TL;DR Summary

Berkshire delivered one of its strongest operating quarters in years: $13.5B in operating earnings (+34% YoY), $30.8B in net income, and a record $381B cash pile. Insurance posted exceptional underwriting profits and float grew to $176B. Yet the stock barely reacted on Nov 3 — reflecting Buffett’s continued caution, no buybacks, and heavy cash positioning. Berkshire looks fairly valued, with modest upside if capital deployment improves.

Quarter Recap

Berkshire reported Q3 2025 earnings on Saturday, November 1. The results showcased the strength of its core businesses:

- Operating earnings surged to $13.485B, driven by rebounding insurance profitability.

- Net income came in at $30.796B, boosted by mark-to-market investment gains.

- Insurance underwriting delivered $2.369B in profit — nearly triple YoY.

- Berkshire Hathaway Energy earned $1.489B; BNSF generated $1.449B.

- The company ended the quarter with $305B in U.S. Treasury bills and $381.7B in total cash and equivalents — a historic record.

Despite these results, Berkshire again did not repurchase shares and was a net seller of equities during the quarter — a message that did not go unnoticed by the market.

Key Highlights

1. A Massive Cash Wall

Berkshire now holds one of the largest cash positions in its history — a sign of both discipline and a lack of compelling opportunities.

2. Insurance Delivered Its Best Quarter in Years

Underwriting profit and investment income both rose sharply, supported by higher rates and disciplined pricing.

3. Apple Exposure Remains High

Apple continues to dominate the equity portfolio, though Berkshire reduced its position earlier in the year.

4. No Buybacks in 2025

Management chose not to repurchase shares for the first nine months — a strong signal that Buffett does not view Berkshire as undervalued at current levels.

5. Market Reaction Was Muted

On Nov 3 (first trading day after earnings), BRK.B closed near $476, showing almost no reaction to the strong quarter — reflecting cautious investor sentiment and the sense that Berkshire is in a holding pattern.

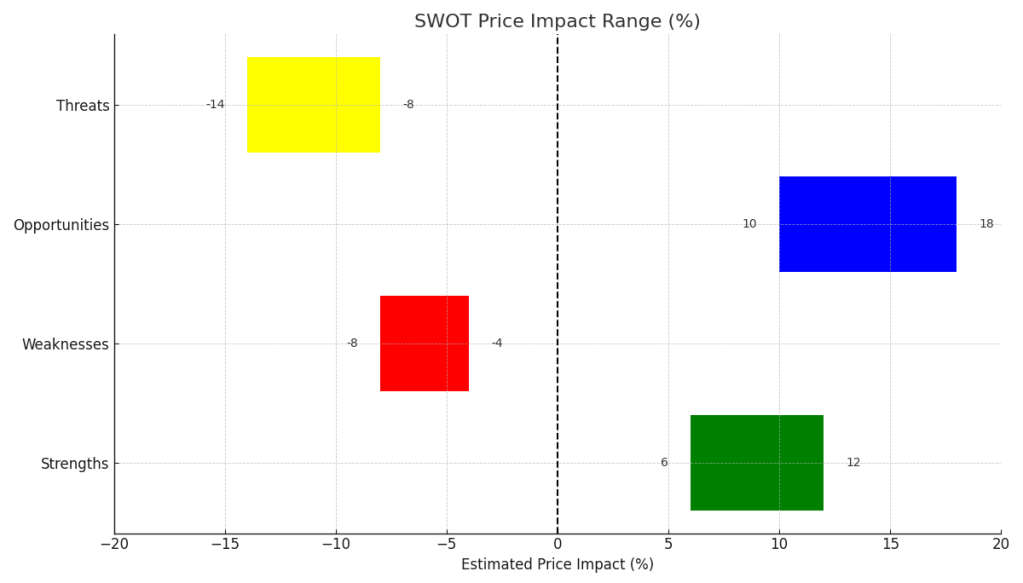

SWOT Analysis

Strengths (+6% to +12%)

