Quick Take: Steady Growth, But Macro Risks Keep a Lid on the Rally

Walmart (NYSE: WMT) delivered a strong Q1 with rising sales, expanding operating income, and—most importantly—e-commerce profitability. Yet the stock barely moved. Why? Inflation, pricing pressure, and the decision to withhold EPS guidance signal near-term caution. For long-term, low-risk growth seekers, Walmart still looks like a solid bet, but now’s the time to watch execution closely.

Quarter Recap: A Landmark Quarter, But Tariff Warnings Weigh Heavily

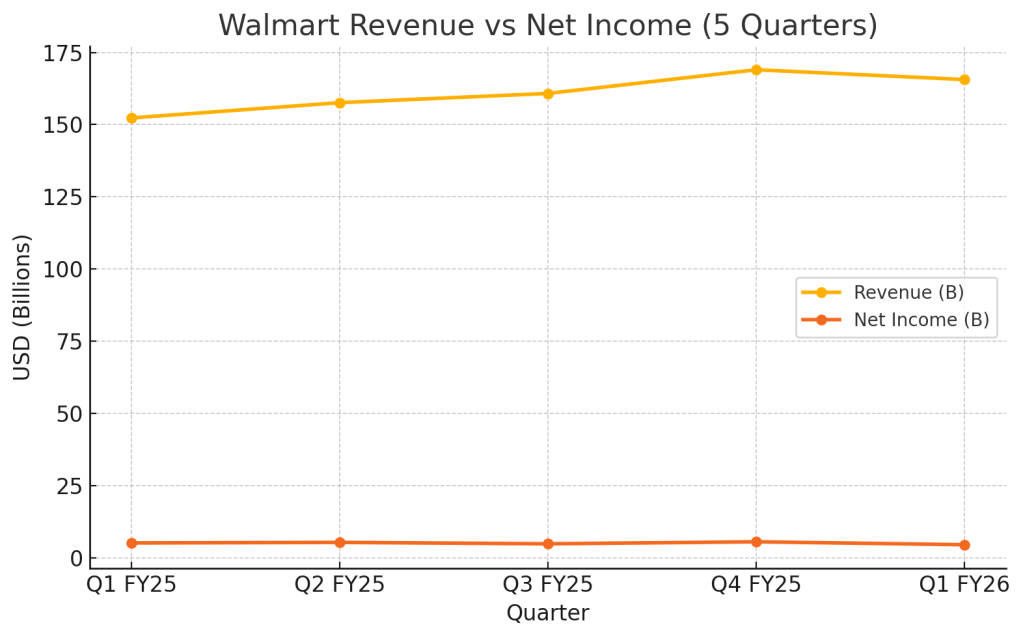

Walmart’s Q1 FY2026 (calendar Q1 2025) showed revenue of $165.61 billion (+2.5% YoY), with operating income up 4.3%. U.S. comparable sales rose 4.5%, driven by strong performance in food and pharmacy. A standout highlight: e-commerce operations became profitable globally—a signal that Walmart’s long-term tech investments are beginning to pay off.

Despite this, the stock dipped –0.5% during regular trading and was down 4% at open, after an initial premarket rise. The reason? CEO Doug McMillon acknowledged that Walmart would raise prices in response to persistent tariffs. And critically, the company withheld EPS guidance, citing economic uncertainty.

Why this quarter matters: Walmart just hit a key profitability milestone in digital—but cost pressures and visibility concerns are limiting investor enthusiasm.

Walmart Q1 2025 – Key Financial Highlights

- Revenue: $165.61B (+2.5% YoY)

- Net Income: $4.49B (down from $5.10B YoY)

- EPS: $0.61 (beat by $0.03)

- U.S. Comp Sales: +4.5%

- Global E-commerce Sales: +22% YoY

- E-commerce Profitability: First time achieved globally

- Operating Income: +4.3%

- FY Guidance: Reaffirmed 3–4% sales growth; EPS guidance withheld

Walmart vs. Amazon vs. Target: Who’s Winning the Retail Transformation?

| Metric | Walmart | Amazon | Target |

|---|---|---|---|

| E-commerce Profitability | Achieved (Q1 2025) | Long-established | Still lagging |

| In-store Sales Growth | +4.5% U.S. comps | Minimal (no store footprint) | Flat to slightly negative |

| Ad Revenue Monetization | Expanding (Walmart Connect) | Robust (Amazon Ads) | Early stage |

| Inventory Strategy | AI + automation scaling | Logistics leader | Struggling with excess |

| Guidance Tone | Cautious, no EPS given | Confident | Defensive, cost-cutting |

Takeaway: Walmart is the only large-format retailer with profitable e-commerce and store traffic momentum. It lags Amazon in tech monetization but is clearly outpacing Target in operational agility.

