Key Takeaways for Income & Value Investors

Cisco (NASDAQ: CSCO) delivered a strong Q3 FY2025, beating expectations and reaffirming its role as a dividend staple. The completed Splunk acquisition adds risk—but also opportunity in cybersecurity and observability. At ~$61, the stock appears fairly valued, with solid yield, modest upside, and limited downside—making it attractive for long-term dividend investors.

Cisco Q3 2025 Earnings Summary

- Revenue: $14.15 billion (+11% YoY)

- Non-GAAP EPS: $0.96 (vs. $0.92 guidance)

- GAAP EPS: $0.62

- Operating cash flow: $5.2 billion

- Dividend paid: $1.6 billion

- Share repurchases: $1.5 billion

- Free cash flow payout ratio: ~61%

- Forward dividend yield: ~2.6%

- Free cash flow yield: ~6.8% (on trailing FCF of ~$15B)

Key Highlights This Quarter

- AI Orders Surge: $600M+ in Q3, exceeding $1B fiscal YTD

- Capital Return: $3.1B to shareholders (buybacks + dividends)

- Splunk Acquisition: $28B deal now closed, expanding security + analytics

- FY2025 Guidance Raised: Modest bump in revenue and earnings outlook

- CFO Change: Mark Patterson to succeed Scott Herren in July

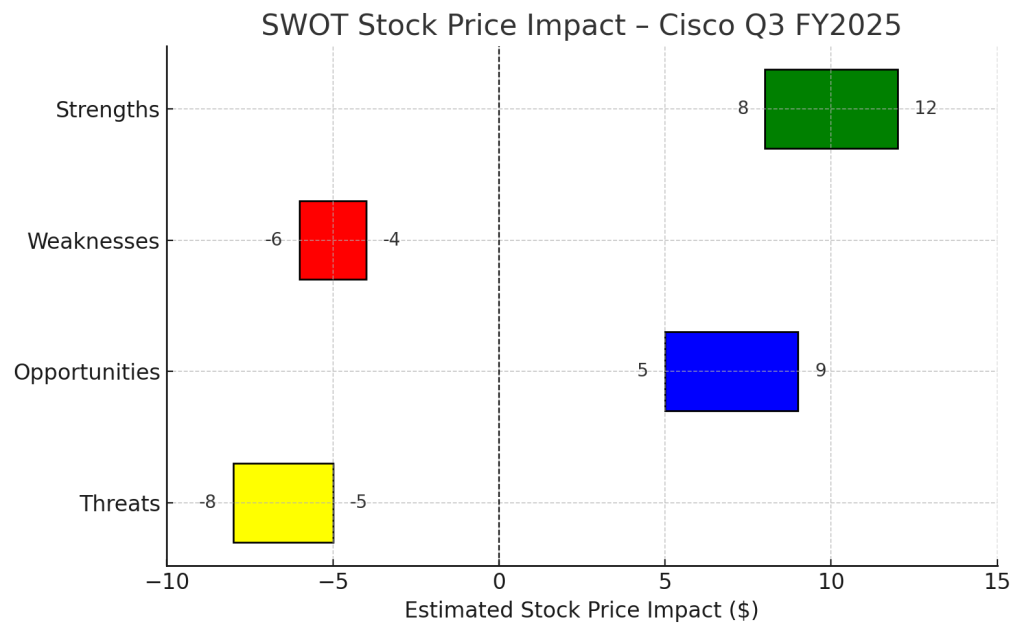

SWOT Analysis (Based on Cisco’s Official Earnings Report & Call)

Strengths

Cisco remains a cash flow powerhouse with predictable returns. It beat guidance, raised full-year forecasts, and maintained a consistent capital return policy. AI orders and secure networking sales accelerated.

Estimated Stock Price Impact: +$8 to +$12

Weaknesses

The security portfolio underperformed, and the integration of Splunk introduces both cultural and execution risks. These could delay synergy realization or weigh on margins short-term.

Estimated Stock Price Impact: –$4 to –$6

Opportunities

Cisco’s software transition, fueled by Splunk, gives it greater recurring revenue potential. Emerging bets like quantum computing and AI-integrated infrastructure add long-term optionality.

Estimated Stock Price Impact: +$5 to +9

Threats

Enterprise IT spending remains vulnerable to macro pressures. Cisco also faces intense competition from hyperscalers and specialized security firms. The CFO transition may cause short-term strategic jitters.

