- Price Target: ~$215

Bull Case — $255

- OCI re-accelerates to 70%+

- AI contracts become margin accretive

- Cloud and software synergy improves profitability

- Market assigns a premium 20× forward multiple

- Price Target: ~$255

Fari Value

Assigning scenario probabilities:

- Bear: 30%

- Base: 50%

- Bull: 20%

FV = (175 x 0.3) + (215 x 0.5) + (255 x 0.2)

= 52.5 + 107.5 + 51 = 211

🎯 Probability-Weighted Fair Value = $211

Verdict

Oracle’s Q2 numbers delivered a mixed message: enormous long-term demand but weaker near-term fundamentals. The stock’s drop to ~$199 reflects investors resetting expectations for cloud profitability and earnings quality. Still, the pullback now places Oracle below our fair value estimate, creating a potentially attractive entry point for long-term, value-oriented investors who accept AI-cycle volatility. For investors seeking steady cash flow, disciplined capital returns, and long-term cloud upside, Oracle now screens more reasonable than before.

Call to Action

If you want structured, fact-based breakdowns of every earnings season — from Big Tech to industrials to retail — subscribe to SWOTstock. We turn dense earnings reports into clear insights so you can invest with conviction, not noise.

Disclaimer

This analysis is for informational purposes only and is not financial advice. All estimates are based on publicly available company filings and earnings calls. Investors should conduct their own due diligence before making investment decisions.