Berkshire Hathaway has disclosed a new US $4.3 billion position in Alphabet Inc. (GOOGL), confirming that Warren Buffett’s conglomerate entered the stock during the third quarter of 2025 — the same period in which Alphabet reported its first-ever US $100 billion revenue quarter.

According to Berkshire’s latest 13-F filing, the company purchased roughly 17.8 million shares of Alphabet, making it one of Berkshire’s ten largest equity holdings. The move surprised market watchers who have long associated Berkshire’s tech exposure primarily with Apple, which the firm trimmed in the same quarter.

A Contrarian Entry at a Trillion-Dollar Scale

Berkshire’s timing stands out. Alphabet shares were trading around US $270 – 280 during Q3 2025 — only modestly above their estimated intrinsic value range. While other institutional investors were rotating out of mega-cap tech after two years of outperformance, Berkshire appears to have treated Alphabet as a value compounder rather than a momentum play.

For Buffett followers, the purchase echoes a familiar pattern: buying into a cash-rich franchise once its growth narrative collides with valuation discipline. Alphabet fits that mold neatly — a business generating more than US $80 billion in free cash flow annually, returning US $15 billion in quarterly buybacks, and maintaining over US $100 billion in cash reserves.

Fundamentals Back the Move

Alphabet’s Q3 2025 report, released October 29, underscored that growth and prudence can coexist in Big Tech.

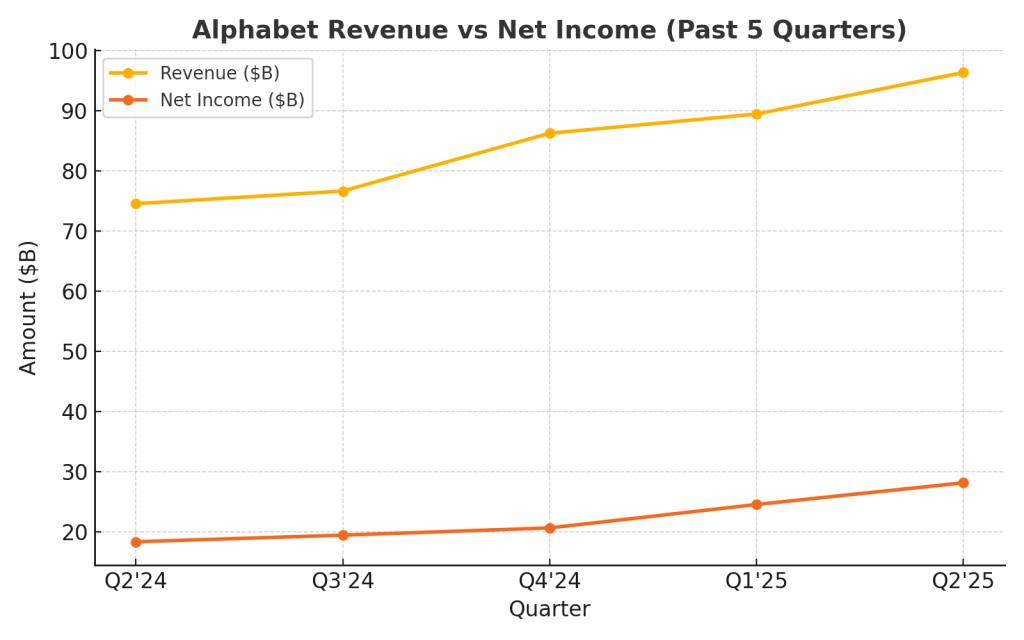

- Revenue: US $102.3 billion (+16 % YoY)

- Operating Income: US $31.7 billion (+23 %)

- EPS: US $2.87

- Google Cloud: +34 % YoY, margin rising to 9 %

- CapEx: Raised to US $91 – 93 billion for AI data-center expansion

CEO Sundar Pichai described the period as “a reflection of how AI is transforming every corner of our business,” while CFO Ruth Porat stressed “disciplined long-term investment.”

Those remarks align closely with Buffett’s own playbook — durable cash flow, reinvestment discipline, and capital allocation guided by intrinsic value rather than quarterly optics.