Estimated Stock Price Impact: –$5 to –$8

SWOT Summary Table

| SWOT Category | Key Driver | Est. Stock Price Impact |

|---|---|---|

| Strengths | Earnings beat, AI orders, dividend reliability | +8 to +12 |

| Opportunities | Software shift, Splunk synergy, R&D expansion | +5 to +9 |

| Weaknesses | Security miss, integration risk | –4 to –6 |

| Threats | Macro exposure, competition, leadership change | –5 to –8 |

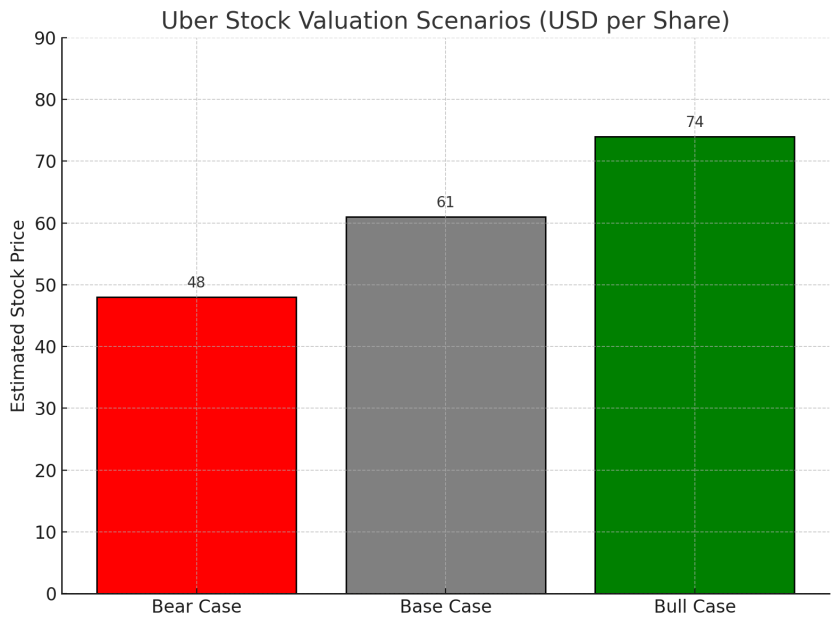

Cisco Stock Valuation Scenarios Based on FY2025 Guidance

| Scenario | EPS (FY25E) | P/E Multiple | Price Target | Probability | Weighted Value |

|---|---|---|---|---|---|

| Base Case | $3.78 | 16x | $60.48 | 60% | $36.29 |

| Bull Case | $3.90 | 18x | $70.20 | 25% | $17.55 |

| Bear Case | $3.60 | 14x | $50.40 | 15% | $7.56 |

Probability-Weighted Fair Value: ≈ $61.40

Current Price: $61.29

Dividend & Value Snapshot

| Factor | SWOTstock Assessment |

|---|---|

| Dividend Yield | ~2.6%, well-covered by FCF |

| Free Cash Flow Trend | Strong ($5.2B this quarter) |

| Dividend Growth History | Consistent increases since 2011 |

| Valuation vs. Peers | Competitive vs. IBM, Juniper, and Broadcom |

| Short-Term Upside | Moderate if Splunk execution improves |

| Downside Risk | Limited barring macro deterioration |

Peer Comparison Snapshot

| Company | Yield | P/E (fwd) | Dividend Growth | Balance Sheet Strength |

|---|---|---|---|---|

| Cisco | 2.6% | ~16x | Consistent | Very Strong |

| IBM | 3.4% | ~15x | Modest | Moderate |

| Juniper | 2.9% | ~14x | Flat | Moderate |

Entry Strategy – Optional Price Zones

- Buy Below $58: More favorable value with >3% yield

- Hold Near $61: Fair value supported by FCF and guidance

- Trim Above $65: Price may run ahead of fundamentals without improved security results

Verdict

At $61.29, Cisco is fairly valued. It offers:

- A sustainable 2.6% dividend backed by robust FCF

- Upside potential tied to AI, Splunk, and enterprise cloud adoption

- Low downside risk for investors seeking capital preservation and steady income

This isn’t a deep value pick—but it’s a solid hold or add-on-dips candidate for dividend-focused portfolios.

Subscribe for No-Jargon, Real-Earnings Analysis

Get breakdowns tailored to real investors—no jargon, no hype.

Follow @SWOTstock or subscribe to our blog for structured, honest takes on earnings.

Disclaimer

This is not investment advice. All analysis is based solely on Cisco’s official financial report and earnings call transcript. Always do your own due diligence.

Leave a comment