TL;DR — What You Need to Know

Goldman Sachs posted EPS of $10.91 on $14.58 billion revenue, beating expectations. The bank raised its quarterly dividend by 33% and repurchased nearly $3 billion in stock, returning over $4 billion to shareholders. With a book value per share of ~$349.7 and a CET 1 ratio of 14.5%, Goldman’s capital position remains strong. Our probability‑weighted fair value: ~$731, slightly above the current share price of ~$724.

Quarter Recap

Goldman Sachs delivered net revenues of $14.58 billion in Q2 2025, up 15% YoY, driven by a strong rebound in trading and advisory revenues. Net earnings came in at $3.72 billion, translating to EPS of $10.91, ahead of consensus expectations.

Assets under supervision hit a record $3.29 trillion, growing by $120 billion in a single quarter. Book value per share now stands at ~$349.7, with a CET 1 capital ratio of 14.5%, providing a robust buffer against market and regulatory risks.

CEO David Solomon noted that Goldman’s pipeline for advisory work is “healthy and diversified across sectors,” while CFO Denis Coleman pointed to anticipated deal flow from technology, healthcare, and energy, supporting investment banking revenues in H2.

Key Highlights

- Revenue beat: $14.58 B (+15% YoY) on strong trading and advisory results.

- EPS: $10.91 vs. consensus of ~$9.7–$9.8.

- ROE: 12.8%, up sharply from 2023 lows.

- Dividend hike: From $3 → $4 per share (+33%), starting Q3 2025.

- Share repurchases: Nearly $3 billion in buybacks, for total shareholder return over $4 billion this quarter.

- Capital strength: Book value per share: ~$349.7, CET 1 ratio: 14.5%.

- Record AUS: $3.29 T, enhancing fee‑based stability.

Peer Comparison: Goldman vs JPMorgan vs Morgan Stanley

Goldman trades at a discounted P/E compared to JPM and MS but offers a smaller dividend yield, which is now improving with its 33% payout increase.

Dividend Growth in Context

Goldman’s dividend hike to $4/share marks one of its largest increases in a decade, reflecting confidence in sustainable earnings.

At current prices, the yield is ~2.2%, moving closer to peers like Morgan Stanley (3.1%) and JPMorgan (2.6%).

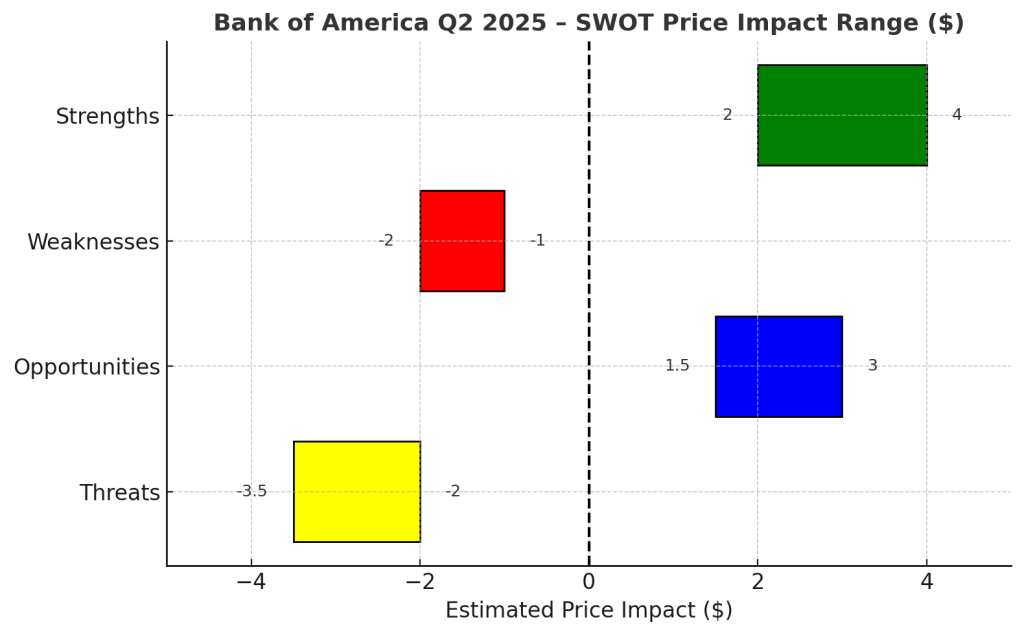

SWOT Analysis (with Price Impact)

Strengths (+$15–$25 impact)

- Robust revenue growth: 15% YoY, with strong trading and M&A advisory.

- Capital returns: 33% dividend hike and $3 B in buybacks signal capital efficiency.

- Book value & capital buffer: $349.7 BVPS, CET 1 at 14.5%.

- Improved ROE: 12.8%, showing recovery from post‑pandemic lows.

Weaknesses (–$8–$12 impact)

- Reliance on trading: Equities revenue is cyclical and market-dependent.

- Subdued consumer banking: Marcus platform still underperforming.

- Rising expenses: Operating costs up 6% YoY, with more spend on tech and compliance.

