TL;DR Summary

JPMorgan Chase (JPM:NYSE) once again proved why it’s considered Wall Street’s fortress.

Third-quarter earnings beat expectations, investment banking is rebounding, and AI-driven efficiency is quietly reshaping operations.

At around $308 per share, the stock looks slightly undervalued with a fair value near $328 — steady upside for long-term value investors.

Quarter Recap

On October 14, 2025, JPMorgan reported EPS $5.07 on $46.4 billion in revenue, up about 9 percent year over year.

Net income reached $13.7 billion, with ROTCE 24 percent and ROE 20 percent, both exceptional for a global bank.

The company raised its full-year net interest income guidance to roughly $93 billion (excluding Markets), signaling confidence in margin stability.

CEO Jamie Dimon described the U.S. economy as “resilient but still pressured,” while emphasizing that AI adoption is already driving measurable productivity gains across fraud detection, operations, and client service.

Key Highlights

- Investment banking surged 25 percent year over year, led by stronger M&A and equity underwriting.

- Net interest income continued to climb, supported by robust consumer deposits.

- Wealth and asset management hit record levels: $4.7 trillion AUM with $80 billion in net inflows.

- Capital strength: CET1 ratio rose to 14.3 percent; management plans ≈ $30 billion in dividends and buybacks.

- Credit quality: Card loss rates normalized to ~2.6 percent — still well below pre-pandemic levels.

Market response was positive: the stock climbed roughly 3 percent to $310 following the release, as investors rewarded its steady execution.

SWOT Analysis (12-Month Price-Impact View)

Strengths (+ $15 to + $25)

- Industry-leading ROE (20 %) and ROTCE (24 %) sustain premium valuation.

- Fortress capital position (CET1 14.3 %) supports $30 B capital return program.

- AI and automation enhance efficiency and risk controls.

- Diversified revenue mix limits cyclicality across business lines.

Weaknesses (– $10 to – $18)

- Deposit costs rising faster than loan yields — NII growth plateau ahead.

- Consumer credit losses slowly normalizing.

- Technology and compliance investments pressure short-term margins.

Opportunities (+ $8 to + $20)

- Revival in deal-making and capital markets fees.

- Continued wealth inflows boost recurring revenues.

- Efficiency gains from AI could add ~3 % EPS growth through 2026.

Threats (– $12 to – $20)

- Potential U.S. slowdown reducing loan demand.

- Basel III Endgame rules may tighten capital buffers.

- Global market volatility could curb trading income.

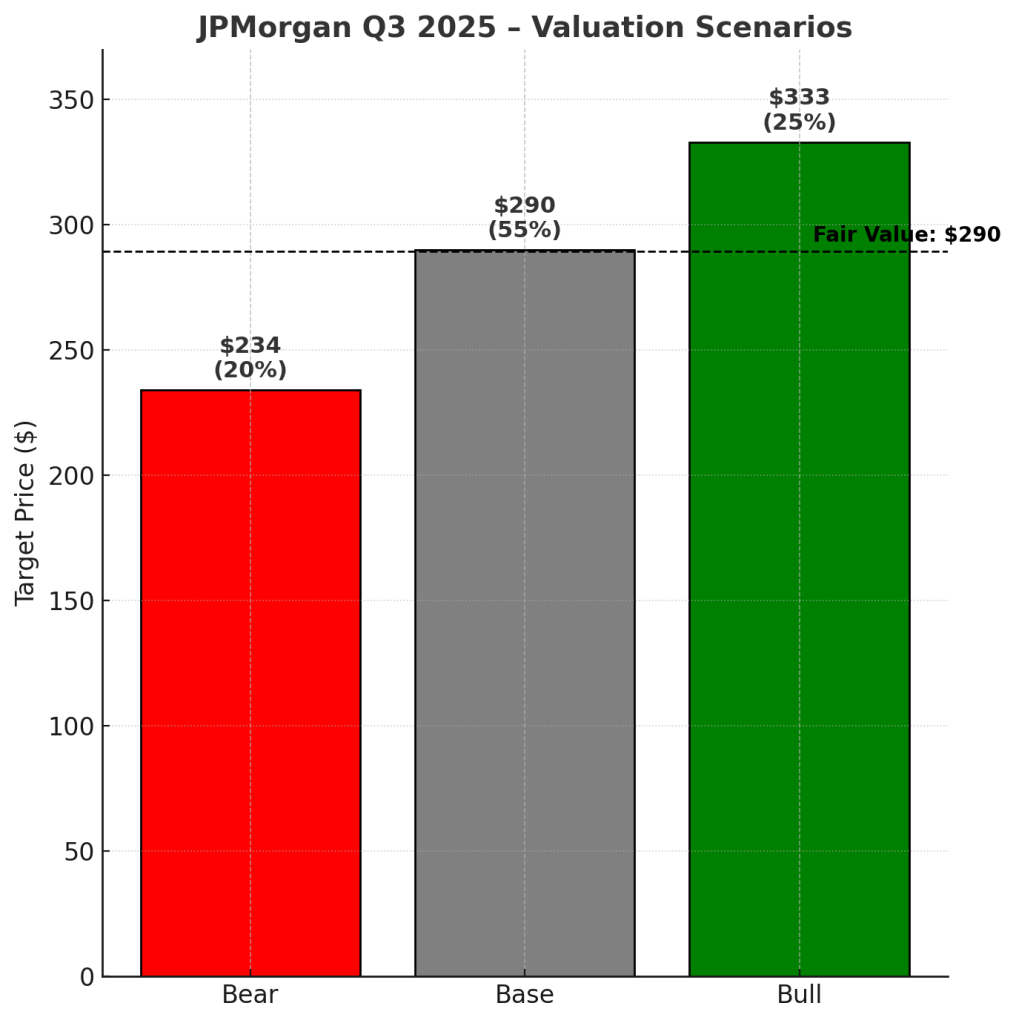

Valuation Scenarios

- Bull (+ 20 %) → $370

- Net interest income stays high, AI efficiency adds ~3 % to EPS, and P/B expands to 1.9×.

- Base (+ 5 %) → $325

- Stable credit costs and moderate growth support 1.7× P/B multiple.

- Bear (– 10 %) → $277

- Economic soft landing turns shaky; credit loss > 3 %, multiple compresses to 1.5×.

Probability-weighted fair value: ≈ $328 per share, implying a 6–7 % upside from the current $308.

Fair Price Assessment

The valuation rests on JPMorgan’s own fundamentals — not sentiment.

At 24 percent ROTCE and 1.7× book value, shares reflect fortress-level returns with room for modest re-rating.

AI efficiency and buybacks should sustain mid-single-digit EPS growth, keeping the fair price range between $315 and $340.

Verdict

JPMorgan is the definition of a fortress value stock — disciplined, diversified, and resilient.

It won’t outpace Silicon Valley, but its consistency and capital strength make it a cornerstone holding for long-term DIY value investors.

If you’re seeking steady dividends and defensive growth in an uncertain rate environment, this remains one of the best-managed banks in the world.

Call to Action

Track how AI efficiency unfolds across JPMorgan’s business lines in the coming quarters.

If those gains compound like its interest income, the “fortress bank” might quietly build its next growth engine.

Disclaimer

This analysis is for informational purposes only and is based solely on JPMorgan Chase’s official Q3 2025 financial report and earnings call transcript.

It does not constitute investment advice or a recommendation to buy or sell securities.

Leave a comment