Quick Take: Microsoft’s Q3 FY25 at a Glance

Microsoft’s Q3 FY25 earnings beat expectations across the board, driven by Azure’s 23% growth and rising Copilot adoption. Margins expanded, and management sounded confident about long-term AI monetization. But with the stock trading at $435, much of that optimism may already be priced in. Our analysis suggests the stock is fairly valued with limited upside unless Copilot monetization accelerates further.

Quarter Recap

Microsoft reported another strong quarter, with revenue reaching $70.1 billion, up 13% year-over-year. Net income rose 18% to $25.8 billion, and EPS hit $3.46—up 18% from last year. The standout performer was Azure, which grew 23% in constant currency, with about 16 percentage points attributed to AI-related services.

CEO Satya Nadella emphasized “material AI usage revenue” and confirmed that Copilot adoption is broadening across Microsoft 365, GitHub, and Dynamics. Despite ramping up AI infrastructure investments (CapEx of $14 billion this quarter), Microsoft maintained strong operating margins at 46%.

This quarter matters because it signals that Microsoft is not just leading in AI hype—it’s beginning to turn that momentum into revenue and margin growth.

Key Highlights

- Revenue: $70.1B (+13% YoY)

- Net Income: $25.8B (+18% YoY)

- EPS: $3.46

- Azure Growth: +23% YoY (16 pts from AI)

- Operating Margin: 46%

- Microsoft 365 Commercial Revenue: +12%

- CapEx: $14B

- Free Cash Flow: $20.3B

- RPO (future revenue backlog): $315B (+34% YoY)

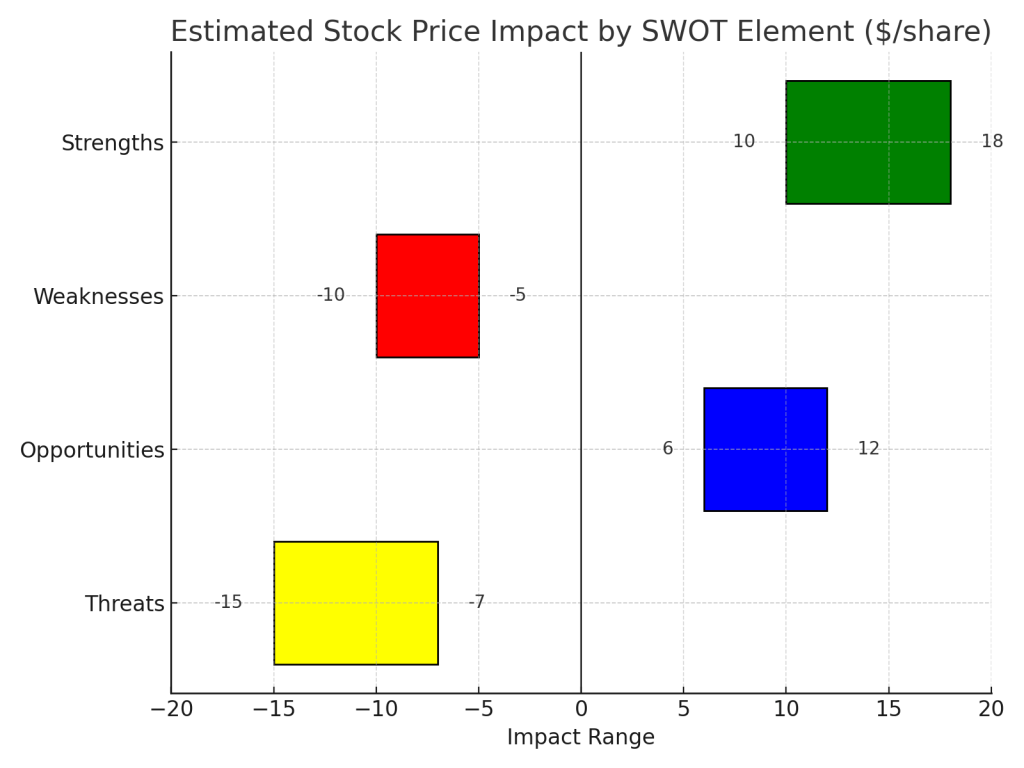

SWOT Analysis: What’s Behind the Numbers

Let’s break it down using the simple SWOT framework—what’s going well, what’s not, where the upside is, and what risks could derail the story.

Strengths

Microsoft’s cloud and AI strategy is clearly working. Azure’s 23% growth—with AI workloads driving more than half that—shows early returns on heavy AI investments. Commercial bookings and RPO (future revenue) are growing fast, and the company has scaled its margin even while expanding CapEx.

Estimated stock impact: If sustained, these results could support a +$20–30/share uplift in fair value.

Weaknesses

The More Personal Computing segment is still sluggish. Windows OEM and Surface revenue posted modest gains (3–5%), and Copilot monetization—while promising—is still early. Some segments may weigh on overall revenue growth if cloud doesn’t continue to outperform.

Estimated impact: A drag on future growth could shave –$5 to –$10/share off fair value.

Opportunities

The biggest upside? AI monetization. Microsoft is embedding Copilot across every product—Office, GitHub, Dynamics—and that creates an enormous paid seat opportunity. With 430M Microsoft 365 commercial seats, even modest Copilot adoption could unlock billions in new revenue.

