💡 TL;DR – Oracle’s AI Engine is Revving, But Is the Price Already Peaked?

Oracle (NYSE: ORCL) delivered a blockbuster Q4 with cloud revenue up 27% and Infrastructure-as-a-Service (OCI) growing 52%. Management forecasts even stronger acceleration in FY2026 — with 70%+ OCI growth and a $25 billion capex plan focused on GenAI. Investors loved it, bidding up the stock nearly 8% after hours. But with Oracle now trading around $190, the key question is whether the AI-fueled upside is already fully priced in.

📅 Oracle’s Cloud Pivot Is Real — and It’s Speeding Up

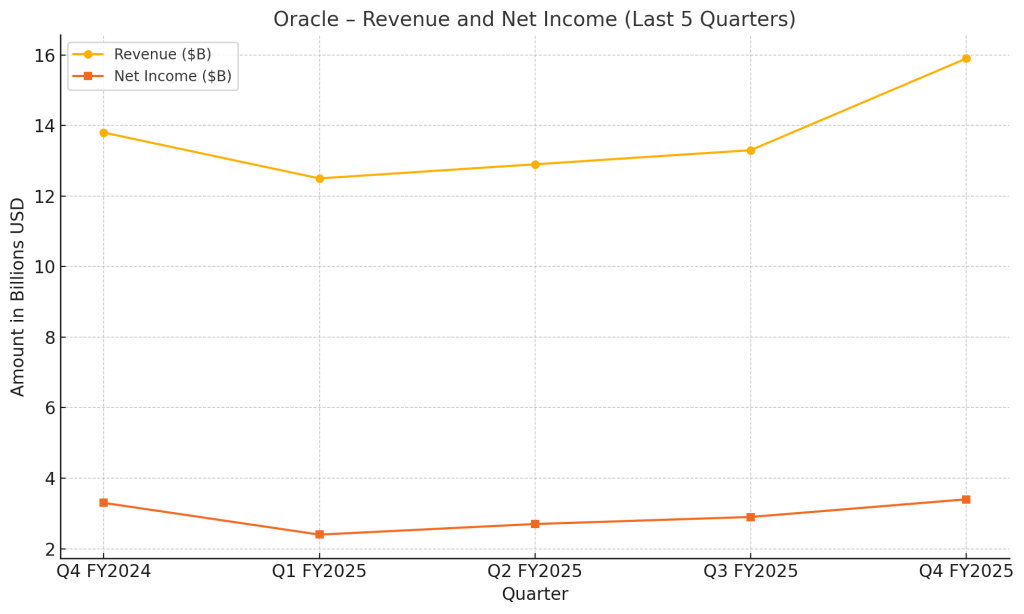

Oracle’s fiscal Q4 FY2025 results (for the quarter ending May 31) showcased a company in transition — and perhaps finally hitting escape velocity from its legacy roots. Total revenue rose 11% YoY to $15.9 billion, fueled by explosive growth in cloud services. Cloud now accounts for over 42% of Oracle’s total revenue base, with the Infrastructure business leading the charge.

Cloud Infrastructure (OCI) revenue surged 52% year-over-year to $3.0 billion. While that slightly missed some analyst whisper numbers, it still handily beat consensus and helped the company deliver a non-GAAP EPS of $1.70. More importantly, management struck an unusually aggressive tone for FY2026, projecting OCI growth of over 70% and overall cloud growth north of 40%.

Investors immediately rewarded the shift in tone — and trajectory. Oracle shares surged from $176.50 to nearly $190 in after-hours trading, reflecting a vote of confidence in the company’s AI roadmap.

🌟 Key Highlights from the Call

- Cloud Infrastructure (OCI) revenue grew 52%, and management expects >70% in FY2026.

- Multicloud partnerships (AWS, Azure, Google) driving 115% YoY database growth.

- AI infrastructure: NVIDIA GPU clusters fully sold out; Oracle now trains large LLMs.

