💡 TL;DR – Pullback Presents Opportunity in a Structurally Strong Business

Broadcom (NASDAQ: AVGO) posted a record-breaking quarter, driven by surging AI demand and expanding software margins, yet the stock declined due to high expectations already priced in. With solid free cash flow, growing custom AI deployments, and a credible software growth engine, our fair value estimate points to +17% upside. This may be one of those rare “buy-the-dip” chances in a business executing on multiple growth vectors.

📊 Quarter Recap – Strong Execution Meets High Expectations

Broadcom delivered a strong Q2 FY2025, with $15.0 billion in revenue, up 43% YoY. The AI semiconductor segment grew 46% YoY to $4.4 billion, marking the ninth consecutive quarter of AI-led growth. On the software side, VMware and VCF added $6.6 billion, a 25% YoY gain.

Margins remained exceptional: 79.4% gross margin, $6.4 billion in free cash flow (43% of revenue). Yet the market response was muted. The stock pulled back ~5% post-report as guidance aligned with expectations, not exceeding them.

🔑 Management Commentary – Scaling AI, Monetizing Software

Broadcom reaffirmed its bullish stance on AI growth. Management guided for 60% YoY growth in AI chip revenue in Q3 and reiterated their target of AI comprising 35% of total revenue by year-end.

CEO Hock Tan emphasized:

“We’re in the early stages of a multi-year infrastructure buildout. Our custom AI accelerators are now in production with three hyperscalers and being evaluated by several more.”

To support hyperscaler workloads, Broadcom also launched the Tomahawk 6 switch, offering 102.4 Tbps bandwidth—a key enabler of ultra-dense AI clusters.

Meanwhile, VMware integration continued as planned. Management highlighted strong ARR and price leverage in its infrastructure software offerings, further enhancing Broadcom’s blended margin profile.

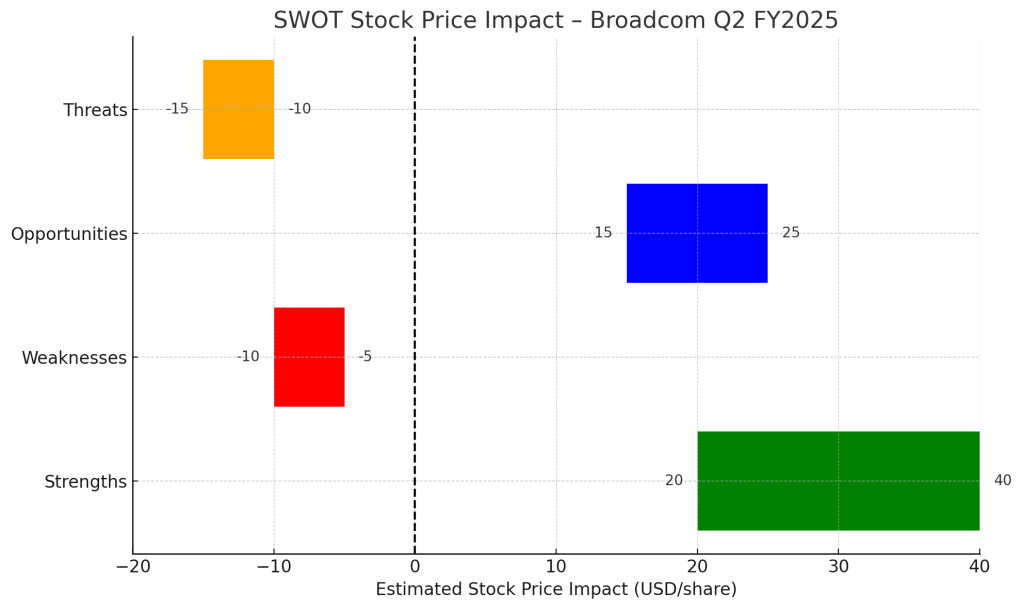

🧠 SWOT Analysis – Strategy and Market Sensitivity

✅ Strengths (+20 to +40 USD/share)

Dual revenue engines—custom AI chips and recurring software—set Broadcom apart. Gross margins and free cash flow generation remain world-class. Management visibility into multi-quarter AI demand de-risks execution.

❌ Weaknesses (-5 to -10 USD/share)

Legacy semiconductor segments like broadband and storage connectivity remain under pressure. VMware integration, though progressing, adds near-term complexity.

🚀 Opportunities (+15 to +25 USD/share)

The hyperscaler pipeline is expanding, and each deployment carries material revenue potential. If even one new customer finalizes deployment by year-end, upside to AI projections may materialize early. Software bundling (hardware + VCF) could also open a new monetization layer.

