TL;DR Summary

American Express (AXP) posted record revenue and beat EPS expectations, yet shares dipped slightly as investors digested rising costs and macro risk. Despite strong cardholder engagement and new card growth, the current valuation leaves little margin of safety. AXP looks like a “Hold” — with better buying potential under $290.

Q2 2025 Recap: Resilient Premium Growth, Margin Watch

AXP reported $17.9B in revenue (+9% YoY) and EPS of $4.08, beating consensus estimates. Spending in premium categories stayed strong, with +10% in business-class travel and +9% in luxury lodging. The company added 3.1 million new cards, a majority in fee-paying tiers.

Despite strong revenue, expenses grew 14% YoY, primarily due to investments in the Platinum platform, Centurion Lounge expansion, and digital infrastructure. Management reaffirmed full-year guidance and expressed confidence in monetizing these investments starting Q4.

Key Highlights

- Record revenue: $17.9B (+9% YoY)

- EPS: $4.08 (vs. $3.87 est.)

- Fee revenue: +20% YoY

- Luxury spend: +10% (biz class), +9% (lodging > $5K)

- New cards: 3.1M (majority fee-based)

- Expenses: +14% YoY

- Guidance reaffirmed: EPS $15.0–15.5 for FY25

📈 Revenue vs Net Income (Past 5 Quarters)

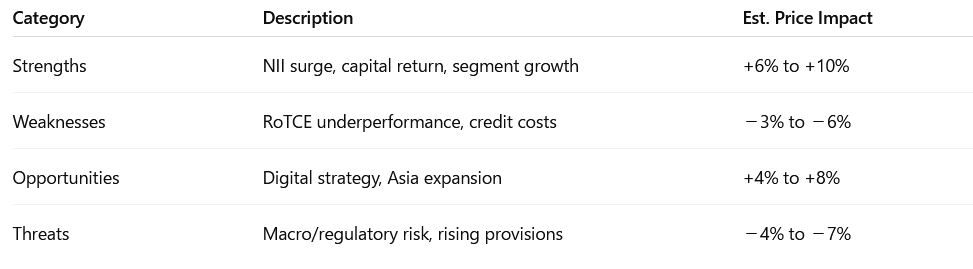

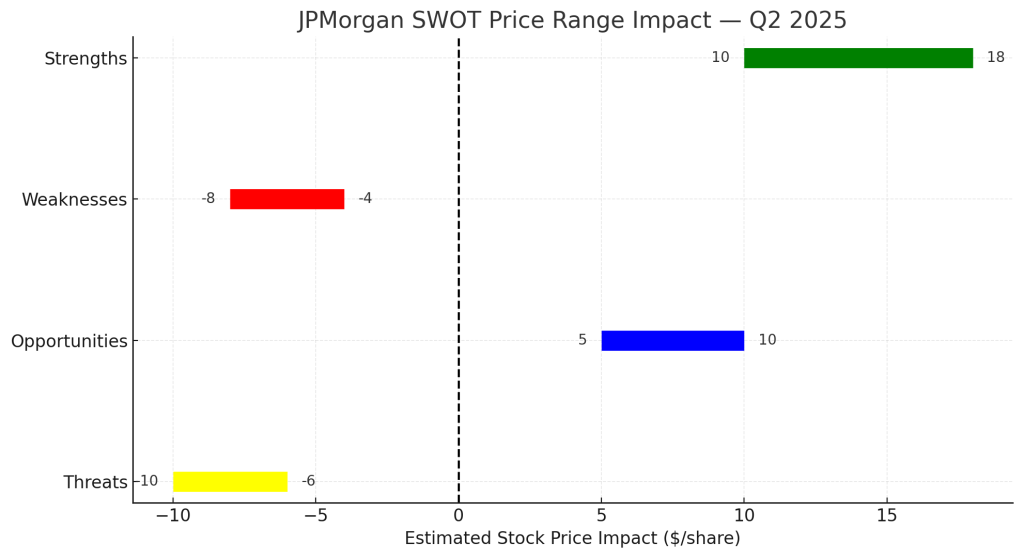

SWOT Analysis

In Q2 2025, American Express showed strong fundamentals with growing revenue and customer engagement, but rising expenses and macro uncertainty created a more balanced risk-reward profile.

Strengths

- Consistent top-line growth

- Strong brand and pricing power

- EPS beat and stable credit metrics

- High-spend user base remains sticky

→ Impact: +$10 to +$15

Weaknesses

- Operating costs growing faster than revenue

- Near-term margin pressure

→ Impact: –$5 to –$10

Opportunities

- Upside from monetizing Platinum & lounges

- Rising NII and strong card acquisition

→ Impact: +$8 to +$12

Threats

- Valuation premium (~21× P/E)

