Summary: Uber’s Q1 2025 Earnings, Stock Price Reaction, and Valuation Insight

Uber’s (NYSE: UBER) Q1 2025 was a win on profitability and user growth, with record free cash flow and rising trip volumes. However, revenue slightly missed Wall Street expectations, and the Freight segment shrank again. Uber’s CEO emphasized strength in consumer demand and platform efficiency, but the stock sold off modestly after the report. Based on Uber’s own financials and guidance, the stock looks moderately overvalued at current levels.

Quarter Recap

Uber reported Q1 2025 revenue of $10.13 billion, growing 14% year-over-year but just shy of the ~$10.2–10.3 billion consensus estimate. Profitability was the highlight: Adjusted EBITDA hit $1.9 billion (up 35% YoY), and free cash flow reached a record $2.3 billion.

CEO Dara Khosrowshahi called this a quarter of “profitable growth at scale,” highlighting rising trip demand, product stickiness, and expansion in both Mobility and Delivery. He credited Uber’s investments in shared rides, Uber Reserve, and autonomous vehicle partnerships as key long-term bets now starting to show traction.

Why this quarter matters: Uber proved it can grow while generating strong free cash flow—but the market reaction shows expectations are already high.

Key Highlights

- Revenue: $10.13B (+14% YoY, slight miss vs. ~$10.2B consensus)

- Adjusted EBITDA: $1.9B (+35% YoY)

- Free Cash Flow: $2.3B (record high)

- Trips: 3.0B (+18% YoY)

- Monthly Active Platform Consumers (MAPCs): 170M (+14% YoY)

- Freight Gross Bookings: –2% YoY

- FX Headwind Impact: –$1.7B to Gross Bookings

- Post-Earnings Stock Reaction: Stock declined ~2.5% to $83.65 on May 7

SWOT Analysis

Let’s break it down using the simple SWOT framework—what’s working, where Uber is vulnerable, where future upside could come from, and what risks could spoil the party.

Strengths

Uber’s strong operational leverage is clear. Trips rose 18%, MAPCs grew 14%, and profitability surged. Management emphasized consistently high user retention, growing use of Uber Reserve, and a broader footprint across suburban areas.

CEO Dara Khosrowshahi: “We kicked off the year with yet another quarter of profitable growth at scale.”

Estimated stock impact: +6 to +8 USD

Weaknesses

Despite the upbeat tone, Uber missed revenue expectations, and the Freight segment declined again. Currency headwinds shaved $1.7 billion from Gross Bookings, highlighting exposure to macro volatility.

Management note: Freight volumes remain challenged amid ongoing softness in global logistics.

Estimated stock impact: –2 to –3 USD

Opportunities

Uber’s expansion into suburban cities, growing advertising business, and rollout of autonomous vehicle services create major long-term growth levers. The partnership with Waymo in Austin is already operating at higher utilization than many human drivers.

Management outlook: “We’re on track to expand Uber Reserve, scale AV operations across multiple U.S. cities, and grow our ads business to $1 billion annually.”

Estimated stock impact: +4 to +6 USD

Threats

Uber cited FX volatility and macro uncertainty, particularly a slowdown in airport trips, as external headwinds. While they didn’t reference Ukraine or tariffs explicitly, the global environment remains a risk—especially with international expansion and AV regulatory hurdles ahead.

CFO comment: “We expect FX headwinds of about 1.5% in Q2. Global conditions remain dynamic.”

Estimated stock impact: –3 to –5 USD

SWOT Summary Table (Mobile-Friendly)

| Category | Details | Est. Stock Impact (USD) |

|---|---|---|

| Strengths | Trip growth, record free cash flow, consistent retention | +6 to +8 |

| Weaknesses | Freight decline, FX headwinds, revenue miss | –2 to –3 |

| Opportunities | AV expansion, Uber Reserve, delivery ads, grocery growth | +4 to +6 |

