📌 TL;DR Summary:

Berkshire Hathaway reported Q2 2025 operating earnings of $11.16 B (–4% YoY) and a $3.8 B writedown on Kraft Heinz, dragging net income down 59%. Cash remains enormous at $344 B, but no buybacks were executed, leaving investors questioning capital deployment. Book value per share grew 6% YoY, but the stock trades near 1.45× book — above Buffett’s historical repurchase thresholds. For value investors, Berkshire remains a fortress‑like hold, but not an obvious bargain as the leadership transition to Greg Abel approaches.

🧾 Quarter Recap:

Berkshire Hathaway’s Q2 2025 earnings reflect disciplined caution with limited offensive moves.

- Operating earnings: $11.16 B (–4% YoY).

- Net income: $12.37 B (–59% YoY) due to a $3.8 B Kraft Heinz impairment.

- Cash: $344 B, slightly down from Q1 but still near record highs.

- Book value per share: ~$262, up 6% YoY and ~1% sequentially.

- No share repurchases, for the second consecutive quarter.

- Equity activity: Net seller of ~$3 B in stock.

- Buffett’s discipline holds: As he wrote in the 2023 letter, “We only repurchase shares when we believe they are selling at a meaningful discount to intrinsic value.”

In Q1, we observed:

“Berkshire is signaling caution, not conviction — sitting on cash, avoiding buybacks, and waiting for real value to emerge.”

Q2 results confirm this stance — cash is stockpiled, but deployment remains elusive.

📌 Key Highlights:

- BNSF Railway: Operating profit up ~19% to $1.47 B on freight volume growth.

- Geico: Underwriting profit ~$1.8 B, with ~16.5% margin.

- Insurance (reinsurance & P/C): Underwriting income declined 12%, with P&C reinsurance premiums down ~10%. Float rose to ~$174 B.

- Consumer goods: Revenue fell ~5%, impacted by tariffs and slowing demand for brands like Fruit of the Loom.

- FX losses: ~$877 M, pressuring underwriting results.

📈 Book Value & Valuation Context:

- Book value per share: ~$262, up 6% YoY.

- Price-to-book: ~1.45×, slightly below the 10‑year average of 1.5×.

- Historical buyback threshold: Buffett previously authorized buybacks when shares traded under 1.2× book. At current levels (~1.45×), Berkshire remains above that range, which explains the lack of repurchases.

Value investor insight: Berkshire’s market price suggests it’s fully valued by Buffett’s own conservative yardstick.

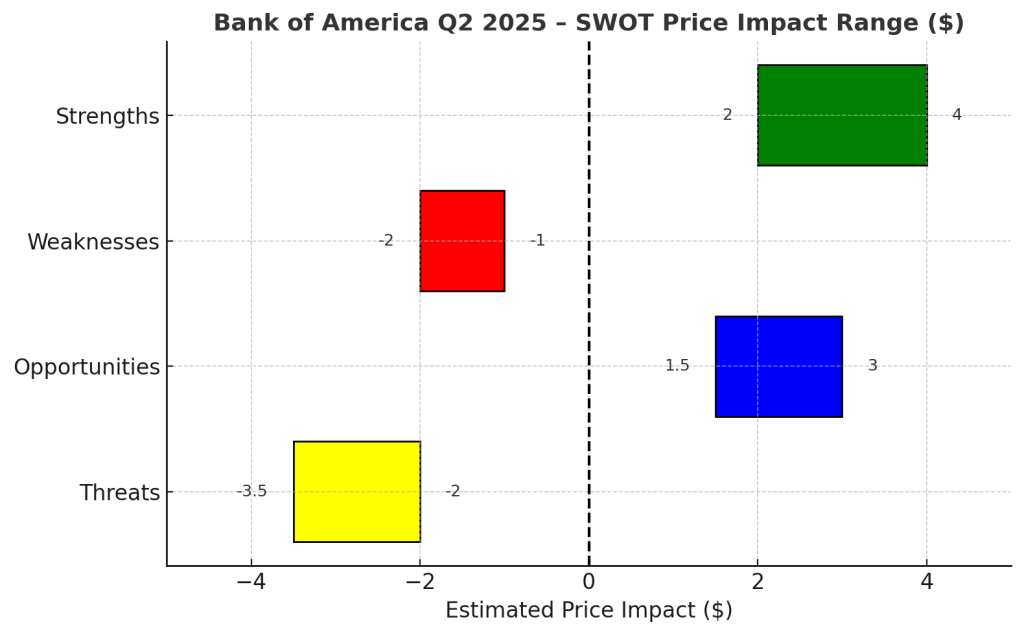

🧠 SWOT Analysis with Price Impact Estimates:

Strengths (+$15 – $25/share)

- Fortress balance sheet: $344 B in cash and $174 B in insurance float.

- Operational resilience: BNSF and Geico continue to deliver.

- Diversified revenue streams: Core industrials and energy shield against sector shocks.

Weaknesses (–$10 – $20/share)

- Kraft Heinz writedown exposes underperforming legacy investments.