- Macro risk: spending could slow

→ Impact: –$10 to –$15

📊 SWOT Price Impact Chart

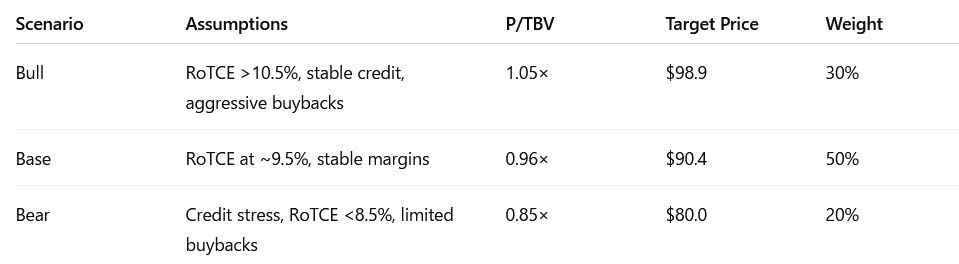

Valuation Scenarios

To gauge where American Express stock could head next, we modeled three valuation scenarios based on management’s full-year EPS guidance and current market conditions. These scenarios—bull, base, and bear—reflect different assumptions about earnings performance and valuation multiples. By assigning probabilities to each case, we arrive at a fair value estimate to help long-term investors assess risk and reward more objectively.

🎯 Fair Value = $307 (probability-weighted)

Visual 3: 📐 Valuation Scenario Chart

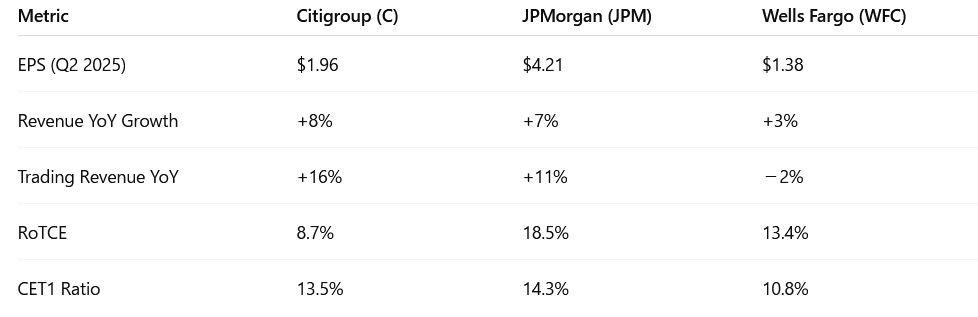

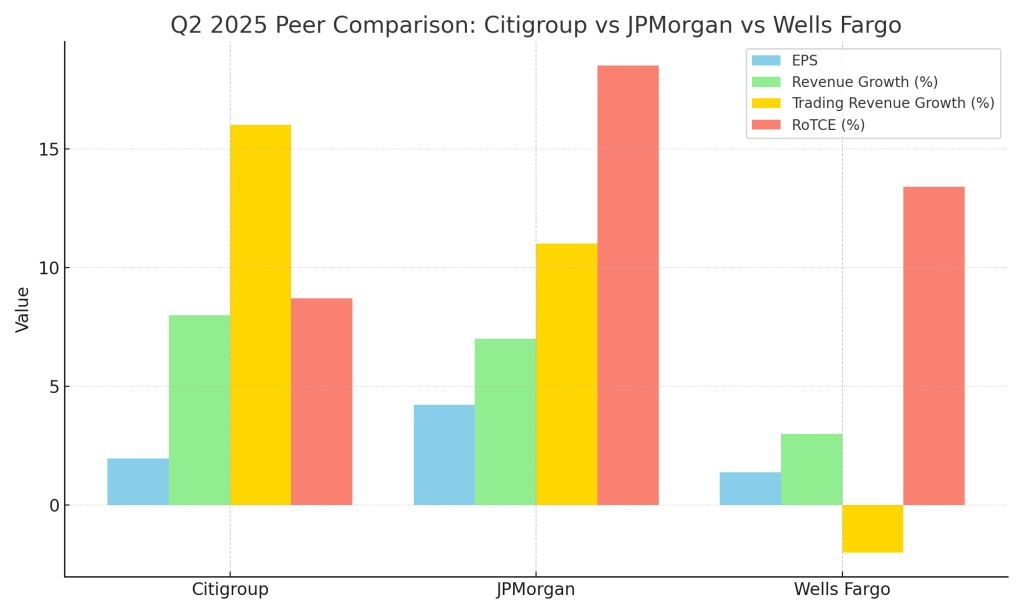

Peer Comparison: How Does AXP Stack Up?

Before deciding whether to hold or accumulate more shares, it’s helpful to see how American Express stacks up against similar financial giants. While AXP excels in card fee growth and premium customer acquisition, competitors like Visaand Capital One offer different strengths—whether it’s higher scale or better short-term valuation. Here’s a snapshot comparing key financial metrics from Q2 2025 across the three companies:

Verdict: Hold For Now — But Watch That $290 Line

American Express is still executing at a high level, but the stock looks fully priced for now. With fair value near $307, the market isn’t offering a discount. For long-term investors, a dip to the $280–290 range could create a more attractive setup.

📌 Current View: Hold

📉 Buy Zone: Under $290

📈 Re-evaluate: Over $325

Call to Action

Enjoying SWOTstock’s clean, earnings-driven breakdowns?

Follow us for investor-focused insights on earnings season.

No hype. Just data, discipline, and decisions that work.

Disclaimer

This analysis is for informational purposes only and does not constitute investment advice. All data is sourced from American Express’s official Q2 2025 earnings release and call transcript.

Leave a comment