TL;DR Summary

Wells Fargo’s (WFC:NYSE) Q4 2025 results confirmed that the bank has largely exited its turnaround phase and entered a period of normalized, capital-driven value creation. Earnings exceeded expectations, profitability targets were raised, and shareholder returns accelerated meaningfully. However, softer net interest income guidance underscored that earnings growth will remain constrained by the rate environment. At around the high-$80s per share, the stock appears fairly valued with modest upside, driven primarily by buybacks rather than revenue momentum. Wells Fargo is no longer repairing — but it is also not re-rating aggressively yet.

Quarter Recap

Wells Fargo reported Q4 2025 earnings that reinforced the durability of its earnings base while clarifying the limits of near-term growth. Results benefited from continued cost discipline and strong capital deployment, allowing the bank to deliver an earnings beat despite a more challenging net interest income backdrop.

Management used the quarter to recalibrate investor expectations. While acknowledging ongoing pressure on net interest income, leadership emphasized that Wells Fargo has now achieved sufficient operational and regulatory stability to focus on normalized profitability and shareholder returns. The quarter marked a shift away from remediation narratives toward disciplined capital allocation, even as the pace of earnings expansion remains tied to macro conditions.

Key Highlights

- Management raised its medium-term ROTCE target to 17–18%, signaling confidence in sustainable profitability

- FY2025 capital returns of approximately $23B, including ~$18B in share buybacks

- Net interest income declined, with forward guidance indicating continued pressure into 2026

- Credit performance remained stable, with no material deterioration in asset quality

- Capital ratios stayed comfortably above regulatory requirements, preserving flexibility

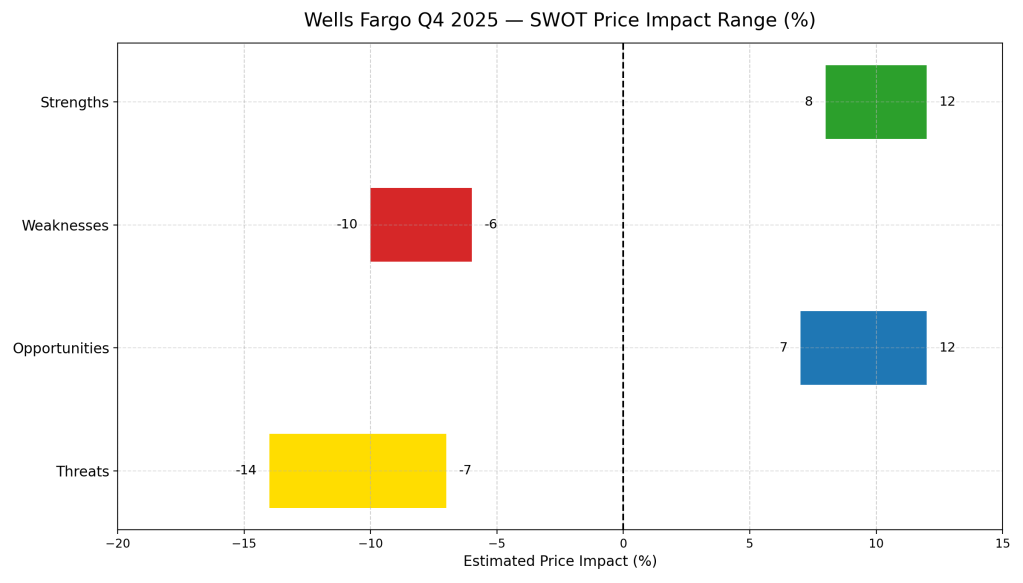

SWOT Analysis

Wells Fargo’s Q4 results reinforce a clear conclusion: the investment case is no longer about fixing the franchise, but about how much value can be created through capital returns in a constrained growth environment.