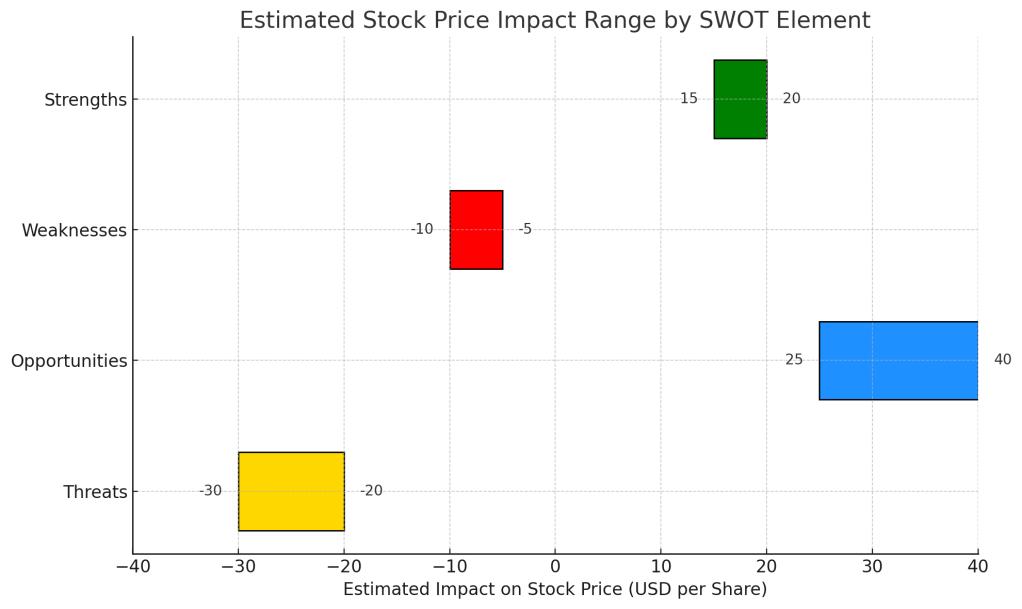

SWOT Breakdown: Walmart’s Digital Wins Meet Margin Headwinds

Let’s break it down using a simple SWOT framework—what’s going well, what’s not, where the upside lies, and what risks could derail the story.

Strengths

Walmart is scaling e-commerce profitably while growing in-store comps. Fulfillment efficiency and automation are boosting operating income.

Stock Price Impact Estimate:

Could support a +$3 to +$5 upside if this continues.

Weaknesses

Margins remain pressured. Net income declined, and the decision not to issue EPS guidance raises questions about confidence in short-term forecasting.

Stock Price Impact Estimate:

Could cap the stock by –$1 to –$3 per share.

Opportunities

Automation, Walmart+, advertising, and health services offer high-margin growth channels. AI integration in logistics and demand planning could unlock additional EPS upside.

Stock Price Impact Estimate:

If scaled well, could add +$4 to +$6 to valuation.

Threats

Tariffs, inflation, and pricing action could impact demand—especially in general merchandise. Management’s caution suggests macro risk isn’t fully priced in.

Stock Price Impact Estimate:

Worst-case downside of –$4 to –$6.

SWOT Table Summary

| Category | Key Takeaways | Est. Stock Impact |

|---|---|---|

| Strengths | Solid comp growth, e-commerce profitability | +$3 to +$5 |

| Weaknesses | Margin pressure, EPS visibility unclear | –$1 to –$3 |

| Opportunities | Monetization of tech, AI, memberships, ad platform | +$4 to +$6 |

| Threats | Tariffs, inflation, pricing backlash | –$4 to –$6 |

Valuation Scenarios: How Walmart Stock Could Play Out from Here

Let’s revisit Walmart’s valuation in light of its solid operational execution, profitability in e-commerce, and the macro risks it faces. With the current stock price at $96.35, here’s how the stock could move in three realistic scenarios.

Base Case (Most Likely – 50%)

- Summary: Walmart maintains low-single-digit revenue growth, keeps e-commerce profitable, and stabilizes margins with the help of automation and better inventory management. However, wage inflation and tariffs continue to pressure near-term earnings. EPS growth remains modest, and valuation multiples stay flat.

- Fair Value Estimate: $100

- Probability: 50%

Bull Case (Optimistic – 30%)

- Summary: Walmart’s automation and AI-driven efficiencies begin to show stronger results, driving margin expansion. Advertising and subscription revenue accelerate, and general merchandise demand rebounds despite pricing headwinds. The company regains multiple expansion as investors price in stronger long-term profitability.

- Fair Value Estimate: $110

- Probability: 30%

Bear Case (Downside – 20%)

- Summary: Consumer demand weakens as inflation and tariff-related pricing continue to rise. Walmart is forced to absorb more costs to maintain competitiveness, leading to margin compression. EPS flattens or declines. Valuation contracts slightly due to uncertainty around macro execution.

- Fair Value Estimate: $85

- Probability: 20%

Weighted Average Fair Value Calculation

(64×0.5)+(72×0.3)+(52×0.2)=$64.00

Valuation Verdict

With the current price at $96.35 (as of May 15, 2025), Walmart appears slightly undervalued based on its fundamental performance and risk-balanced outlook. For long-term, growth-conscious investors seeking resilience and scalable upside, Walmart may offer a reasonable entry point—especially if the company can maintain its digital momentum while defending margins.

Call to Action

Want focused stock breakdowns like this for every major earnings report?

Subscribe now for no-jargon, data-backed posts you can trust.

Disclaimer

This analysis is based solely on Walmart’s official Q1 FY2026 financial report and earnings call transcript. It is not investment advice. Please do your own research before investing.

Leave a comment