📌 TL;DR

JPMorgan (NYSE: JPM) delivered a strong Q2 with a solid earnings beat and raised full-year guidance, returning $11B to shareholders. While the stock barely moved, long-term value remains intact. DIY investors should watch for dips below $285.

📆 Q2 2025 Recap — Earnings Beat, Capital Strength

JPMorgan’s Q2 2025 performance was a masterclass in disciplined execution. The bank delivered an 11% EPS beat, maintained a stellar 21% ROTCE, and raised its full-year NII guidance—despite a revenue drop tied to tough comps from the prior year. Business segments like investment banking and trading outperformed, while capital return to shareholders remained robust with $11B distributed in just one quarter. This level of consistency and balance is exactly what long-term value investors look for.

Earnings highlights (July 15 release):

- 🧾 EPS: $4.96 (vs $4.48 est), +11% beat

- 💰 Net income: $15.0B (or $14.2B excl. tax benefit)

- 📉 Revenue: $45.7B, down 10% YoY (due to Visa gain comp)

- 💸 Capital Return: $3.9B in dividends + $7.1B in buybacks

- 📈 ROTCE: 21% (20% adjusted)

Corporate & Investment Bank (CIB):

- Net income: $6.7B, +13% YoY

- Dealmaking fees: $2.5B, +7% YoY

- Markets revenue: +15%, led by fixed income

📊 FY NII guidance raised: $95.5B (previously ~$94B)

📉 Market Reaction — Earnings Beat, Flat Price

JPM closed at $286.55, down ~0.3% on earnings day.

Despite delivering an impressive earnings beat and raising its full-year NII guidance, JPMorgan’s stock barely budged—closing the day slightly lower. The muted reaction puzzled many, but it likely reflects broader market caution rather than company-specific weakness. Investors may be focusing on rising expense trends, margin pressure from anticipated rate cuts, or simply digesting mixed signals from the banking sector as a whole. In other words, the fundamentals impressed—but sentiment lagged behind. For long-term investors, that disconnect may represent an opportunity.

- YoY revenue drop from one-offs

- Core expenses rising 5% YoY

- Margin pressure from rate cuts

🧠 Jamie Dimon cautioned on “geopolitical instability, unsustainable fiscal deficits, and central bank pressure.”

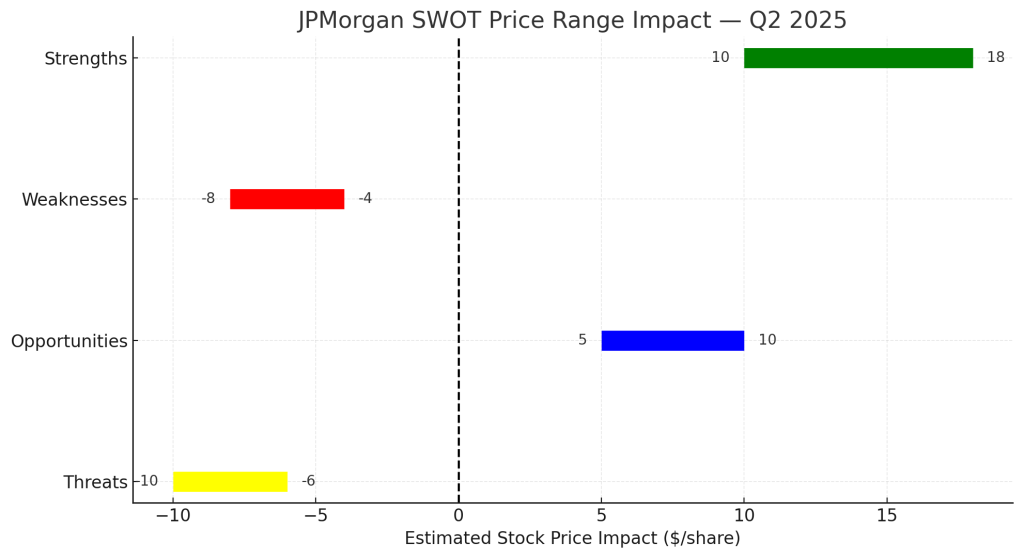

🧠 SWOT Analysis with Price Ranges

To make sense of JPMorgan’s positioning, we broke down the quarter using our dollar-anchored SWOT framework. This isn’t just a list of talking points—it’s a tool to map potential price impacts. Strengths like high ROTCE and capital discipline support the upside, while expense growth and macro risk could pull against it. The result? A snapshot of both opportunity and risk that’s grounded in the fundamentals, not speculation.

📊 Valuation Scenarios

JPMorgan’s current share price sits just below our estimated fair value—but the path ahead depends on how macro and internal drivers unfold. In our model, we outline three scenarios: a bull case driven by continued earnings strength and compounding tech investments; a base case reflecting stable profitability; and a bear case factoring in rate compression and regulatory drag. We assign probabilities to each and arrive at a weighted fair value—offering a disciplined way to anchor expectations.

🔍 JPM vs Peers (Q2 2025 Snapshot)

What sets JPMorgan apart isn’t just the size of its balance sheet—but how efficiently it runs. Compared to Citi and Wells Fargo this quarter, JPM led in ROTCE, delivered solid beats, and even raised guidance. Meanwhile, peers either maintained or cut forecasts. The market’s muted response to JPM’s beat may have more to do with sector fatigue than actual fundamentals. The data tells a clearer story.

→ JPM’s valuation remains more attractive vs peers with stronger capital efficiency.

✅ Verdict — Value with a Margin of Safety

For value-focused investors, JPMorgan continues to check the boxes: high ROTCE, strong dividend yield, and durable earnings. The muted stock reaction creates an opening—not for hype-driven gains, but for steady compounding. With shares trading just below our fair value estimate, the risk-reward profile remains favorable. If your investing playbook includes buying quality on dips, JPM still earns a spot near the top of the list.

- Strong ROTCE and stable capital return

- Resilient fee-based businesses (trading, IB, payments)

- Undervalued at current price with room for compounding

Buy range: Below $285

Fair value: $290–$295

Dividend yield: ~2.0%

5-Year Dividend CAGR: ~8.6%

📣 Why Subscribe to SWOTstock?

If you found this analysis useful, don’t just bookmark it—subscribe. At SWOTstock, we break down every major earnings report using only official numbers, structured insights, and investor-first language. No hype, no jargon. Just clear, actionable takeaways built for long-term thinkers. Whether you’re tracking your portfolio or building conviction, you’ll get the clarity you need—right when it matters most.

📬 Official-sourced only.

📉 No hype. Just facts.

📈 Fair value + SWOT + Visuals in every post.

👉 Subscribe now and get value investor reports delivered weekly.

⚠️ Disclaimer

This content is provided for informational and educational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. All analysis is based solely on publicly available financial reports and official company statements. Always conduct your own research or consult with a licensed financial advisor before making investment decisions. The authors of this post may hold positions in the companies mentioned.

Leave a comment