- Operating cash flow for the year was $20.8B (+12% YoY).

- Legacy business drag continues, with hardware down 6% and license support up just 3%.

🔍 What Oracle’s Execs Just Told Us (and Why It Matters)

CEO Safra Catz called FY2025 a “very good year,” but made clear the company sees FY2026 as an inflection point. That’s not just talk — Oracle is backing its vision with capital, planning to invest $25 billion into AI-focused infrastructure, including NVIDIA GPU clusters and new datacenters.

Larry Ellison emphasized that Oracle now trains large-scale language models on OCI superclusters and highlighted that OCI’s AI capacity is already fully sold out. He also touted 115% year-over-year growth in multi-cloud database revenue from hyperscaler partners like Microsoft, Google, and AWS. That stat alone turns heads — and signals that Oracle is more than just a slow-moving enterprise giant.

At the same time, Oracle’s legacy businesses continue to lag. Hardware revenue was down 6%, and traditional license support only grew 3%. But it’s clear where the company’s energy — and investor attention — is going.

🧠 Oracle’s AI Trajectory: What Could Go Right (or Very Wrong)

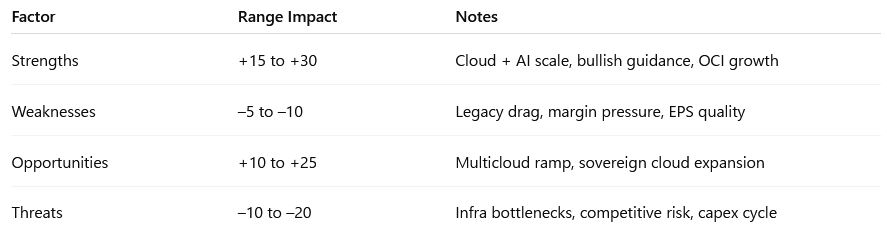

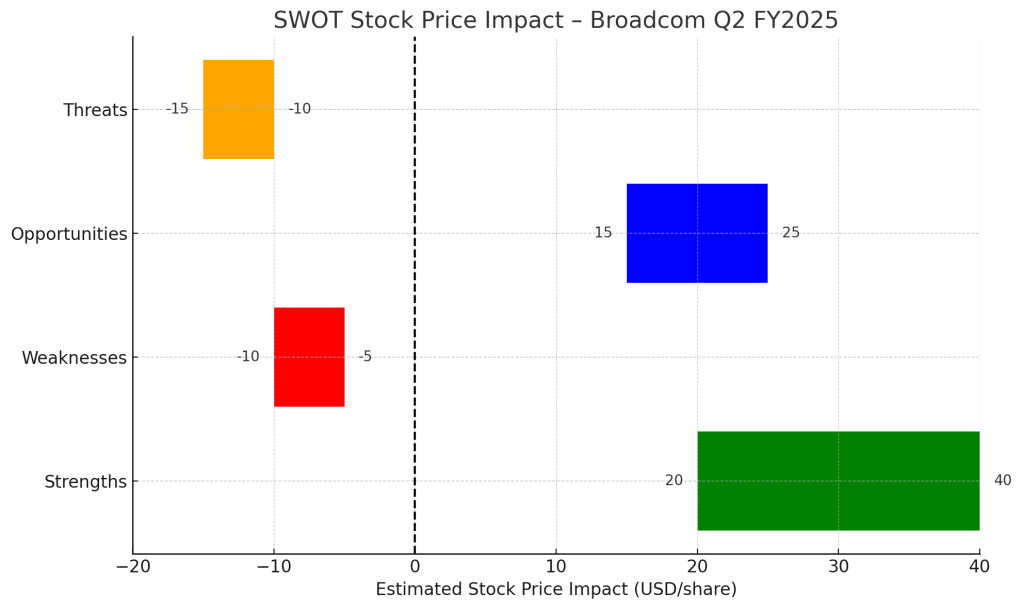

✅ Strengths (+15 to +30 USD/share)

Oracle’s biggest asset right now is momentum. The company isn’t just talking about AI infrastructure — it’s actively deploying it. With OCI consumption revenue up 62% and GPU demand outpacing supply, the company’s pivot into AI cloud infrastructure is both real and scalable. If Oracle delivers on its >70% growth target, investors could reward it with a premium multiple, adding as much as $30/share in upside.

