🚨 TL;DR — The Market Isn’t Rewarding This Beat (Yet)

Adobe (NASDAQ: ADBE) delivered double-digit growth, accelerating AI adoption, and raised full-year guidance. Yet the market response was muted. With fundamentals clearly improving and AI monetization tracking ahead of schedule, this gap presents an opportunity for long-term investors.

📆 A Strong Quarter Powered by AI and Recurring Revenue

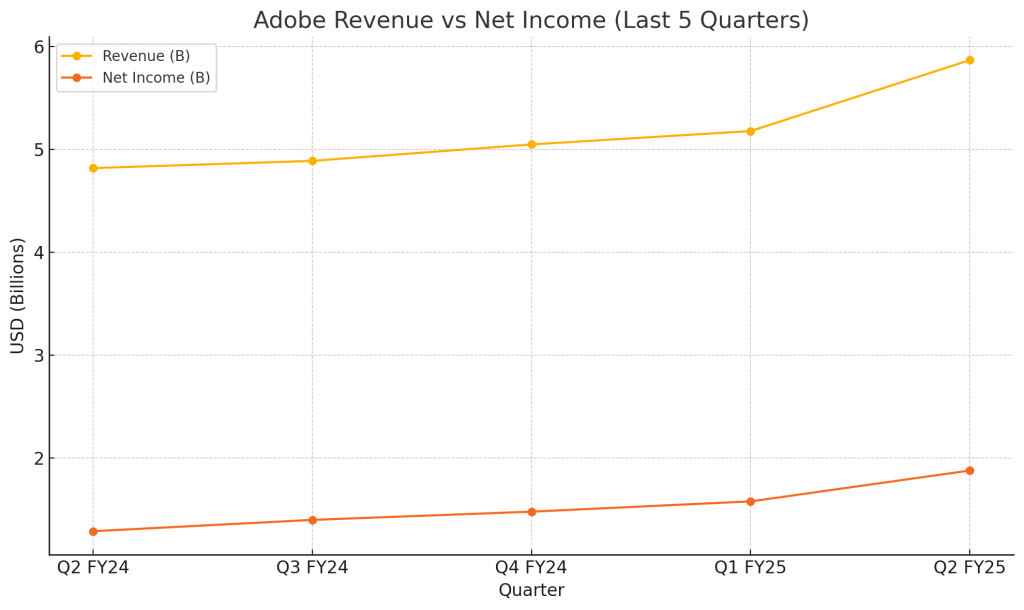

Adobe posted another record quarter with $5.87 billion in revenue (up 11% YoY) and $5.06 in non-GAAP EPS (up 13%). Management raised full-year revenue and EPS guidance, reflecting confidence in the AI product suite and its impact on customer value.

✨ Q2 FY2025 Highlights at a Glance

- Revenue: $5.87B (+11% YoY)

- Non-GAAP EPS: $5.06 (+13%)

- Operating Income: $2.67B (non-GAAP)

- Digital Media ARR: $18.09B (+12.1%)

- Business Pros & Consumers: $1.6B revenue (+15%)

- MAUs: 700M+ across Acrobat & Express (+25%)

- AI monetization on track to surpass $250M ARR

- Operating Cash Flow: $2.19B

- Shares Repurchased: 8.6M

- FY2025 Guidance Raised: Revenue to $23.5–23.6B; EPS to $20.50–$20.70

🚀 What’s Driving Growth: Firefly, Acrobat AI, GenStudio

CEO Shantanu Narayen confirmed that Firefly, Acrobat AI Assistant, and GenStudio are central to Adobe’s AI push. Adoption of these tools is growing across both creative pros and new user groups, such as business professionals and educators. While Adobe doesn’t break out revenue by product, they reiterated that AI-driven ARR is already contributing “billions” and tracking ahead of plan.

📉 Why the Stock Fell Despite the Beat

Adobe’s stock dipped around 1% in after-hours trading — a familiar pattern for growth names with high expectations. Although Adobe raised guidance and showed real AI traction, investors may have been hoping for more granular AI revenue breakdowns or a clearer timeline for when this monetization becomes a larger part of total ARR.

Additionally, macro uncertainty and the strong YTD performance likely triggered some profit-taking. But CFO Dan Durn also noted that demand rebounded in Q2, a sign that macro pressures may be easing.

🧩 SWOT Analysis: What’s Driving the Price Range?

Adobe’s own financial data and management commentary give us a clear view of its strengths and risks. Among the positives: accelerating AI monetization, strong margins, a growing base of non-creative users, and consistent free cash flow. These fundamentals could justify a price range of $455 to $475 — representing 10–15% upside.

On the flip side, investors may be disappointed by the lack of specific AI revenue detail. Combined with cautious buyback disclosures, these introduce a near-term downside risk of 3–5%. Macroeconomic pressure or poor execution on AI could also push the stock toward the $385–$390 level.

📊 SWOT Summary Table

🔮 What’s Adobe Worth? Valuing the Stock Based on Official Guidance

Using Adobe’s internal EPS guidance and valuation history, we mapped out three scenarios:

- Bull Case: AI monetization exceeds expectations and Adobe reclaims a premium P/E multiple (30×).

→ $20.70 EPS × 30 = $621 - Base Case: Adobe delivers its guidance and trades at 24×, slightly below its historical average.

→ $20.60 × 24 = $494 - Bear Case: AI monetization stalls and valuation contracts to 19×.

→ $20.50 × 19 = $389

Weighting these scenarios (20% bull, 60% base, 20% bear), our fair value estimate is $498.40 — roughly 20% above the current price of $413.

🏁 Our Take: Mispricing Creates Opportunity

Adobe’s raised guidance, strong recurring revenue growth, and accelerating AI adoption all point to a business gaining momentum. Even more compelling: our fair value estimate of $498 closely mirrors the average analyst target of ~$497, reinforcing the case for upside.

Management noted that demand improved sequentially in Q2, a sign that macro headwinds may be easing. While competition in generative AI is heating up across creative tools, Adobe is positioning itself well by embedding AI across its full product suite.

For long-term investors with a focus on high-quality, cash-generative, AI-leveraged software businesses, the post-earnings dip appears to be a gift.

💬 Like This Analysis? Get More on SWOTstock

At SWOTstock, we distill earnings calls, official filings, and executive strategy into investor-ready breakdowns — backed by data and free from noise. Please subscribe to stay on top.

⚠️ Disclaimer

This post is based entirely on Adobe’s official financial statements and earnings call from Q2 FY2025. It is not financial advice.

Leave a comment