- Record cash levels

- Strong underwriting performance

- Diversified, resilient businesses

- Significant float growth

Weaknesses (–4% to –8%)

- Sluggish revenue growth

- No buybacks YTD

- Heavy reliance on Apple

Opportunities (+8% to +15%)

- Capital deployment potential

- Treasury valuation upside

- Insurance pricing cycle

Threats (–10% to –18%)

- Succession transition

- Market downturn exposure

- Catastrophe risk

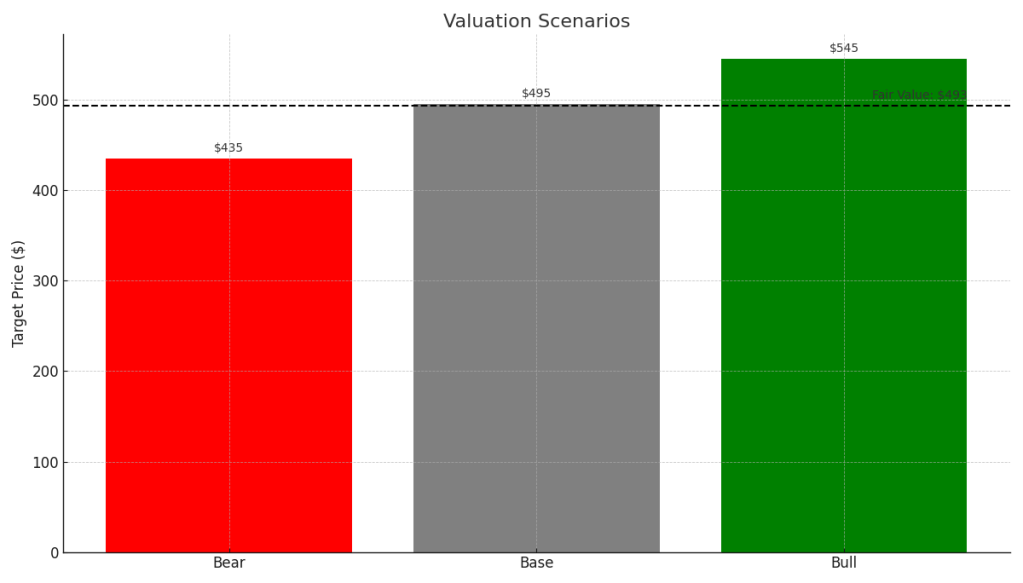

Valuation Scenarios (Bull / Base / Bear)

Bear Case — $435 (25%)

- Uses mid-threat impact

- No buybacks, leadership uncertainty

- Market correction risk

Fair value: $476 × (1 – 9%) ≈ $435

Base Case — $495 (50%)

- Balanced strengths/weaknesses

- Stable operating earnings

- Treasury yield support

Fair value: $476 × (1 + 4%) ≈ $495

Bull Case — $545 (25%)

- Strong insurance profitability

- Opportunistic capital deployment

- Rate cuts boosting Treasury book

Fair value: $476 × (1 + 14.5%) ≈ $545

Probability-Weighted Fair Value

= (0.25 × 435) + (0.50 × 495) + (0.25 × 545)

= $493

Final Fair Value: $493

≈ 3.6% above current price → Fairly Valued

Verdict

Berkshire remains a fortress — high-quality, resilient, and disciplined. But with such a massive cash position and no buybacks, the market is waiting for a catalyst. Q3 shows strength, but until Berkshire deploys capital or signals undervaluation with buybacks, the stock likely stays range-bound.

For long-term value investors, Berkshire remains a low-risk compounder — but not yet a bargain.

Call to Action

If you found this analysis helpful, follow SWOTstock for more breakdowns of major earnings, fair-value scenarios, and investor-focused research. Share this post with another DIY value investor who follows Berkshire closely.

Disclaimer

This article is for informational and educational purposes only and is not investment advice. All analysis is based solely on Berkshire Hathaway’s official Q3 2025 financial report and management disclosures.