❌ Weaknesses (–5 to –10 USD/share)

Still, legacy Oracle hasn’t disappeared. Low-growth segments like license support and hardware continue to weigh on consolidated performance. Margins remain under pressure, and part of the recent EPS growth came from share buybacks and tax adjustments, not pure operating leverage.

🌱 Opportunities (+10 to +25 USD/share)

Oracle’s MultiCloud strategy — deploying services across AWS, Azure, and Google Cloud — is opening new frontiers. Government workloads, healthcare, and sovereign cloud deployments are becoming high-growth areas. This isn’t just a defensive move; it’s Oracle expanding its addressable market at precisely the right time.

⚠️ Threats (–10 to –20 USD/share)

Of course, scaling infrastructure this aggressively brings risk. The company is committing $25 billion in capex, and any delay in deployment, cost overruns, or demand shortfall could damage margins. On top of that, the competitive threat from hyperscalers like AWS and Microsoft remains fierce.

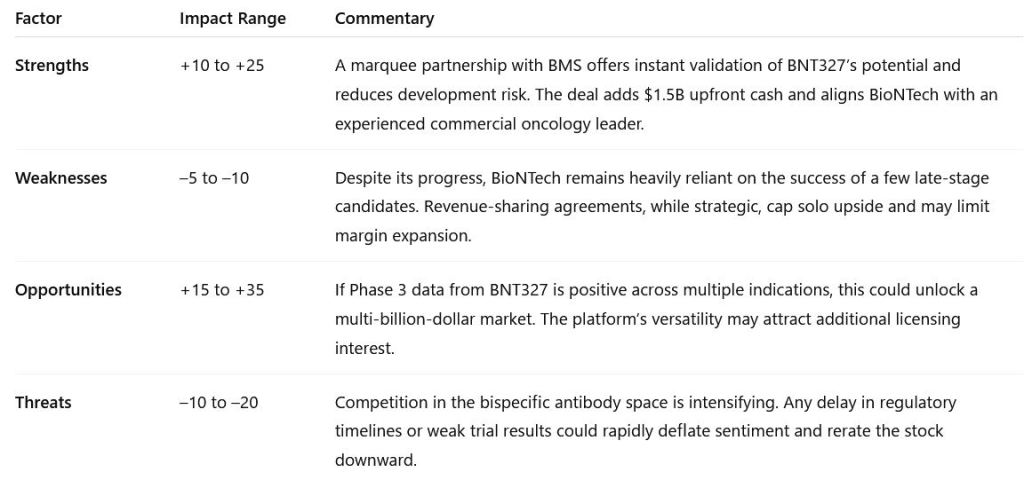

📊 SWOT Summary Table

💰 Oracle’s Future by the Numbers — How Far Can It Run?

