TL;DR

Goldman Sachs (GS:NYSE) delivered a strong Q4 2025, confirming that capital markets activity has meaningfully recovered and earnings power has re-emerged. At today’s price, GS is no longer a balance-sheet or re-rating story. The stock is valued on sustained earnings strength, with future returns increasingly dependent on how durable this recovery proves to be through the next cycle.

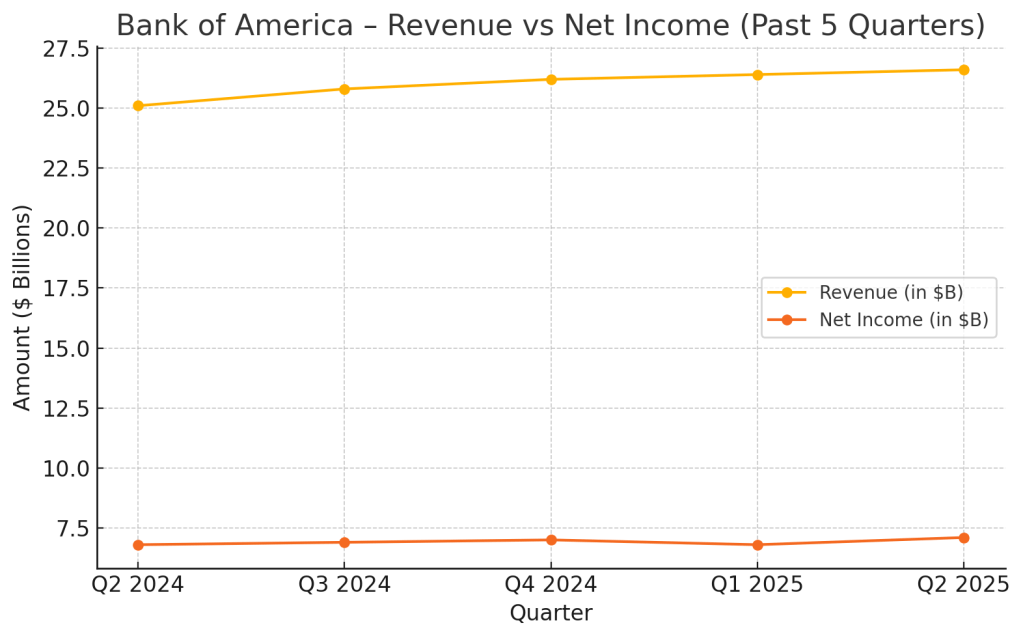

Quarter Recap

Goldman Sachs closed out 2025 with a solid fourth quarter, reflecting improved client engagement across Investment Banking and Global Markets. Revenues rebounded, profitability strengthened, and returns moved back into the mid-teens. Management commentary pointed to healthier capital markets conditions and disciplined capital deployment, reinforcing the sense that GS has exited its post-cycle trough.

Key Highlights

- Q4 net revenues: $13.45bn, driven by stronger Investment Banking and Markets activity

- Net income: ~$4.6bn

- EPS: $14.01, up meaningfully year over year

- Annualized ROE: ~16%, back above through-cycle targets

- Book value per share: $357.60

- Quarterly dividend increased to: $4.50, signaling confidence in earnings durability

