McDonald’s (NYSE: MCD) just released its earnings for the first quarter of 2025 on May 1, 2025, and the market had a mixed reaction. While global growth remained steady, softness in the U.S. weighed on investor sentiment. In this post, we’ll break down what happened this quarter, summarize the key highlights, provide a structured SWOT analysis, and assess whether the current stock price is justified—or a bit ahead of itself.

Q1 2025 Recap: A Mixed Meal

McDonald’s reported total revenue of $5.96 billion, down 2% year-over-year, falling short of expectations. The main drag? U.S. comparable sales declined 3.6%, driven by reduced traffic among low-income consumers. This came as a surprise, especially given the resilience shown in prior quarters.

On the bright side, global comparable sales rose 1.9%, with particularly strong performance in International Developmental Licensed Markets. The company’s digital flywheel continues to expand, now boasting over 170 million 90-day active users and generating $30 billion in annual systemwide sales.

Profitability held steady. EPS came in at $2.66, flat compared to last year, and the company maintained its full-year guidance, signaling long-term confidence.

Still, investors punished the stock on release day, driving it down by –1.9%, reflecting concern about core market softness.

Quarter Summary – Key Highlights

- Revenue: $5.96B (–2% YoY), below consensus

- EPS: $2.66 (flat YoY)

- U.S. Comparable Sales: –3.6% (unexpected contraction)