Reinforcing the “Still Underpriced” Thesis

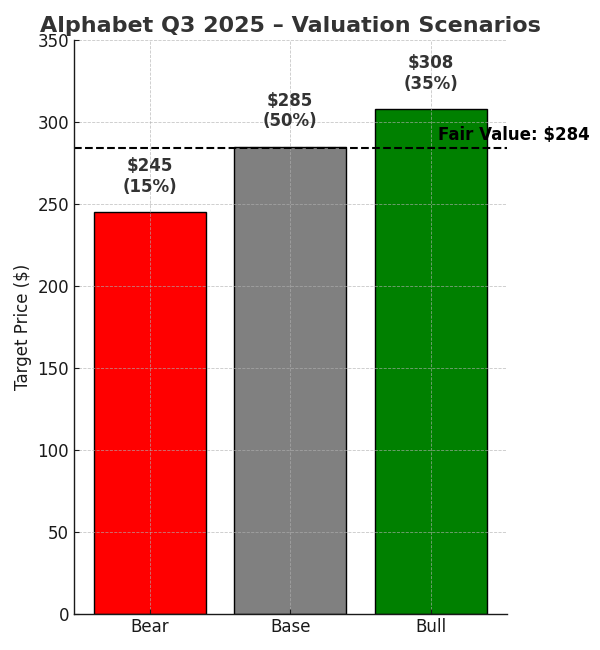

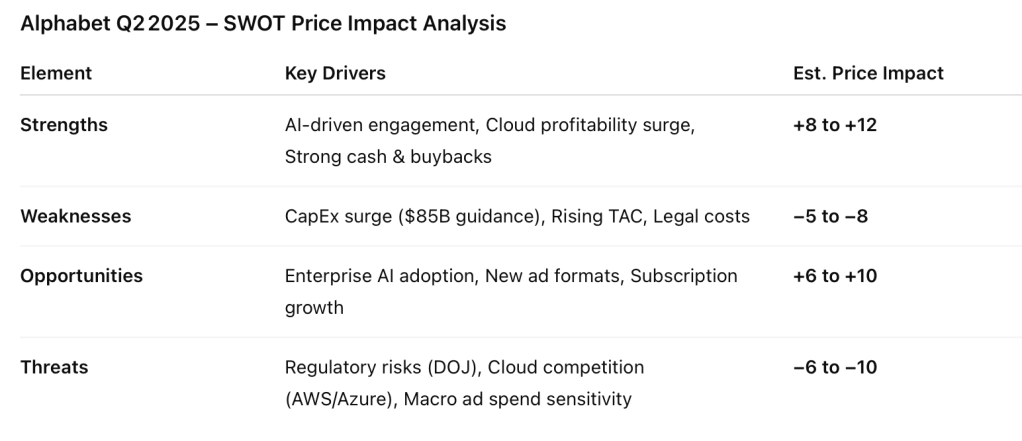

Our prior SWOTstock analysis of Alphabet’s Q3 results placed fair value near US $284 per share, with the market trading just above that level post-earnings. Berkshire’s purchase suggests that even at these prices, long-term investors still see a margin of safety — particularly as Alphabet’s AI infrastructure spending begins to translate into productivity and monetization gains across Search, YouTube, and Cloud.

For value-oriented readers, the implication is clear: when Berkshire buys into a trillion-dollar tech name after a record quarter, it’s not chasing growth — it’s buying durability.

Market Reaction

The disclosure briefly lifted Alphabet shares in after-hours trading on Friday, as investors digested the significance of Berkshire’s first new mega-cap tech stake in years. Analysts now expect fresh comparisons between Alphabet’s AI capital discipline and Apple’s maturing growth profile, which Berkshire has been gradually reducing.

As of mid-November 2025, Alphabet trades around US $277, giving the stake a paper value near its initial cost — a rare instance where Buffett’s patience and Alphabet’s execution appear perfectly aligned.

Disclosure: This article is based on public filings and Alphabet’s official Q3 2025 financial results. It does not constitute investment advice.

Leave a comment