Estimated impact: If realized at scale, this could add +$30–50/share to valuation over time.

Threats

Valuation is the elephant in the room. Microsoft is trading at 33x forward earnings—well above its 10-year average of 26x. That’s a premium for perfection. If AI adoption underwhelms or regulation slows the rollout, the stock could de-rate quickly.

Estimated downside: In a bearish scenario, risks could cut –$40–60/share off the stock.

SWOT Summary Table

| Category | Highlights | Est. Price Impact |

|---|---|---|

| Strengths | Azure + AI growth, strong margins | +$20–30 |

| Weaknesses | PC revenue lag, early-stage Copilot monetization | –$5 to –$10 |

| Opportunities | AI monetization across Microsoft ecosystem | +$30–50 |

| Threats | Rich valuation, regulatory headwinds | –$40–60 |

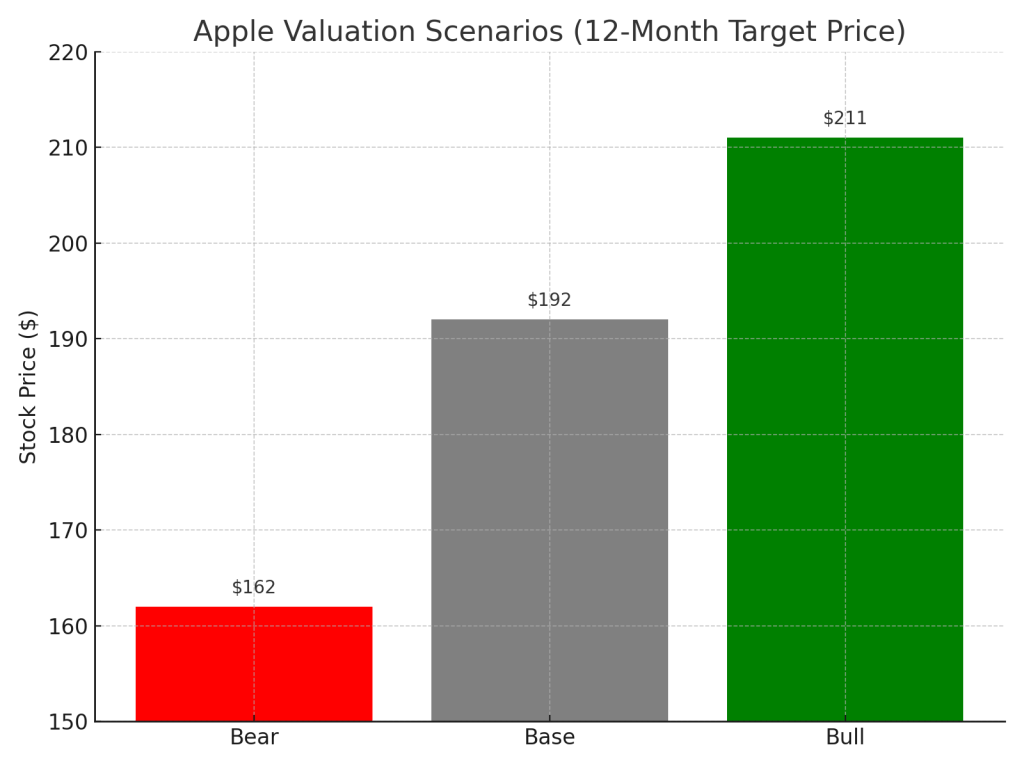

Valuation Scenarios

Based on these insights, here’s how the stock could play out in three different scenarios:

Base Case (Most likely)

- Summary: Azure continues strong, AI monetization grows gradually, margins hold

- Fair Value: $412

- Probability: 50%

Bull Case

- Summary: Copilot adoption surges, AI margins expand, regulation minimal

- Valuation: $476

- Probability: 30%

Bear Case

- Summary: AI monetization lags, CapEx overwhelms margins, P/E compresses

- Valuation: $336

- Probability: 20%

Weighted Average Estimate

(412 × 0.5) + (476 × 0.3) + (336 × 0.2) = 206 + 142.8 + 67.2 = \textbf{$416/share}

Current Price: $435

Estimated Fair Value: $416

Implied Overvaluation: ~4.3%

Verdict

At $435, Microsoft stock appears slightly overvalued, with much of the AI success already priced in. That doesn’t mean it’s a sell—but it suggests a hold for long-term investors and a wait-for-a-better-entry for new buyers.

If you believe Copilot will be as transformative as Office or Azure, the bull case may still hold. But in the near term, upside looks limited unless Microsoft significantly accelerates AI monetization.

Final Call: Fair to mildly overvalued. Hold.

Call to Action

Want simple, no-fluff breakdowns like this delivered before the headlines hit?

Subscribe now at SWOTstock.com and get our next earnings deep dive straight to your inbox.

Disclaimer

This post is based solely on Microsoft’s official Q3 FY25 financial report and earnings call transcript. It does not constitute investment advice. Please conduct your own research or consult a financial advisor before making any investment decisions.

Leave a comment