- No share buybacks, signaling management sees limited margin of safety at current levels.

- Underwriting softness and FX headwinds pressure insurance results.

Opportunities (+$10 – $20/share)

- Capital deployment: $344 B cash can be deployed for opportunistic M&A or buybacks if valuations fall.

- Rail consolidation: BNSF may benefit from strategic M&A moves in the sector.

- Insurance cycle hardening: Potential for improved pricing in future quarters.

Threats (–$10 – $15/share)

- Leadership transition: Buffett‑to‑Abel handoff raises uncertainty about future capital allocation.

- Macro risks: Tariffs and FX volatility weigh on consumer and manufacturing units.

- Equity portfolio volatility: GAAP fair‑value swings distort net income.

📊 SWOT Summary Table

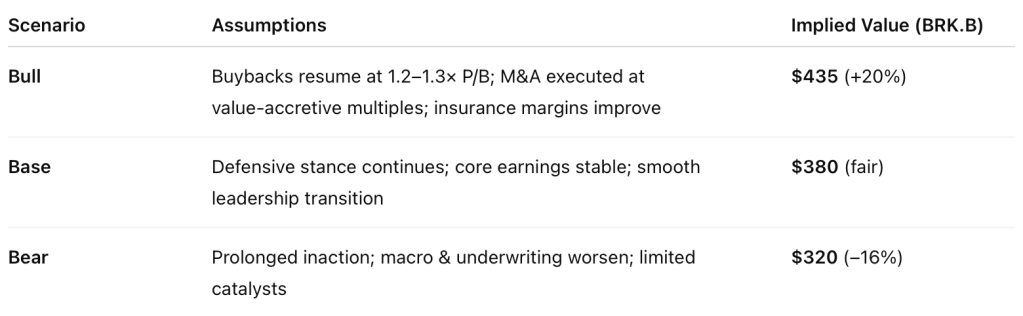

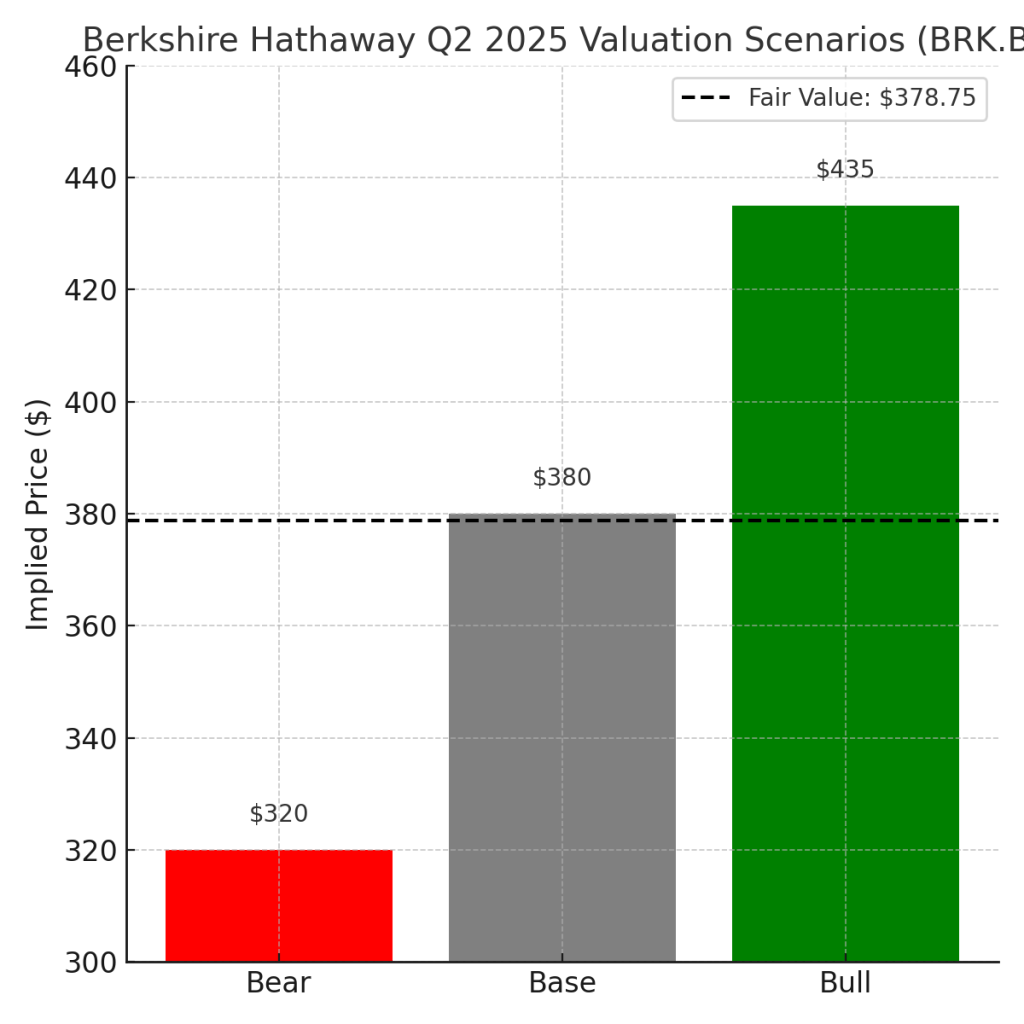

💸 Valuation Scenarios:

We apply sum‑of‑parts (subsidiary cash flows + equity portfolio) and P/B benchmarking:

Probability‑Weighted Fair Value = (0.25 × 435) + (0.5 × 380) + (0.25 × 320) = $378.75/share.