Opportunities (+$10–$18 impact)

- M&A & capital markets revival: Advisory pipeline in tech, energy, and healthcare indicates momentum in H2 2025.

- Wealth management growth: Record AUS positions Goldman for fee expansion.

- Technology leverage: AI and automation investments could boost efficiency.

Threats (–$12–$20 impact)

- Macro headwinds: Tariffs, election‑year volatility, and slower global growth may hurt client activity.

- Speculative market behavior: Management flagged rising “retail‑driven trading excesses” as a systemic risk.

- Regulatory tightening: Basel III and other potential capital rules could cap returns.

SWOT Summary Table

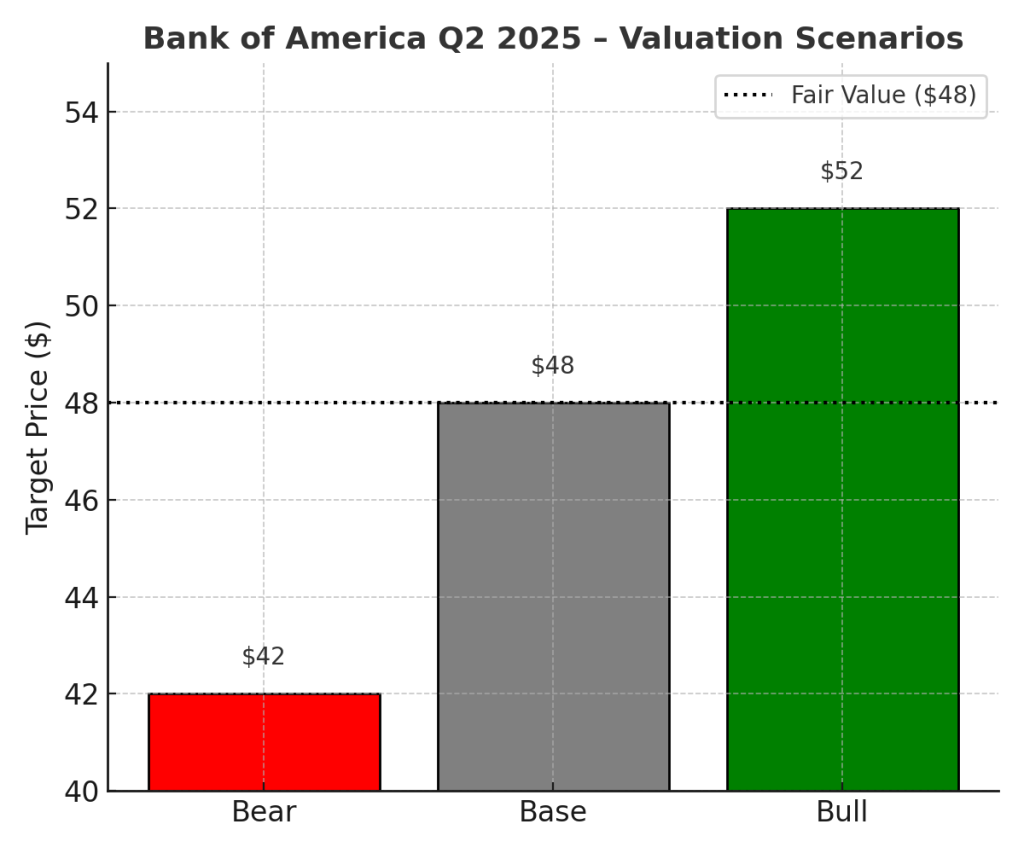

Valuation Scenarios (Price Targets)

- Base Case (50% probability): $725

Assumes mid‑single‑digit revenue growth in H2, steady trading, and continued buybacks/dividends. - Bull Case (30% probability): $780

Assumes a robust M&A rebound, sustained trading momentum, and controlled expense growth. - Bear Case (20% probability): $670

Assumes a slowdown in advisory and trading, plus stricter capital requirements.

Probability‑Weighted Fair Value:

(0.5×725)+(0.3×780)+(0.2×670)=730.5(0.5×725)+(0.3×780)+(0.2×670)=730.5

→ Fair Value: ≈ $731

How This Compares to Other Valuations

Community-based models (e.g., Simply Wall St) place fair value between $594–$701. Our $731 target reflects a higher confidence in Goldman’s capital efficiency, pipeline strength, and capital return policy—but also assumes macro risks remain manageable.

Verdict

At $731, for value investors, it offers:

- Resilient earnings in a diversified revenue base,

- Stronger capital returns (higher dividends + buybacks),

- Attractive capital buffers supporting stability.

Compared to peers, Goldman trades at a discounted valuation but offers lower yield, which is now improving. For income-focused investors who value both stability and growth in payouts, Goldman looks like a steady hold with modest upside.

Call to Action

Do you see Goldman’s trading and advisory strength continuing into H2? Are you adding bank stocks to your portfolio this year? Share your thoughts in the comments or join the conversation on our LinkedIn page.

Disclaimer

This analysis is based solely on Goldman Sachs’ official Q2 2025 financial report and earnings call. It is for informational purposes only and does not constitute financial advice.

Leave a comment