TL;DR Summary

Bank of America (BAC: NYSE) delivered a solid Q4, reinforcing the durability of its core franchise even as net interest income continued to soften. Earnings exceeded expectations, credit remained well-behaved, and capital levels stayed comfortably above regulatory requirements. At around $53 per share, the stock appears fairly valued to modestly undervalued, but the upside case remains dependent on rate normalization and capital return timing, not quarterly momentum. BAC is no longer under stress — but it is still in a waiting phase.

Quarter Recap

Bank of America reported Q4 2025 results that confirmed earnings resilience amid an unfavorable interest-rate backdrop. Revenue and EPS came in ahead of expectations, supported by strong trading performance and diversified fee income, which partially offset continued pressure on net interest income.

While credit costs remained within management’s guidance, the quarter also made clear that NII has not yet bottomed, delaying the point at which operating leverage can meaningfully re-emerge. Management reiterated confidence in the underlying strength of the U.S. consumer and emphasized balance-sheet flexibility, while acknowledging that the pace and shape of rate cuts will be the dominant driver of earnings normalization into 2026.

Key Highlights

- Revenue of approximately $28.4B and EPS of $0.98 exceeded consensus expectations

- Net interest income continued to decline, with no clear trough yet visible

- Trading and markets revenues provided meaningful offset to rate-driven pressure

- Credit costs remained controlled and within guided ranges

- Capital ratios stayed comfortably above regulatory minimums, preserving long-term buyback optionality

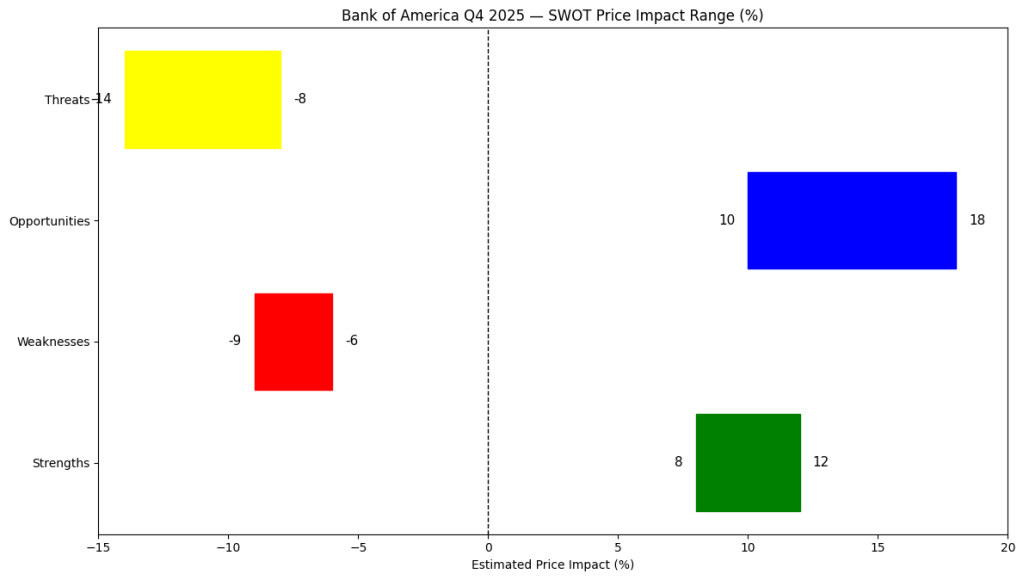

SWOT Analysis

Bank of America’s Q4 results reinforce a familiar conclusion: this is a high-quality, systemically important bank whose valuation is now driven less by execution risk and more by macro timing and capital deployment.

Strengths

Bank of America’s scale, deposit franchise, and balance-sheet strength continue to provide earnings durability across cycles. Despite ongoing NII pressure, the bank generated mid-teens returns on tangible equity, underscoring the resilience of its core business. Diversified revenue streams — particularly in markets and fee-based businesses — further reduce earnings volatility and reinforce franchise quality.

Estimated price impact: +$5 to +$8

Weaknesses

Net interest income remains under pressure as asset yields reset faster than deposit costs can adjust. In addition, the bank’s structurally high cost base limits operating leverage in a slow-growth environment, delaying the inflection point investors are waiting for.

Estimated price impact: −$4 to −$7

Opportunities

A gradual rate normalization cycle would allow NII to stabilize and support a re-rating toward historical mid-cycle valuation multiples. In parallel, the eventual re-acceleration of share buybacks could materially enhance EPS growth even in a modest revenue environment, providing a powerful lever for shareholder value creation.

