TL;DR Summary

Microsoft (MSFT:NASDAQ) delivered another powerful AI-driven quarter, with Azure accelerating to 29% growth and Copilot adoption scaling across enterprise workloads. Operating income rose faster than revenue, confirming strong margin leverage even amid elevated AI datacenter spending. The stock jumped over 4% after earnings, reflecting confidence that Microsoft remains the most durable platform for enterprise AI. Our fair value estimate is $453 per share, slightly above current levels.

Quarter Recap

Microsoft’s Q1 FY2026 results showcased a company benefitting from the early waves of enterprise AI adoption while managing the heavy capex load required to stay ahead of demand. Revenue grew 15% to $65.7 billion, supported by broad-based strength across cloud, productivity, and personal computing. Azure was the standout, accelerating to 29% YoY growth as AI workloads—training, inference, and agent-based tasks—continue to scale. Operating income rose 18% to $28.3 billion, showing that Microsoft is leveraging its size and product mix to offset surging datacenter investments. Earnings per share came in at $3.05, ahead of expectations, driven by robust cloud profitability and disciplined spending.

Key Highlights

- Azure +29% YoY, driven by AI infrastructure and inference workloads

- Copilot adoption accelerating across Office, GitHub, and Dynamics

- Operating income +18% YoY, showing durable profitability

- Management reiterated: “AI demand continues to exceed supply”

- Datacenter and GPU capex remains elevated through FY2026

- Stock jumped +4.4% after Q1 results

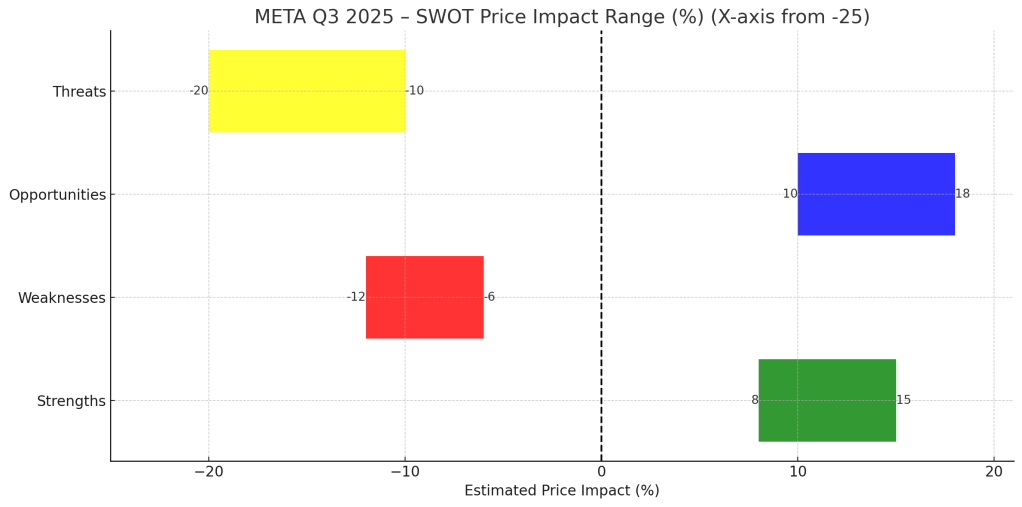

SWOT Analysis

Microsoft’s Q1 FY2026 results reinforced its position as the leading enterprise AI ecosystem. Azure’s accelerating growth, combined with expanding Copilot monetization, offers a unique blend of scale, stickiness, and margin durability. Yet, high AI capex and growing competition across cloud and AI infrastructure remain key risks to monitor.

