TL;DR Summary

Alphabet (GOOGL:NASDAQ) just passed the $100 billion quarterly revenue mark for the first time — growing 16 % year over year with broad strength across Search, YouTube, and Cloud. Despite record profits, the stock still trades near fair value, offering patient investors a long-term compounding story powered by disciplined AI execution.

Q3 2025 Financial Highlights

- Revenue: $102.3 B (+16 % YoY)

- Operating Income: $31.7 B (+23 %)

- EPS: $2.87 (diluted)

- Google Cloud: $15.2 B (+34 %), operating margin 9 % (up from 5 %)

- YouTube Ads: +18 % YoY, Shorts monetization gaining traction

- Buybacks: $15 B this quarter

- CapEx: Guidance raised to $91–93 B (from $85 B) to expand AI infrastructure

Management Commentary — The AI Era at Work

CEO Sundar Pichai described the quarter as “a reflection of how AI is transforming every corner of our business.”

He highlighted how Gemini models are now woven across Search, Workspace, and Android, while Google Cloud has become “a foundation for the next wave of AI applications.”

Pichai also drew attention to Waymo’s momentum, noting tens of thousands of fully autonomous rides weekly — a reminder that Alphabet’s portfolio still holds long-term optionality beyond advertising.

CFO Ruth Porat reiterated a focus on “disciplined investment” and sustainable capital returns, ensuring AI expansion doesn’t come at the expense of profitability.

Market Reaction

Shares rose roughly 6 % post-earnings to around $288, as investors applauded Alphabet’s combination of growth and cost control.

Growth investors celebrated the $100 B milestone; value investors noticed something quieter but more powerful — free-cash-flow compounding and balance-sheet strength, with over $100 B in cash and a business model that still prints double-digit operating margins despite surging AI spend.

SWOT Analysis — What’s Driving and Challenging Alphabet

Strengths — The Engine Still Scales

- Alphabet’s ability to integrate AI across core products has turned efficiency into a margin lever, driving a 23 % jump in operating income.

- Cloud growth of +34 % confirms enterprise adoption of Google AI and Vertex AI, while YouTube continues to monetize Shorts effectively.

- A balance sheet boasting $109 B in cash and $80 B in free cash flow gives management the flexibility to invest and repurchase shares without financial strain.

- These elements together could support a 6 – 12 % upside in valuation, equivalent to +$16–32 per share, if current trends hold.

Weaknesses — Spending Before the Payoff

- The biggest risk near term is CapEx intensity: management raised 2025 guidance to $91–93 B, pushing short-term margins down to 31 %.

- Cloud infrastructure build-out and TPU chip development consume cash before incremental revenue arrives.

- For value investors, this is the “patience tax” — reinvestment that depresses earnings temporarily but is critical to maintain AI leadership. Estimated drag: −6 to −10 % on near-term fair value.

Opportunities — Optionality Beyond Ads

- The rollout of Gemini-powered experiences across Search and Workspace is still early. If user engagement and monetization scale as expected, Alphabet could open entirely new revenue lines within existing products.

- Waymo’s commercialization offers an overlooked lever: as autonomous rides expand to new cities, the segment could evolve from cost center to strategic asset.

- Together, these trends imply +8 to +15 % potential uplift as new businesses begin contributing meaningfully.

Threats — The Unseen Headwinds

- Alphabet faces regulatory pressure in the U.S. and EU that could reshape how it structures Search partnerships.

- Rising AI training costs and limited chip supply could inflate unit economics in 2026.

- Global digital tax initiatives also threaten to trim net margins.

- These could shave 10 – 18 % off valuation in a downside scenario.

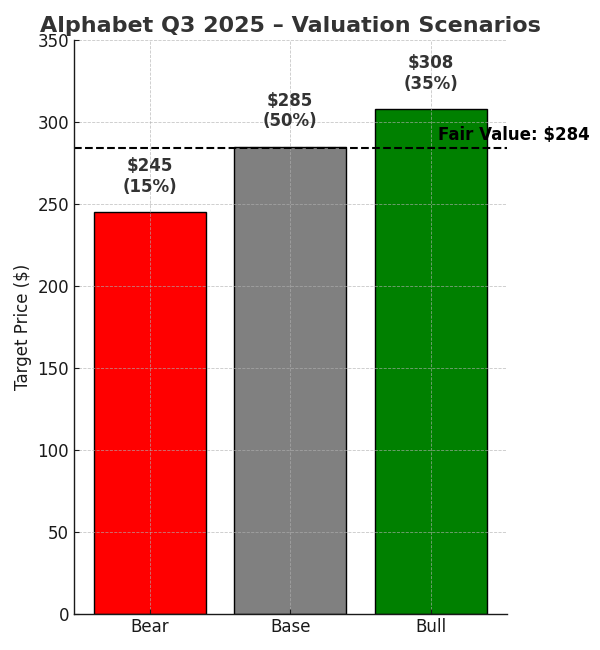

Valuation Scenarios — Fair Value Still Around $284

Bull Case (35 % probability)

If Gemini monetization accelerates and Cloud margins surpass 10 %, EPS could reach $14 in FY 2026. At 22× earnings, that implies a $308 target — driven by full AI adoption and modest multiple expansion.

Base Case (50 % probability)

A more realistic view assumes 12 % revenue growth and modest margin recovery. With EPS near $13 and 20× multiple, fair value sits at $285 — consistent with steady compounding and disciplined reinvestment.

Bear Case (15 % probability)

If regulatory constraints slow Search deals or AI costs balloon, EPS might stall around $12. Applying 17× multiple yields $245 per share.

Even here, Alphabet remains profitable and cash-rich, limiting true downside risk.

Weighted Fair Value: ≈ $284/share — almost identical to where the stock trades now (~$288).

For long-term holders, that suggests limited short-term upside but strong margin of safety given cash reserves and buyback velocity.

Verdict — Hold, Accumulate Below $270

Alphabet remains a quiet compounding engine: dominant in AI infrastructure, prudent in spending, and generous in shareholder returns.

At $288, the stock sits near intrinsic value. But below $270, its 3.5 % free-cash-flow yield and recurring revenue make it a compelling long-term hold for patient investors.

For value investors, the strategy is clear: own quality, wait through the CapEx cycle, and let compounding do the work.

What to Watch Next

- Gemini monetization in Search and YouTube

- Cloud profitability progression toward 10 %+ margins

- DOJ antitrust outcomes and global tax rulings

- Returns from AI infrastructure CapEx and Waymo expansion

Call to Action

Follow SWOTstock for clear, fundamentals-based coverage of high-cash-flow AI compounders like Alphabet, Microsoft, and Amazon.

Subscribe to receive new posts right after each earnings call.

Disclaimer

This analysis is based solely on Alphabet Inc. official Q3 2025 financial report and earnings call transcript.

It is not investment advice. Please conduct independent research before investing.

One response to “💡 Alphabet Q3 2025 Earnings — A $100 B Quarter that Still Feels Underpriced”

-

[…] 💡 Alphabet Q3 2025 Earnings — A $100 B Quarter that Still Feels Underpriced […]

LikeLike

Leave a comment