- Global Comparable Sales: +1.9%

- Digital Engagement: 170M+ active loyalty users; $30B in system sales

- Store Growth: Targeting 2,200 new units globally in 2025

- Guidance: Unchanged; long-term growth remains intact

- Stock reaction: –1.9% on earnings day

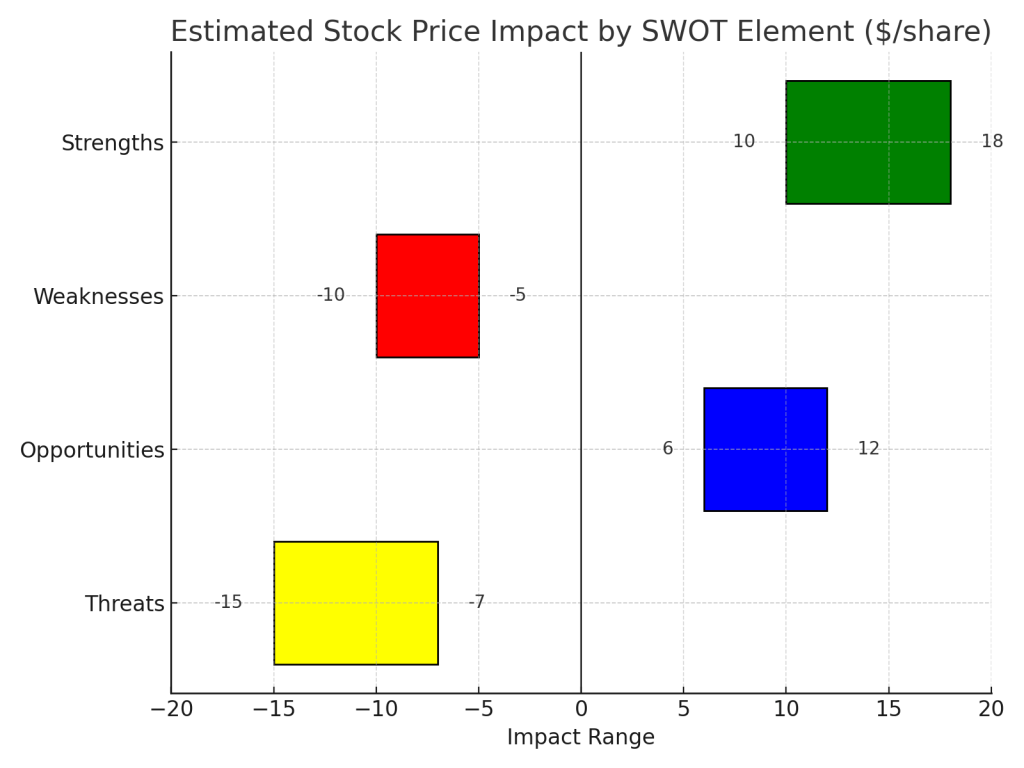

SWOT Analysis with Quantitative Stock Price Impact

Now that we’ve covered the surface, let’s dive deeper. A SWOT analysis gives us a structured way to assess the quarter’s real implications—including how each element likely impacted the stock price.

Strengths

McDonald’s international operations continue to deliver. The 1.9% global comparable sales growth helped soften the blow from weak U.S. performance. In addition, the company’s digital ecosystem is a major asset. With 170M+ loyalty users contributing to $30B in sales, this customer retention engine is likely to support long-term revenue stability.

Stock impact: These strengths contributed to a +1.0% to +1.7% positive pressure on the stock price.

Weaknesses

The glaring weakness this quarter was the –3.6% decline in U.S. comparable sales, reflecting a pullback in visits from lower-income consumers. Management acknowledged that value offerings weren’t enough to fully retain traffic. Flat EPS ($2.66) also showed that margin strength couldn’t offset volume weakness.

Stock impact: Weaknesses contributed to a –1.8% to –2.7% downward adjustment.

Opportunities

McDonald’s sees opportunity in its global expansion plans, with 2,200 new store openings planned this year (including 1,000 in China). Value menu strategies, like a €4 Happy Meal in Germany, are also being deployed to retain budget-conscious customers.

Stock impact: These growth signals added +0.5% to +1.0% upside potential.

Threats

Consumer sensitivity to inflation, especially among low-income groups, poses a real threat to short-term performance. Additionally, competitive pressure in Europe, especially the UK, remains elevated and was acknowledged by management on the call.

Stock impact: Threats exerted –0.7% to –1.2% negative pressure.

Net Stock Impact Estimate: Combining all elements, the stock saw a net estimated drop of –0.8% to –1.2%, which aligns closely with the actual decline of –1.9% post-earnings.

SWOT Summary

| SWOT Analysis – Q1 2025 | |

|---|---|

| Strengths • Digital loyalty program scaling globally • $30B in digital systemwide sales • Global comparable sales +1.9% • Stock impact: +1.0% to +1.7% |

Weaknesses • U.S. comparable sales –3.6% • Soft traffic among low-income groups • Flat EPS YoY • Stock impact: –1.8% to –2.7% |

| Opportunities • 2,200 store openings in 2025 • Strong growth in China • Value-based pricing in Europe • Stock impact: +0.5% to +1.0% |

Threats • Rising price sensitivity • Competitive pressure in key markets • Inflation could impact margin recovery • Stock impact: –0.7% to –1.2% |