Strengths (+6% to +12%)

- AI infrastructure leadership with Azure +29% YoY

- Rapid Copilot monetization across Microsoft 365, GitHub, and Dynamics

- High enterprise switching costs and long-term retention

- Operating income growing faster than revenue

Weaknesses (–4% to –8%)

- Heavy, multi-year datacenter and GPU capex

- Strategic dependence on OpenAI technology stack

- Enterprise budget pressure from rising AI software costs

- Ongoing regulatory scrutiny in the US and EU

Opportunities (+10% to +18%)

- Copilot becoming the default enterprise AI agent

- Azure gaining share as AWS growth slows

- AI PC upgrade cycle expected in 2026

- Higher-tier subscriptions in security and developer tools

Threats (–8% to –14%)

- Risk of AI capacity oversupply compressing hyperscaler margins

- Cloud and AI competition from AWS, Google Cloud, Oracle

- Rising adoption of open-source AI models

- Geopolitical tech restrictions affecting supply chains

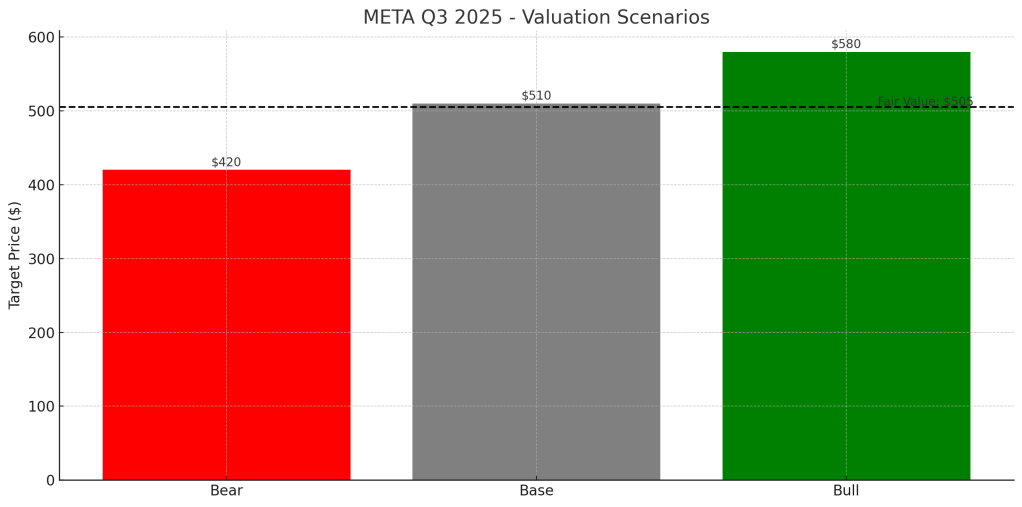

Valuation Scenarios

Our valuation framework incorporates Microsoft’s AI momentum, Azure growth trajectory, and margin durability to model a Bear, Base, and Bull scenario. Each scenario includes explicit growth and margin assumptions tied to EPS and forward multiples.

Bear Case — $385 (25%)

- Azure growth slows to mid-20%

- AI monetization ramps slower than expected

- Margins compressed by elevated capex

- Valuation: 25× forward EPS of ~$15.40 → $385

Base Case — $455 (50%)

- Azure steady at ~27–29%

- Strong enterprise AI adoption

- Stable operating margins

- Valuation: 29× forward EPS of ~$15.70 → $455

Bull Case — $515 (25%)

- Azure growth surpasses 30%

- Copilot becomes core enterprise AI layer

- Higher-margin subscription mix expands

- Valuation: 32× forward EPS of ~$16.10 → $515

Probability-Weighted Fair Value

→ $453 per share

Verdict

Microsoft remains the most structurally advantaged enterprise AI platform. Azure’s acceleration to 29% growth validates the demand narrative, and early Copilot adoption shows enterprises are already willing to pay for AI productivity gains. The biggest risk remains the scale of AI-related capex, but so far profitability is holding up strongly. With a probability-weighted fair value of $453, Microsoft remains slightly undervalued for long-term AI-focused investors.

Call to Action

If you found this analysis helpful, follow SWOTstock for more AI-focused quarterly breakdowns of the world’s most important companies. We cover earnings, valuation scenarios, and management commentary in a simple, investor-friendly format.

Disclaimer

This analysis is for informational and educational purposes only and does not constitute financial advice. Investing involves risk, including potential loss of principal. Please conduct your own research or consult a qualified financial professional before making investment decisions.