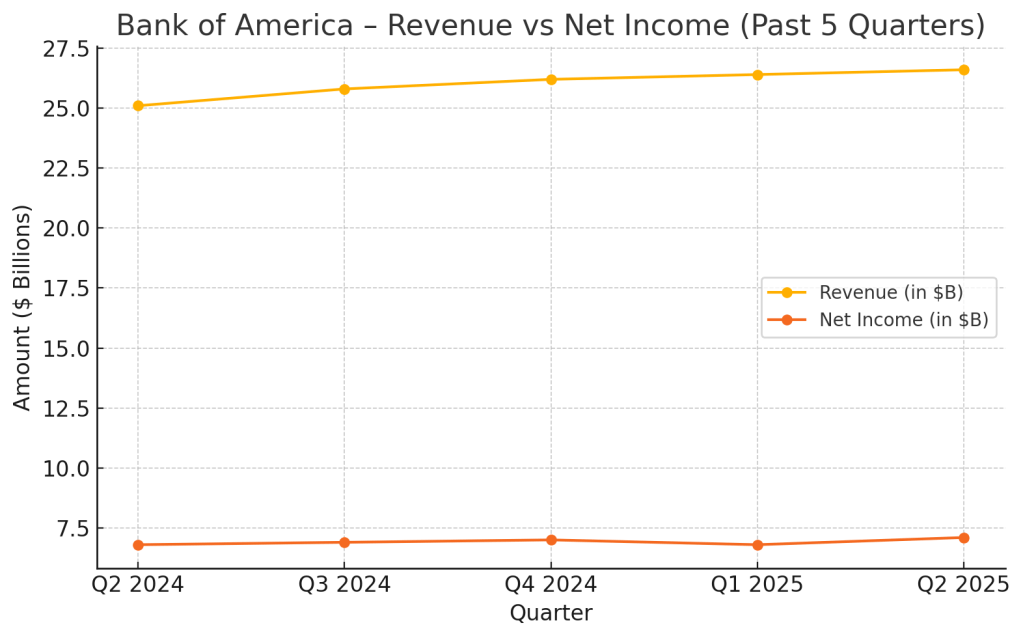

📊 Peer Comparison Insight:

Berkshire Hathaway’s P/B ratio of 1.45 positions it above Markel (1.2) but far below the S&P 500 average of 4.2, reinforcing its standing as a value‑oriented conglomerate rather than a growth‑priced index constituent. Its ROE of 10% trails the S&P 500’s 14%, reflecting Berkshire’s conservative leverage and capital deployment posture, yet it still outpaces Markel’s 8%. The YTD return of 4% lags the S&P 500’s 6%, highlighting market skepticism about near‑term catalysts amid Buffett’s upcoming transition and limited capital actions. For DIY value investors, this underscores Berkshire’s role as a steady compounding hold rather than a momentum‑driven outperformer.

🔑 Catalysts for Re‑rating and Market Reaction

Berkshire’s stock continues to trade like the fortress it is — steady but unspectacular — with a year‑to‑date gain of about 4%, trailing the S&P 500’s roughly 6% advance. The muted market response to Q2 earnings suggests that investors see the quarter as “business as usual”: strong balance sheet, reliable operating results, but little in the way of near‑term excitement. For the stock to re‑rate higher, investors are watching for clearer capital deployment signals — whether that’s buybacks at higher price‑to‑book levels, opportunistic large‑scale acquisitions, or a more aggressive investment approach under Greg Abel’s leadership once the Buffett transition is complete. A significant market downturn, which would give Berkshire the chance to deploy its $344 B cash pile into undervalued opportunities, also remains a potential catalyst for a re‑rating. Until then, the shares are likely to trade within a range that reflects their defensive compounding profile rather than breakout growth.

🧠 Verdict:

For value investors, Berkshire remains a defensive cornerstone: diversified, cash‑rich, and well‑positioned for opportunistic moves. But at ~1.45× book, shares are not trading at a margin of safety by Buffett’s standards. Until buybacks resume, M&A materializes, or valuations reset lower, this is a hold for long‑term compounding — not a bargain entry point.

📣 Call to Action:

Stay ahead of Berkshire’s next moves — from buybacks to the post‑Buffett era.

Subscribe to SWOTstock for deep‑dive analyses that cut through the headlines.

⚠️ Disclaimer:

This analysis is based solely on Berkshire Hathaway’s Q2 2025 public filings (Form 10‑Q, earnings release). It does not constitute financial advice. Perform your own due diligence or consult a licensed advisor before making investment decisions.

Leave a comment