TL;DR

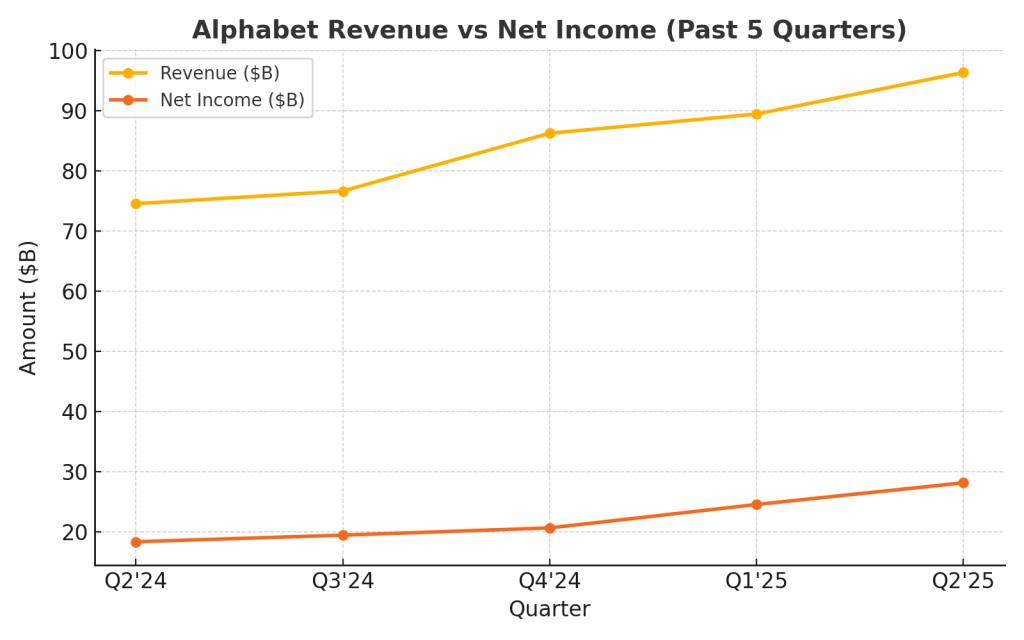

Alphabet delivered Q2 2025 revenue of $96.4B (+14% YoY) and EPS of $2.31 (+22% YoY), driven by AI‑powered engagement across Search and YouTube, and a Google Cloud margin jump to 20.7%. However, CapEx surged 70% YoY to $22.4B (guidance raised to $85B), raising near‑term cash flow concerns. Our probability‑weighted fair value: ~$195/share, suggesting GOOGL is fairly valued with modest upside.

Quarter Recap: Alphabet’s AI‑Fueled Growth

Alphabet beat expectations across the board:

- Revenue: $96.43B (+14% YoY)

- Net Income: $28.2B (+19% YoY)

- EPS: $2.31 (+22% YoY)

- Google Services: $82.5B (+12%), driven by Search & YouTube.

- YouTube Ads: $9.8B (+13% YoY); Shorts monetization now equals in‑stream levels.

- Google Cloud: $13.62B (+32% YoY) with 20.7% operating margin, nearly doubling YoY.

- CapEx: $22.4B (↑70% YoY), FY25 guidance lifted to $85B for AI/cloud data centers.

CEO Sundar Pichai emphasized AI as “positively impacting every part of the business.” He highlighted that $250M+ Google Cloud deals doubled YoY, showcasing enterprise AI traction.

Key Highlights from Q2

- AI at Scale: AI Overviews hit 2B+ monthly users; AI Mode reached 100M+ monthly users in the U.S. & India.

- Enterprise Momentum: Cloud operating margin doubled to 20.7%, with stronger large‑scale enterprise deals.

- Subscription Growth: Platforms & Devices up 20% YoY, enhancing recurring revenue streams.

- Regulatory Watch: Q2 included $1.4B in legal costs; DOJ antitrust rulings could progress later this year.

- AI Talent Retention: Pichai addressed competitive pressures, reaffirming Alphabet’s “ability to attract and retain top‑tier researchers.”

- Search Trade‑offs: AI Overviews may reduce ad click rates in some verticals — management is testing new ad formats to offset this.

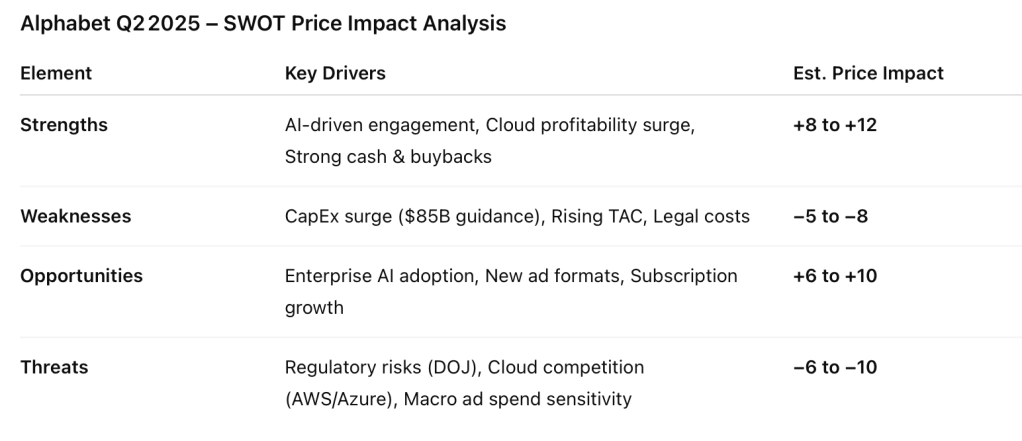

SWOT Analysis (With Price Impact)

Strengths (+$8 to +$12):

- AI products deepening Search & YouTube engagement.

- Cloud at 20.7% margin, $50B+ annualized revenue run‑rate.

- Strong cash position ($95B) and shareholder returns ($13.6B buybacks, $2.5B dividends).

Weaknesses (–$5 to –$8):

- FY25 CapEx raised to $85B, weighing on free cash flow.

- Rising TAC (traffic acquisition costs) and operating expenses.

- Elevated legal expenses impacting profitability.

Opportunities (+$6 to +$10):

- Enterprise adoption of Gemini AI models and Google Cloud solutions.

- AI‑driven Search and YouTube monetization enhancements.

- Subscription and device growth for stable recurring revenue.

Threats (–$6 to –$10):

- DOJ antitrust remedies may reshape Search monetization.

- Intense competition from AWS & Azure in enterprise AI.

- Ad spend vulnerability during macroeconomic slowdowns.

SWOT Price Impact Table

Valuation Scenarios

Fair Value Calculation (12‑month outlook)

From the valuation scenarios:

- Bull: $225 × 30% = $67.5

- Base: $192 × 50% = $96.0

- Bear: $156 × 20% = $31.2

Weighted Fair Value=67.5+96.0+31.2=194.7Weighted Fair Value=67.5+96.0+31.2=194.7

Rounded: ≈ $195 per share

Verdict

At $192, Alphabet is fairly valued, offering limited short-term upside but strong long-term growth potential if AI-driven monetization plays out as management anticipates. Growth-focused investors may see this as an attractive hold for AI & cloud exposure; value-focused investors may prefer to wait for a wider margin of safety.

Call to Action

Are you positioning for Alphabet’s AI-powered future? Share your thoughts — is GOOGL a buy, hold, or wait for a dip?

Disclaimer

This analysis is for informational purposes only and based solely on Alphabet’s official Q2 2025 financial report and earnings call. It does not constitute financial advice.

Leave a comment