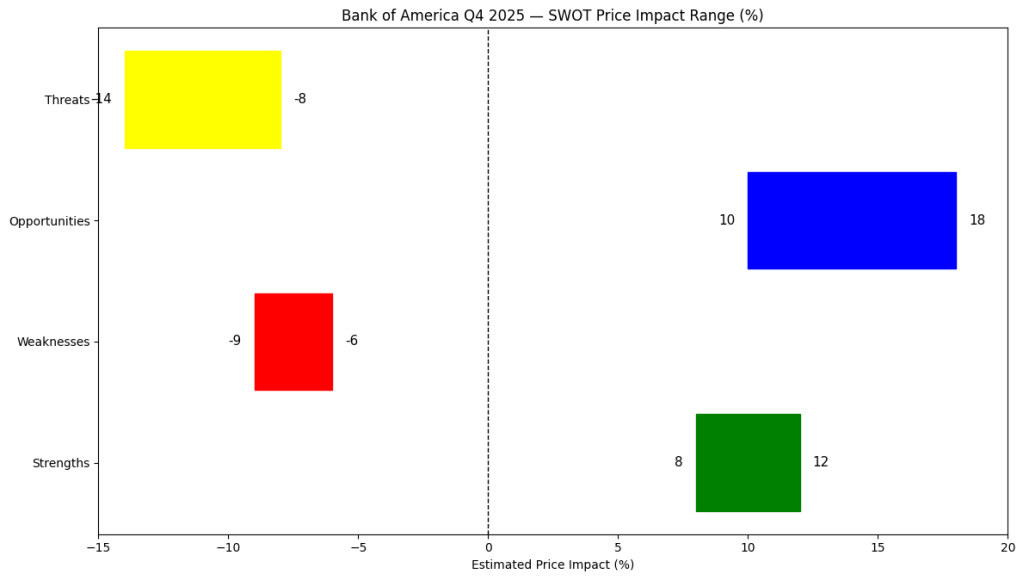

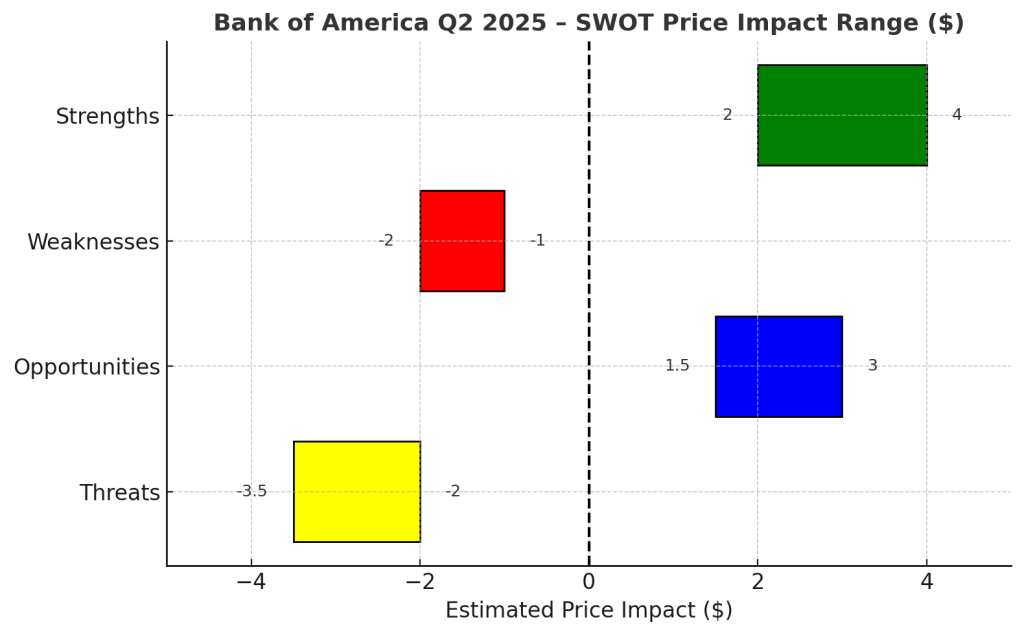

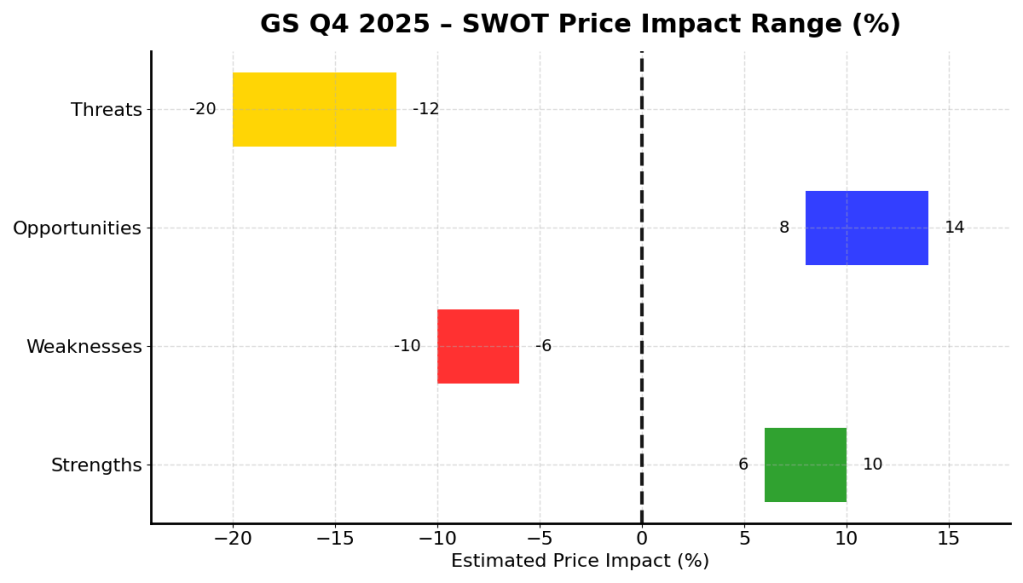

SWOT Analysis

At current valuation levels, Goldman Sachs is being priced primarily on normalized earnings power, not balance-sheet metrics. The SWOT below reflects that shift.

Strengths

Goldman’s core franchise is reasserting itself as capital markets normalize, with operating leverage returning across its most profitable businesses.

- Investment Banking and trading rebound driving earnings momentum (+6% to +10%)

- Mid-teens ROE supports a premium earnings multiple (+4% to +7%)

Weaknesses

Despite improvement, earnings remain inherently cyclical and sensitive to market conditions.

- Revenue volatility tied to deal flow and trading activity (-6% to -10%)

- Asset & Wealth Management margins remain below peak potential (-3% to -5%)

Opportunities

If capital markets recovery proves durable, earnings power could exceed current expectations.

- Sustained M&A and issuance activity into 2026 (+8% to +14%)

- Continued dividend growth and buybacks supporting total returns (+3% to +6%)

Threats

At current valuation levels, downside risk increases if the cycle turns earlier than expected.

- Macro or market shock reducing client activity (-12% to -20%)

- Regulatory or capital rule changes constraining ROE and payout capacity (-4% to -7%)

