TL;DR Summary

- American Express (AXP:NYSE) delivered another solid quarter, driven by resilient premium spending and strong cardmember engagement.

- Management guided to continued revenue and EPS growth in 2026, but higher investment and normalizing credit costs remain a headwind.

- At current levels, the stock looks fair to slightly expensive, with better risk–reward on pullbacks.

Quarter Recap

American Express Company reported Q4 2025 and full-year results that were fundamentally strong, yet met with a cautious market response. Revenue growth remained healthy, supported by Travel & Entertainment spending and a premium customer mix, while earnings landed slightly below expectations due to higher expenses. Management emphasized that credit trends are normalizing rather than deteriorating and reiterated confidence in the long-term earnings trajectory.

Key Highlights

- Revenue grew at a double-digit pace year over year, reflecting continued strength in premium consumer spending.

- Full-year earnings reached a record level, supported by fee income and cardmember engagement.

- Credit performance remained within management’s expected range, consistent with a return to pre-pandemic loss patterns.

- Ongoing investments in rewards, marketing, and technology weighed modestly on near-term margins.

- Capital returns through buybacks and dividends remain a core part of the shareholder story.

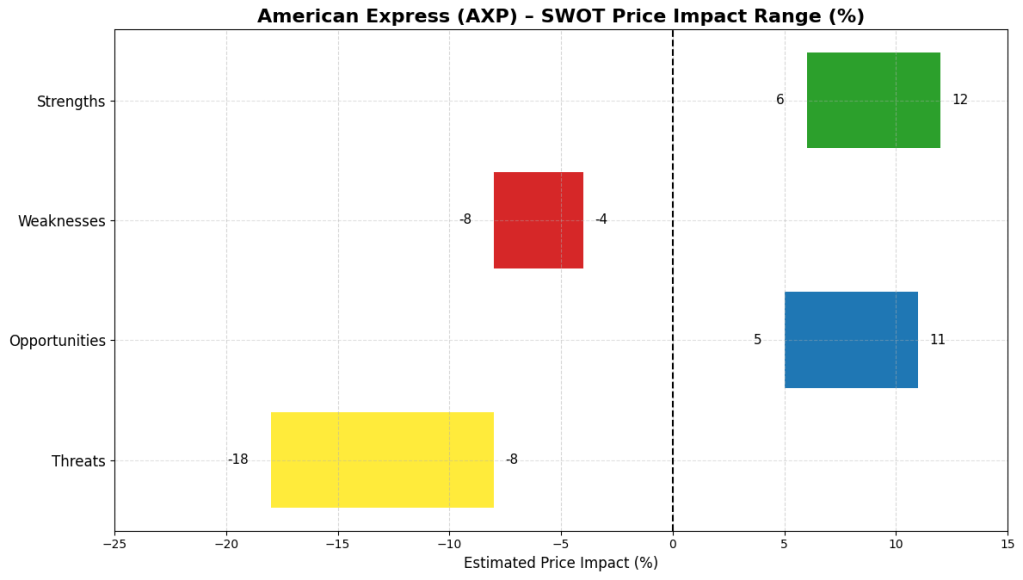

SWOT Analysis

American Express continues to stand out as a high-quality financial franchise with a differentiated premium model. However, valuation sensitivity has increased as investors focus more on cost discipline and credit normalization rather than pure top-line growth.

Strengths

- Affluent customer base with resilient Travel & Entertainment spending, supporting earnings durability (+6% to +12%).

- Sticky membership model with annual fees and rewards, driving strong lifetime value and pricing power (+4% to +9%).

- Clear medium-term growth outlook anchored by management’s 2026 guidance (+5% to +10%).

Weaknesses

- Elevated marketing and reward investments can pressure margins and lead to small EPS misses (−4% to −8%).

- Combined network, issuing, and credit exposure makes earnings more sensitive to credit normalization (−3% to −7%).

Opportunities

- Continued acquisition of Millennials and Gen Z customers enhances long-term earnings power (+5% to +11%).

- Premium product refreshes can lift engagement, fees, and spending per cardmember (+3% to +8%).

Threats

- Regulatory scrutiny and policy headlines can weigh on sentiment even without immediate financial impact (−6% to −15%).

- A macro slowdown could dampen Travel & Entertainment spend and accelerate credit costs (−8% to −18%).

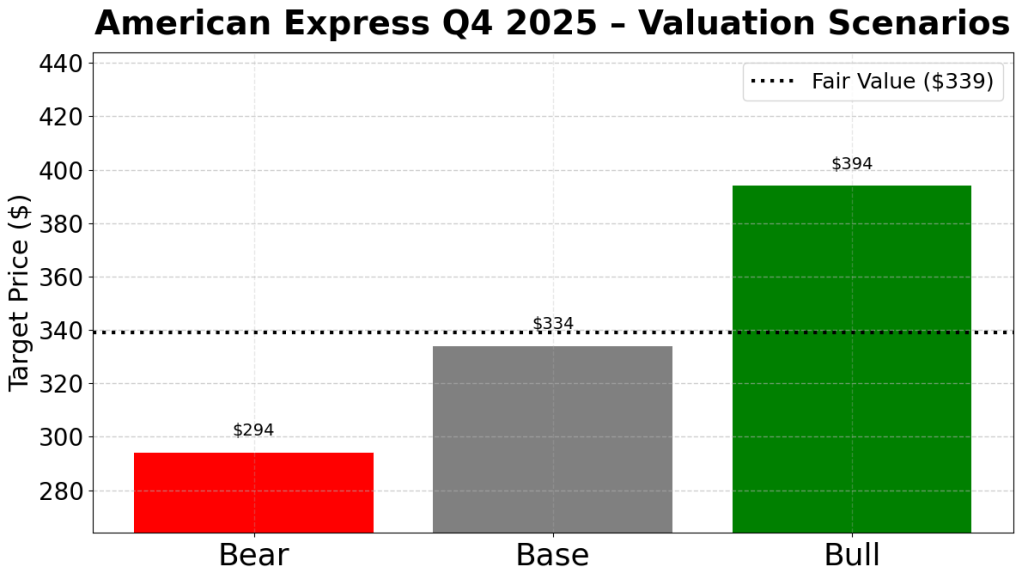

Valuation Scenarios

Using management’s 2026 EPS guidance and a range of reasonable valuation multiples, the stock’s upside and downside can be framed as follows.

Bear Case

- EPS at the low end of guidance with multiple compression.

- Implied value around $294, reflecting credit and cost concerns.

Base Case

- Midpoint EPS with a normalized premium multiple.

- Implied value around $334, assuming steady execution and controlled investments.

Bull Case

- High-end EPS with multiple expansion driven by premium growth re-rating.

- Implied value around $394, assuming strong affluent spending and operating leverage.

Probability-weighted fair value

- Combining these scenarios yields a fair value estimate of around $340.

Verdict

American Express remains a best-in-class consumer finance franchise with durable growth drivers and strong capital returns. However, at current prices, much of that quality is already reflected in the stock. For value-oriented investors, the shares look fair to slightly expensive, with a more attractive entry point likely emerging during periods of market volatility or macro-driven pullbacks.

Call to Action

If you’re tracking high-quality financial stocks through the cycle, follow SWOTstock for clear, earnings-driven analysis that separates long-term fundamentals from short-term noise.

Disclaimer

This article is for informational and educational purposes only and does not constitute investment advice. Investors should conduct their own research and consider their financial situation and risk tolerance before making investment decisions.

Leave a comment