Estimated price impact: +$6 to +$10

Threats

The primary downside risk remains macro-driven. Faster-than-expected rate cuts would extend margin pressure, while any material deterioration in consumer or commercial credit would quickly overwhelm incremental operating improvements. Regulatory intervention also remains a persistent, though less immediate, structural risk.

Estimated price impact: −$6 to −$12

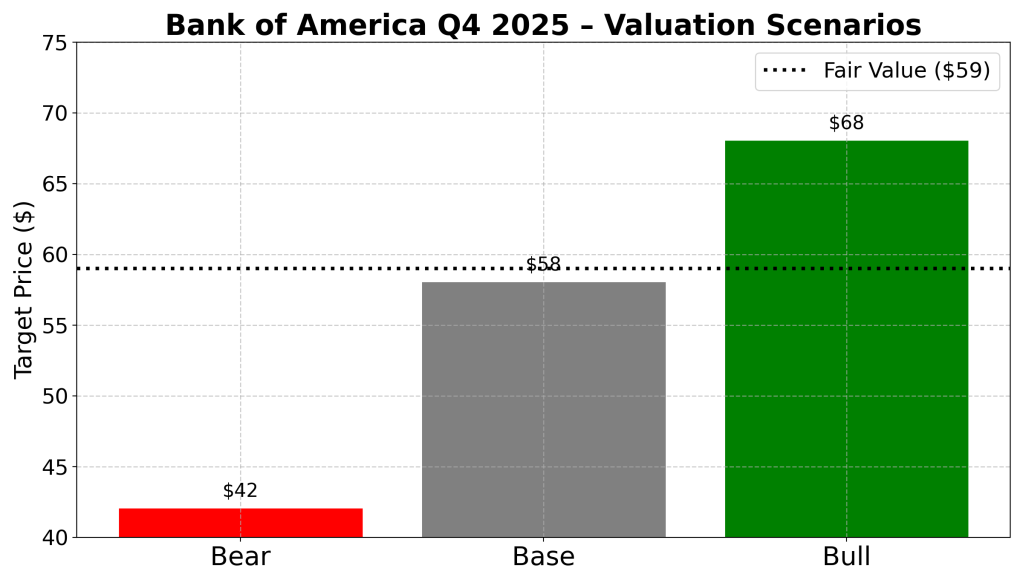

Valuation Scenarios

Bank of America should be valued using a normalized return-on-tangible-equity framework, rather than quarter-to-quarter earnings volatility. The scenarios below reflect how changes in rates, credit, and capital returns would shape valuation outcomes.

Bear Scenario

This scenario assumes prolonged NII pressure combined with rising credit costs, forcing valuation toward the lower end of historical P/TBV ranges.

- Assumptions: NII continues to decline into 2026; credit losses rise above guidance; buybacks remain constrained

- Implied value: ~$40–43

Base Scenario

This reflects the current market view: NII bottoms over the next several quarters, credit normalizes, and modest capital returns resume.

- Assumptions: Mid-teens ROTCE; stable credit; gradual buyback recovery

- Implied value: ~$55–60

Bull Scenario

This scenario assumes a supportive rate environment, stable credit, and an accelerated buyback cycle that lifts EPS growth.

- Assumptions: NII stabilization; strong capital return; valuation re-rates toward mid-cycle multiples

- Implied value: ~$65–70

Probability-Weighted Fair Value

Taking these scenarios together, Bank of America’s fair value clusters around:

~$57–60 per share

Verdict

Bank of America has moved decisively out of the “stress discount” phase, but it has not yet entered a clear re-rating regime. Q4 confirmed franchise strength and earnings durability, yet the stock remains anchored by uncertainty around rates and the timing of capital return acceleration.

At current levels, BAC is best viewed as a hold or accumulate-on-weakness position for DIY value investors. The upside case exists, but it is macro-dependent, not execution-driven. Patience — rather than optimism — remains the dominant investment requirement.

Call to Action

If you own Bank of America, the key question is no longer balance-sheet safety — that has been reaffirmed. The real question is whether the rate cycle will cooperate in unlocking earnings normalization and capital returns. For investors building resilient, valuation-aware portfolios, BAC remains a credible component — but not yet a high-conviction opportunity.

Disclaimer

This analysis is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider your financial situation before making investment decisions.