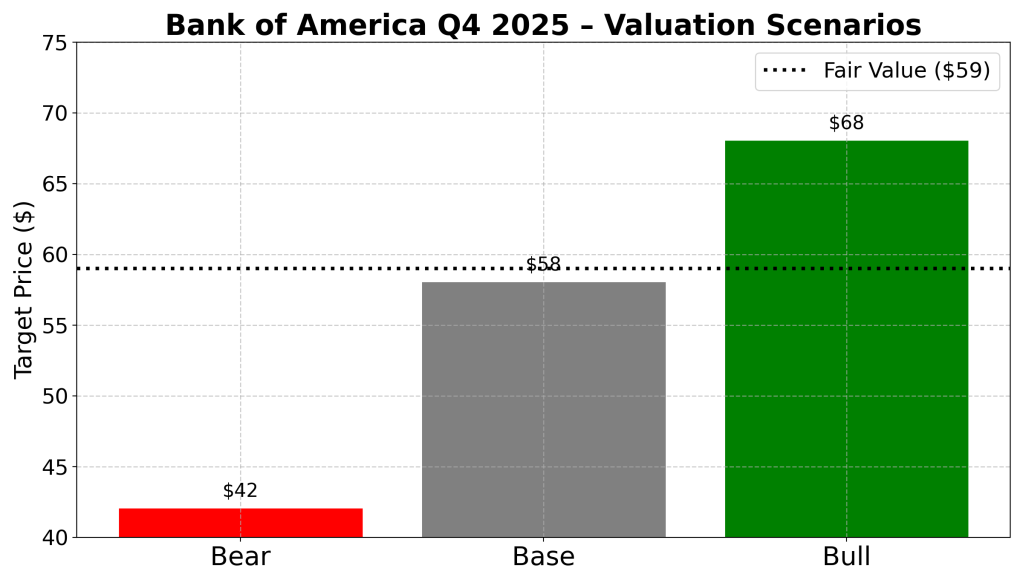

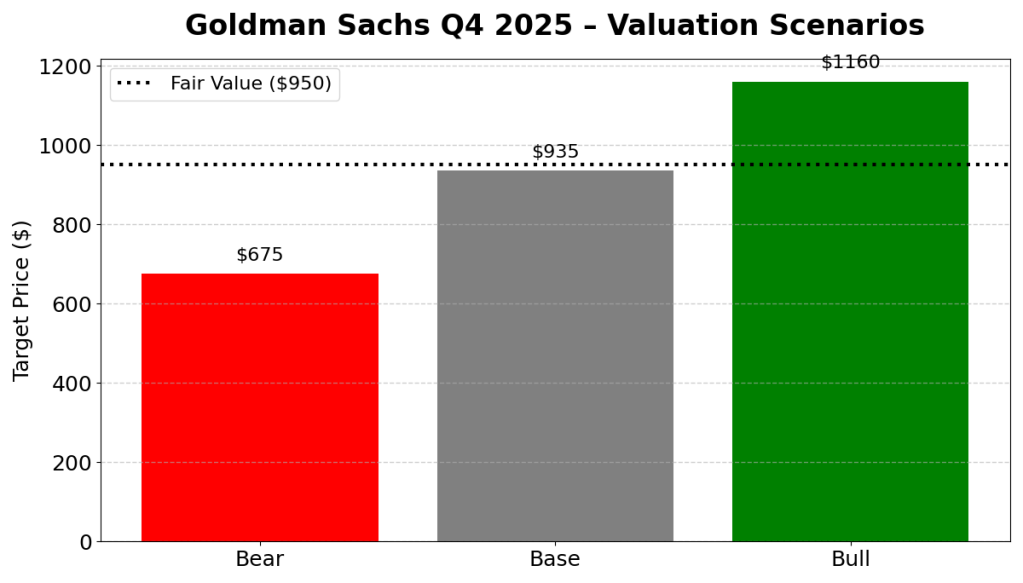

Valuation Scenarios

With GS trading far above book value, valuation should be framed around normalized earnings, not balance-sheet multiples.

Bear Case (~$675)

This scenario assumes the current capital markets rebound fades as macro conditions tighten.

- Normalized EPS declines toward ~$45

- Investment Banking and trading activity cool meaningfully

- Operating leverage works in reverse, pressuring margins

- Valuation compresses to ~15× earnings, typical of late-cycle conditions

Base Case (~$935)

The base case assumes capital markets stabilize at healthier, mid-cycle levels.

- Normalized EPS of ~$52, broadly in line with FY 2025 earnings power

- Deal activity and trading remain solid but not overheated

- The stock trades at ~18× earnings, reflecting franchise strength with cyclical risk

Bull Case (~$1,160)

The bull case assumes a sustained and broad-based capital markets recovery.

- Normalized EPS rises toward ~$58

- Strong M&A, IPO, and trading activity drive operating leverage

- Valuation expands to ~20× earnings on improved earnings visibility

Probability-Weighted View

- Bear: 25%

- Base: 50%

- Bull: 25%

Probability-weighted fair value: ~$950

Verdict

Goldman Sachs has transitioned from a recovery story to an earnings-power story. At current levels, the stock appears fairly valued on normalized earnings, with upside now dependent on sustaining capital markets momentum rather than further multiple expansion. GS remains a high-quality franchise, but future returns will increasingly reflect execution and cycle durability.

Call to Action

If you’re tracking U.S. banks and capital markets exposure, follow SWOTstock for earnings-driven analysis that focuses on valuation realism — not headline noise.

Disclaimer

This content is for informational purposes only and does not constitute investment advice. Investors should conduct their own research.