Strengths

Wells Fargo’s improving profitability profile and aggressive capital return program now anchor the equity story. The decision to raise the ROTCE target reflects confidence that the bank’s earnings power is structurally higher than in prior cycles. Large-scale buybacks at or near intrinsic value materially enhance per-share value and provide downside support even in a slow-growth scenario. Balance-sheet strength and disciplined risk management further reinforce earnings durability.

Estimated price impact: +8% to +12%

Weaknesses

Net interest income remains under pressure as asset yields reset faster than deposit costs can adjust, limiting operating leverage. While cost controls have improved, revenue growth remains heavily rate-dependent, constraining near-term upside. The reliance on capital returns rather than organic growth also caps the stock’s re-rating potential in the absence of a more favorable rate backdrop.

Estimated price impact: −6% to −10%

Opportunities

Sustained execution toward the newly raised ROTCE target could gradually improve investor confidence and support modest multiple expansion. Continued buybacks represent a powerful compounding mechanism, particularly if shares remain priced near intrinsic value. Incremental recovery in fee-based businesses, including wealth and card services, offers optional upside not fully reflected in current expectations.

Estimated price impact: +7% to +12%

Threats

The primary risks remain macro-driven. Faster-than-expected rate cuts would extend net interest income pressure, delaying earnings normalization. A material economic slowdown could push credit costs higher, overwhelming incremental efficiency gains. Regulatory intervention also remains a structural risk, even if less acute than in prior years.

