TL;DR Summary

- Morgan Stanley (MS:NYSE) delivered a strong Q4 2025, driven by a sharp rebound in investment banking and steady wealth management growth.

- Full-year profitability and returns remain well above cost of capital, reinforcing MS as a high-quality franchise.

- However, after a post-earnings rally, the stock looks close to fair value rather than clearly cheap.

- Fair value estimate: around $180 per share, implying limited upside at current levels unless the deal cycle stays strong.

Quarter Recap

Morgan Stanley reported Q4 2025 results that clearly exceeded market expectations. Net revenues rose meaningfully year-over-year, with earnings boosted by a recovery in advisory and underwriting activity. Wealth Management continued to provide a stable backbone, while Institutional Securities re-accelerated as capital markets activity improved into year-end.

The earnings release confirmed that FY2025 was a record year for the firm in terms of revenues and earnings, validating the long-term strategy of building a more balanced, fee-driven business alongside cyclical market activities.

Key Highlights

- Q4 net revenues: $17.9B, up solidly year-over-year

- Q4 EPS: $2.68

- FY2025 EPS: $10.21 (record)

- ROTCE: ~22%, firmly above historical averages

- CET1 capital ratio: ~15%, supporting dividends and buybacks

- Wealth Management revenues: $8.4B in Q4, reflecting durable fee income

- Investment Banking revenues: sharply higher year-over-year, signaling a deal-cycle rebound

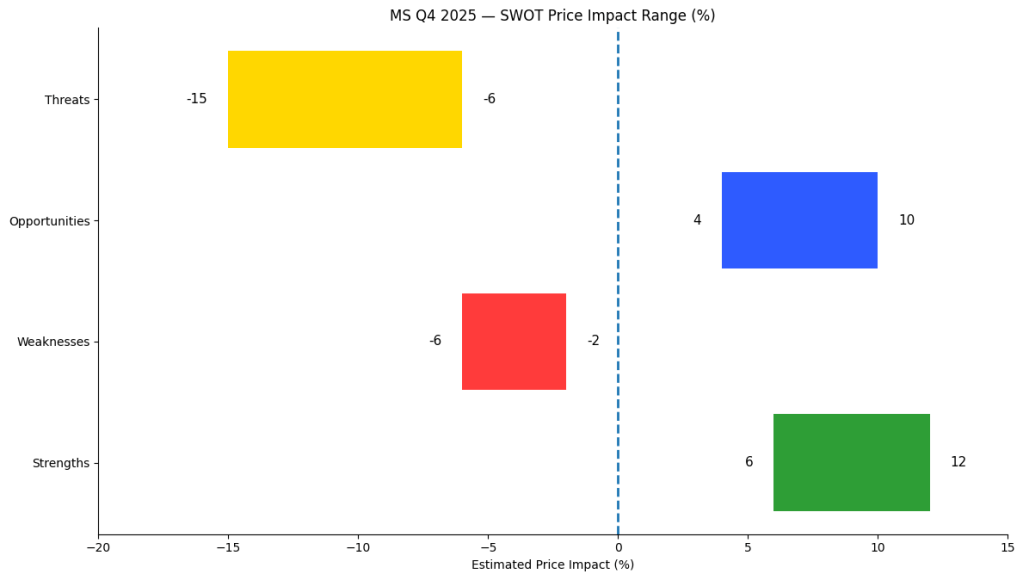

SWOT Analysis

Morgan Stanley’s Q4 results highlight the strength of its integrated model: a resilient wealth management base combined with cyclical upside from investment banking. The following SWOT translates these drivers into estimated valuation impacts.

Strengths

- High-quality earnings power and profitability driven by diversified businesses and ~22% ROTCE. (Estimated impact: +6% to +12%)

- Wealth Management scale and stickiness, with large fee-based assets providing earnings stability. (+5% to +10%)

- Clear rebound in investment banking, supporting upside to normalized earnings. (+4% to +9%)

- Strong capital position (CET1 ~15%), enabling consistent capital returns. (+2% to +5%)

Weakness

- Earnings remain market-sensitive, particularly in trading and underwriting. (−2% to −6%)

- Rising technology and execution costs, which could pressure margins if they become structural. (−2% to −5%)

- Isolated credit noise, including CRE-related charge-offs, reminds investors of tail risks. (−1% to −3%)

Opportunities

- Sustained deal-cycle recovery could keep Institutional Securities returns elevated. (+4% to +10%)

- Further shift toward fee-based wealth revenues enhances durability and valuation quality. (+3% to +8%)

- Operating leverage, as incremental revenues flow through at higher margins. (+2% to +6%)

Threats

- A reversal in capital markets sentiment could quickly compress revenues and multiples. (−6% to −15%)

- Regulatory or capital rule changes that reduce returns on equity. (−3% to −8%)

- Cost inflation becoming structural, limiting valuation re-rating. (−2% to −7%)