| Threats | Macro slowdown, FX risk, regulation, valuation pressure | –3 to –5 |

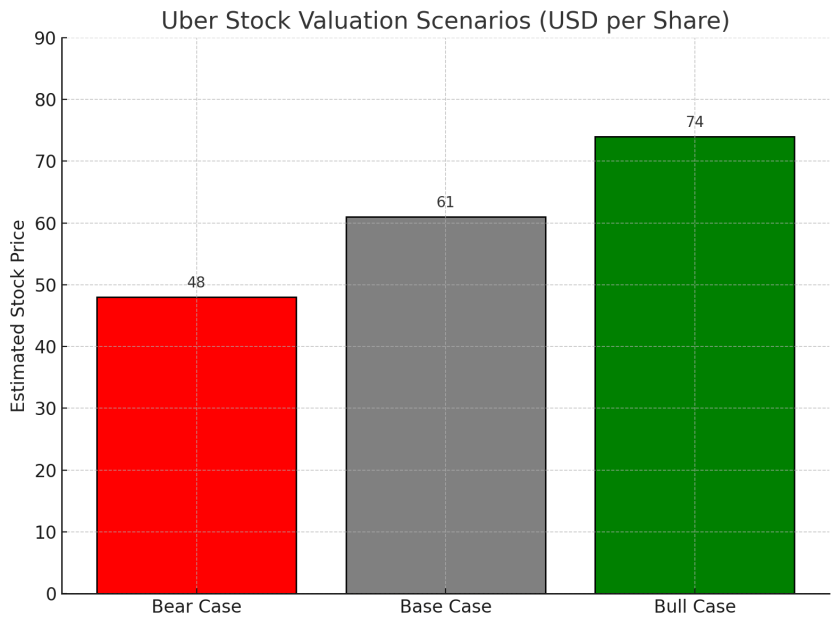

Valuation Scenarios

Based on these factors and company guidance, here’s how Uber’s stock could play out over the next 6–12 months:

| Scenario | Summary | Valuation | Probability |

|---|---|---|---|

| Bull Case | AV expansion accelerates, international growth drives margin gains | $74 | 25% |

| Base Case | Solid execution, stable margins, FX impact manageable | $61 | 55% |

| Bear Case | Global slowdown + regulatory drag reduce upside | $48 | 20% |

Weighted Average Valuation

(74 × 0.25) + (61 × 0.55) + (48 × 0.20) = $61.65

Current price (as of May 10): $82.81

Verdict

Uber’s financial performance is impressive—but the stock is already pricing in much of the good news. At nearly $83, it’s trading ~34% above the base case valuation of $61.65, suggesting limited upside without a major re-rating from AV or international expansion.

Conclusion: Overvalued for now. Strong execution, but patience may pay off.

Call to Action

Enjoying these deep dives into earnings?

Subscribe now to get simple, structured stock breakdowns — powered by real earnings data, not hype.

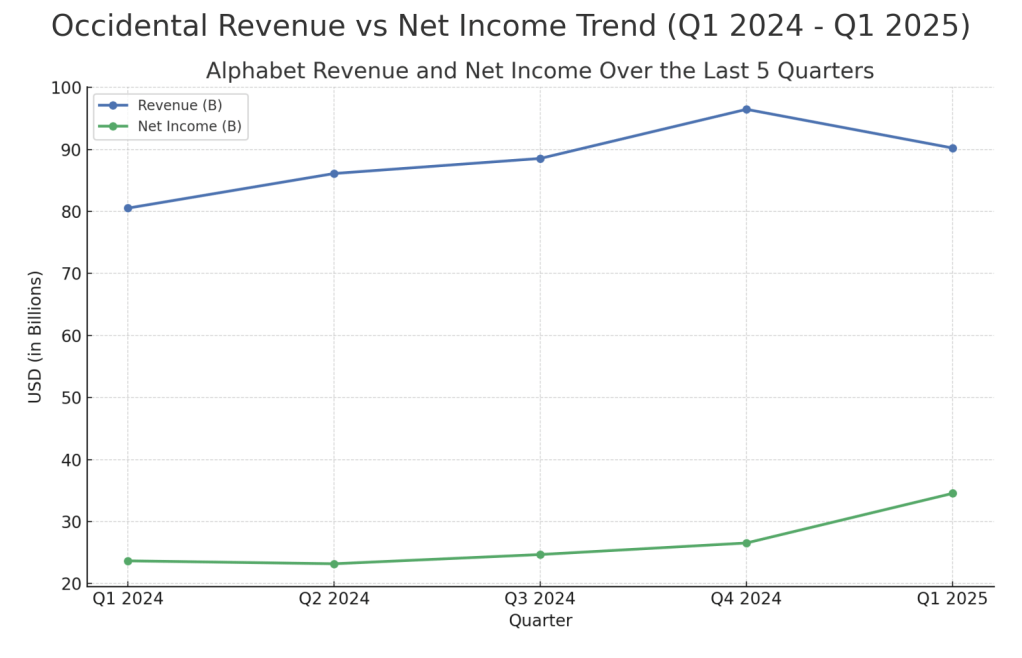

Also check out our recent breakdowns of Amazon Q1 2025, Meta Q1 2025, and Alphabet Q1 2025 for more actionable insights.

Disclaimer

This post is based solely on Uber’s official Q1 2025 financial report and earnings call transcript.

It is not investment advice. Always do your own research or consult a financial advisor before investing.

Leave a comment