⚠️ Threats (-10 to -15 USD/share)

Investor expectations are high. A single quarter of missed growth or a slower ramp from a hyperscaler could compress multiples quickly. Integration drag or logistical ramp issues also remain execution risks.

📋 SWOT Summary Table

💰 Valuation Scenarios – Grounded Upside Based on Execution

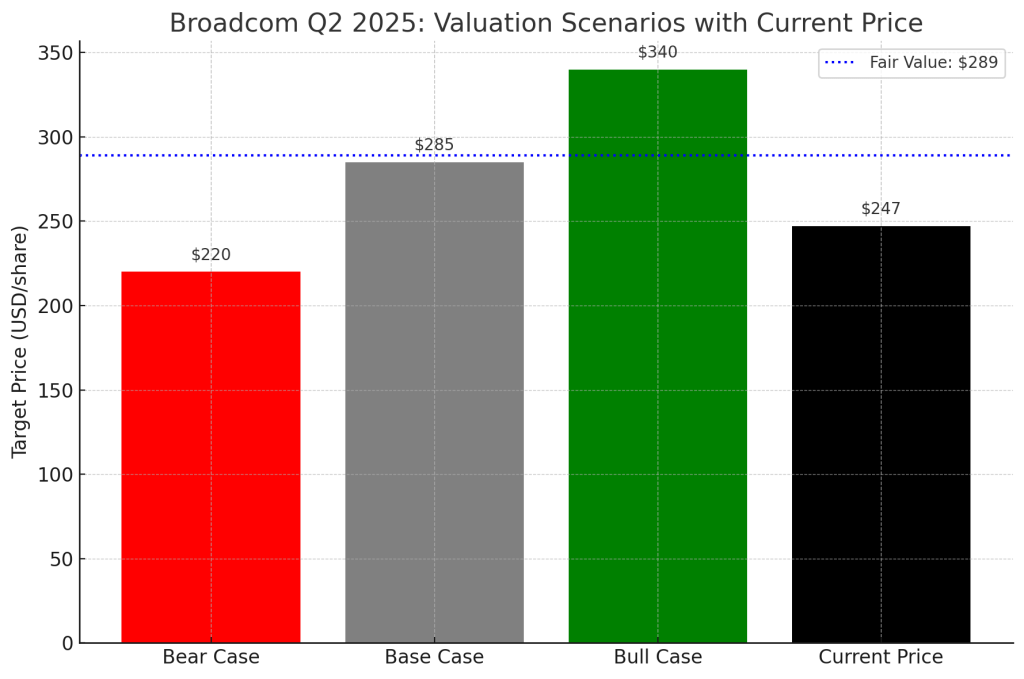

We modeled three outcomes based strictly on Broadcom’s own forward guidance and commentary.

🟢 Bull Case – $340/share (25%)

If Broadcom successfully scales to 5+ hyperscaler customers and executes VMware integration smoothly, EPS could rise to $51, supported by a 27x P/E.

⚪ Base Case – $285/share (60%)

The most probable path: strong, steady AI growth and normalized software contribution. EPS reaches $46, with a 22x multiple.

🔴 Bear Case – $220/share (15%)

Execution delays or margin pressure reduce EPS to $42, and a 19x multiple results in $220/share.

🧮 Weighted Fair Value Calculation

(0.25×340)+(0.60×285)+(0.15×220)=289.00

📌 Fair Value: $289/share

📉 Current Price: $247/share (as of June 6, 2025)

📈 Upside Potential: +17%

🏁 Verdict – Quality Name With Re-Rating Potential

The short-term pullback seems more about timing than fundamentals. Investors may have front-loaded expectations ahead of earnings, creating a mismatch. Yet Broadcom’s long-term visibility, growing software margins, and accelerating AI scale-ups suggest the story remains intact.

📉 Technical note: The stock is approaching prior support near $235–245, which also aligns with March consolidation levels—an area long-term investors may be watching.

📢 Call to Action

Broadcom represents a high-quality, cash-generating, AI-fueled compounder. If you’re looking for a name with both infrastructure exposure and durable software margins, the current setup may offer an attractive entry. Bookmark or share this post as Broadcom rolls into the second half of FY2025.

⚠️ Disclaimer

All analysis in this post is based exclusively on Broadcom’s official Q2 FY2025 financial disclosures and earnings call commentary. This is not investment advice.

Leave a comment