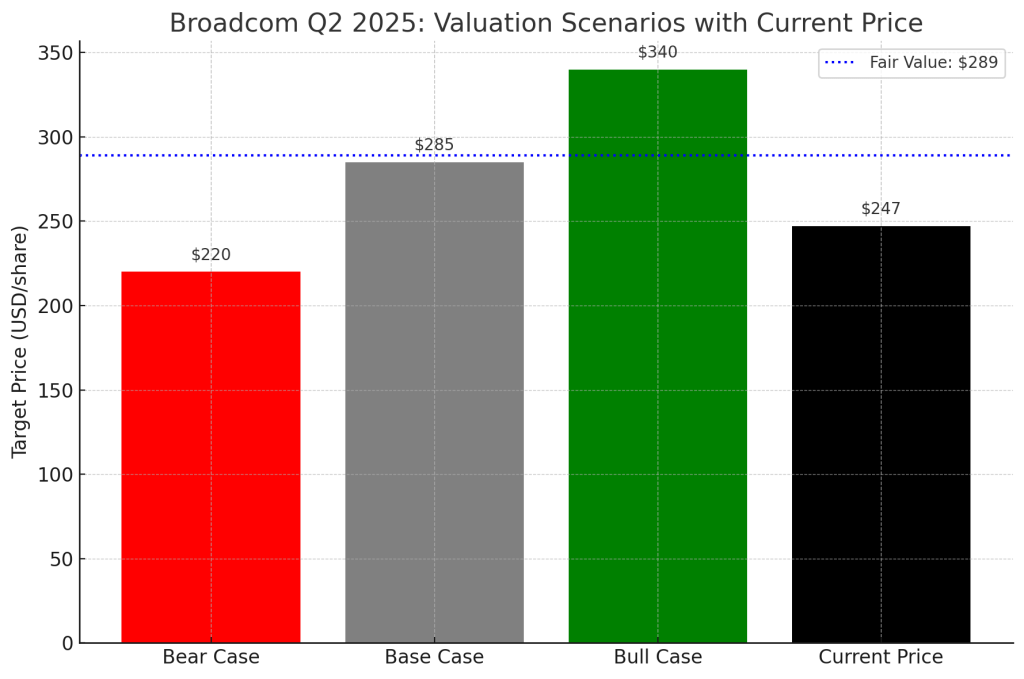

To evaluate Oracle’s investment case, we modeled three potential futures based entirely on official guidance and internal execution assumptions.

Bull Case – $210 (25%)

In the bull case, Oracle delivers on everything. GPU constraints ease, datacenters ramp up smoothly, and OCI’s explosive growth becomes the new norm. FY2026 EPS could reach $8.40, and if the market assigns a 25x multiple, we get a $210/share valuation. That would reflect Oracle’s full transformation into an enterprise AI infrastructure leader. We assign a 25% probability to this outcome.

Base Case – $185 (60%)

The base case, our most likely scenario (60%), assumes that execution remains strong, but not flawless. Some datacenter bottlenecks persist, but cloud revenues grow consistently. EPS lands around $7.40, which supports a $185/share valuation under a stable 25x multiple. This scenario reflects healthy, disciplined growth and is likely already reflected in current investor expectations.

Bear Case – $160 (15%)

In the bear case, execution lags. Capex pressures margins, and OCI growth slows to below expectations. If EPS only reaches $6.40, and multiples remain steady, we get a $160/share valuation. We think the chance of this outcome is about 15%.

Taken together, these scenarios point to a weighted fair value of $187.50/share, which is just about where Oracle is trading after earning released.

🎯 Weighted Fair Value Calculation

(0.25×210)+(0.60×185)+(0.15×160)=52.5+111+24=187.5

📌 Estimated Fair Value = $187.50/share

🎯 Should You Buy Oracle Now — or Wait for the Dip?

There’s no question Oracle is no longer the conservative enterprise holdout it once was. Its Q4 results and aggressive AI roadmap show that it’s pushing hard to become a core infrastructure layer for the AI economy. If you believe in that future, it may still have room to run — but likely at a steadier pace than the post-earnings rally suggests.

With the stock already trading near our fair value estimate, we think the best move now depends on your position. If you’re a long-term holder, this quarter reinforced your thesis. But if you’re still on the sidelines, a pullback toward $175 may offer a better risk-adjusted entry.

📣 Call to Action

Looking for clear, data-driven earnings insights that cut through the noise?

🟢 Subscribe to SWOTstock for no-hype analysis that follows the money, not the buzzwords.

⚠️ Disclaimer

This article is for informational purposes only and does not constitute financial advice. All data and commentary are based solely on Oracle’s official Q4 FY2025 earnings release and management statements.

Leave a comment