Estimated price impact: −7% to −14%

Valuation Scenarios

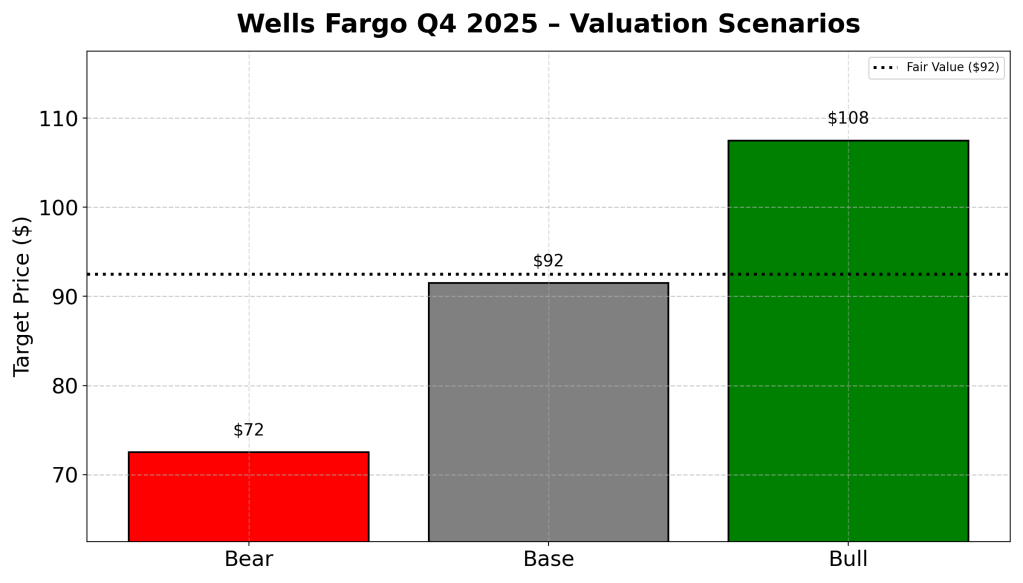

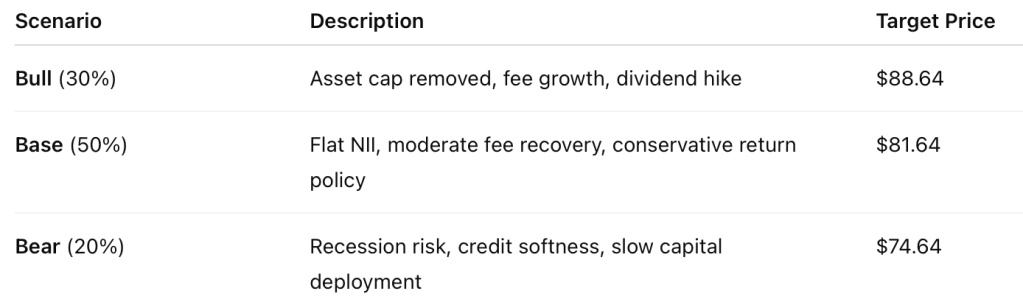

Wells Fargo is best valued using a normalized profitability and capital-return framework, rather than quarter-to-quarter earnings volatility. The scenarios below illustrate how different macro and execution paths could shape valuation outcomes.

Bear Scenario

This scenario assumes prolonged net interest income pressure combined with rising credit costs, limiting earnings growth and keeping valuation anchored near historical lows.

- Assumptions: Continued NII decline into 2026; higher credit costs; slower buyback pace

- Implied value: ~$70–75

Base Scenario

This reflects the current market consensus: net interest income stabilizes, credit remains well-behaved, and capital returns continue at scale.

- Assumptions: Mid-to-high-teens ROTCE; stable credit; sustained buybacks

- Implied value: ~$88–95

Bull Scenario

This scenario assumes a more supportive rate environment, fee income recovery, and faster progress toward profitability targets, enabling modest multiple expansion.

- Assumptions: NII stabilization; strong capital returns; gradual re-rating

- Implied value: ~$105–110

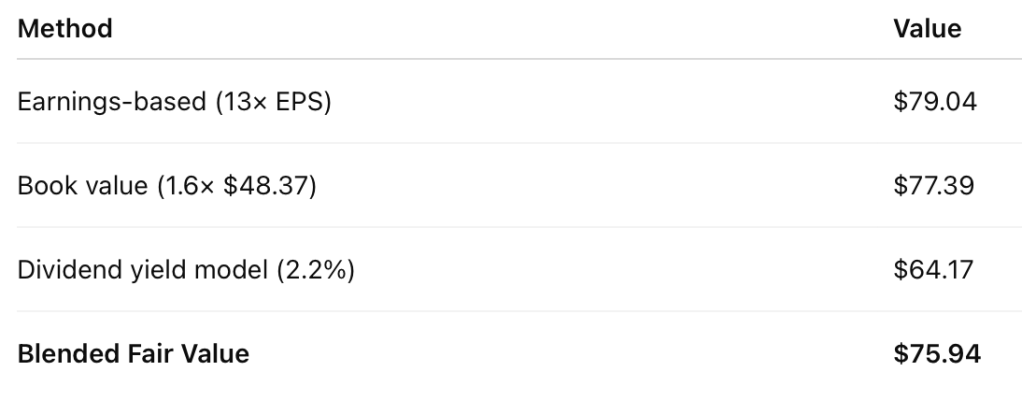

Probability-Weighted Fair Value

Across scenarios, Wells Fargo’s fair value clusters around:

~$90–95 per share

Verdict

Wells Fargo has decisively moved beyond its remediation phase, but it has not yet entered a clear growth-driven re-rating regime. Q4 confirmed improved earnings quality, strong capital returns, and rising profitability targets, yet the stock remains constrained by net interest income headwinds and macro uncertainty.

At current levels, Wells Fargo is best viewed as a hold or incremental accumulate for DIY value investors. The return profile is attractive, but it is driven by capital discipline and patience, not acceleration. The upside case exists — but it will take time.

Call to Action

If you own Wells Fargo, the key question is no longer whether the bank is fixed — that question has largely been answered. The real issue is whether capital returns and normalized profitability can compound value while investors wait for the rate cycle to turn. For valuation-aware investors building durable portfolios, Wells Fargo remains relevant — but not urgent.

Disclaimer

This analysis is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider your financial situation before making investment decisions.

Leave a comment