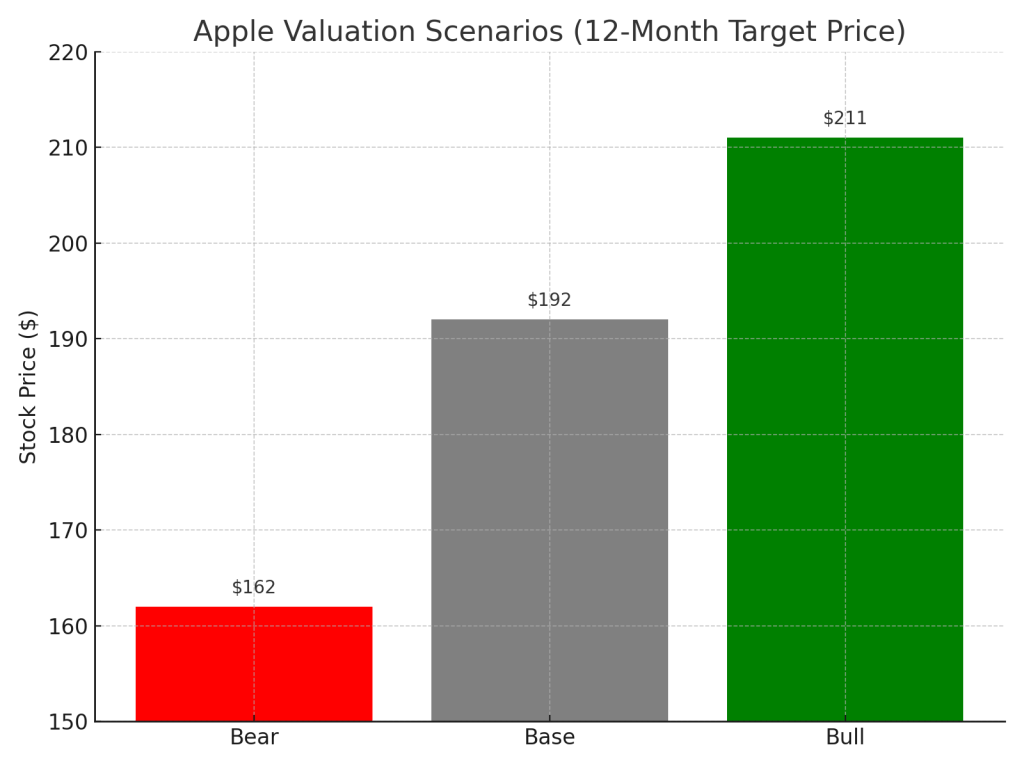

Base, Bull, and Bear Cases

Let’s now examine where McDonald’s stock could go from here, using base, bull, and bear cases based on the earnings report.

| Scenario | Narrative | Stock Price Estimate | Probability |

|---|---|---|---|

| Base Case | Balanced view: EPS flat, U.S. weak, digital stable | $310.67 (–1.2%) | 60% |

| Bull Case | Focus on digital loyalty, global expansion offsets U.S. drag | $317.56 (+1.0%) | 25% |

| Bear Case | Market reacts strongly to U.S. weakness and low-income trends | $304.00 (–3.0%) | 15% |

Expected Value:

= $314.42 × (1 – 0.0092) = $311.52

With the actual current price at $308.42 (May 2, 2025), the market is leaning more pessimistic than our weighted scenario suggests.

Valuation: Is the Stock Fairly Priced?

McDonald’s is currently trading at a P/E ratio of ~27.15×, which is slightly above its 5-year historical range of 23×–26×. With no earnings growth and U.S. comps turning negative, the fundamentals suggest that a 25× multiple is more appropriate, implying a fair value around $284.

| Metric | Value |

|---|---|

| Current Price | $308.42 |

| Fair Value (Base Case) | $284 |

| Premium to Fair Value | +8.6% |

| Verdict | Overpriced by ~8–10% |

Final Take

McDonald’s remains a strong global brand with a powerful digital strategy, but the U.S. consumer softness and flat profitability raise questions about near-term growth. While long-term investors may look past these issues, at today’s price, the stock appears to be slightly overpriced relative to its fundamentals.

If you’re holding, stay patient—but if you’re considering buying, it may be worth waiting for a better entry point.

Comment on Source Usage:

This analysis is based exclusively on McDonald’s official Q1 2025 financial report and the corresponding earnings call transcript. No third-party news articles, analyst opinions, or external data sources were referenced. This approach ensures the insights presented reflect only the company’s own disclosures and strategic messaging.

Disclaimer:

This content is for informational purposes only and does not constitute financial advice, investment recommendations, or an endorsement to buy or sell any securities. Readers should conduct their own research or consult a qualified financial advisor before making investment decisions.

Please subscribe to our blog for the latest analysis. If you want a detailed full analysis report, please leave a comment.

Leave a comment