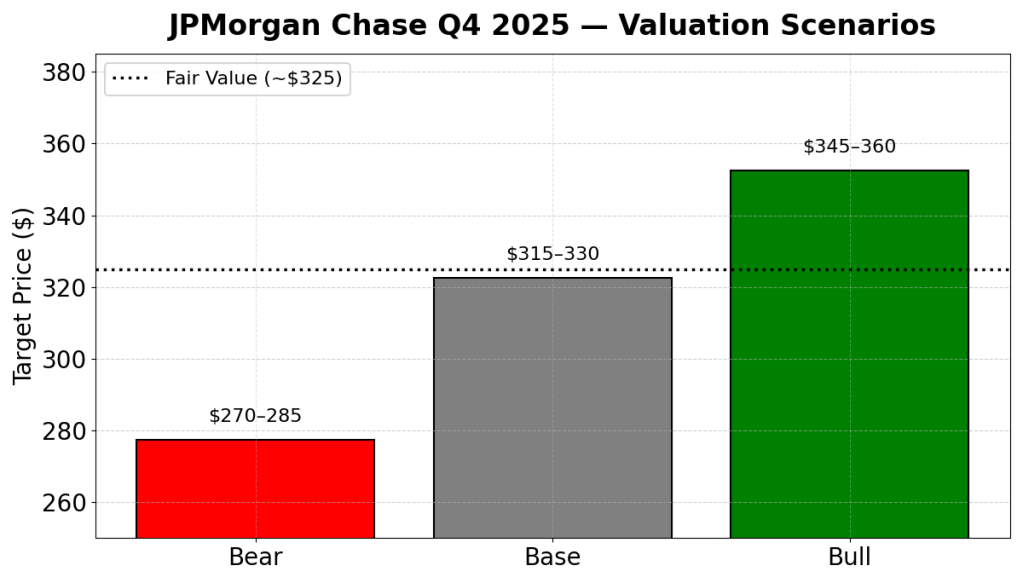

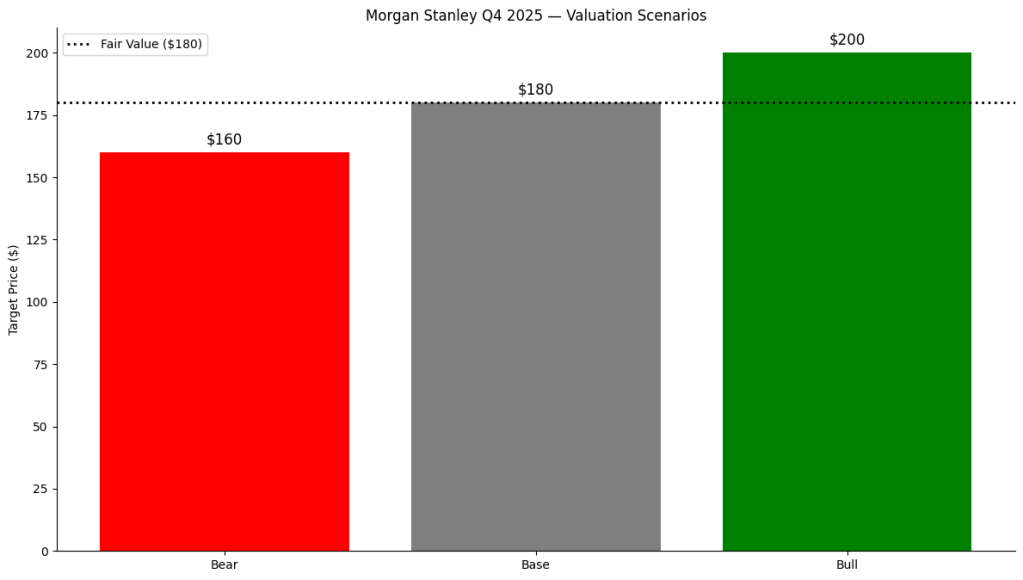

Valuation Scenarios

For Morgan Stanley, valuation is best anchored on tangible book value and returns on equity. With tangible book value per share around $50, different P/TBV multiples reflect how much premium the market assigns to a ~20%+ ROTCE franchise.

Bear case (~$160)

- Deal activity cools and market conditions soften.

- Valuation compresses toward a more conservative quality-bank multiple.

Base case (~$180)

- Wealth Management remains stable and investment banking normalizes.

- MS sustains premium returns without further multiple expansion.

Bull case (~$200)

- Deal momentum persists and the integrated-firm narrative strengthens.

- Market assigns a top-tier multiple to durable earnings power.

Probability-weighted fair value: ~$180 per share.

Verdict

Morgan Stanley remains a best-in-class financial franchise, and Q4 2025 confirms that its diversified model works when markets recover. However, after the post-earnings rally, the stock appears fairly valued rather than obviously undervalued.

For long-term, value-oriented investors:

- Above ~$190: upside looks limited unless the deal cycle stays unusually strong.

- Around ~$180: valuation is reasonable for a high-quality compounder.

- Below ~$165: the stock would begin to offer a more compelling margin of safety.

Call to Action

If you found this breakdown useful, follow SWOTstock for clear, fundamentals-driven earnings analysis that cuts through the noise and focuses on valuation, risk, and long-term returns.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. All analysis is based on publicly available company disclosures. Investors should conduct their own research or consult a financial professional before making investment decisions.