TL;DR Summary

Amazon (AMZN:NASDAQ) delivered another quarter showing that it is evolving into an AI infrastructure and cloud profit engine layered on top of global retail scale. AWS continues to expand strongly, retail efficiency is improving, and operating income remains robust. However, free cash flow compressed sharply due to heavy AI-driven capital investment. The market now views Amazon as a long-term AI compounder, but near-term valuation is capped by capex intensity.

Quarter Recap

Amazon reported Q4 2025 revenue growth of 14% year over year, with AWS again acting as the primary profit engine. Operating income expanded despite several one-time charges, and North America retail margins improved as logistics efficiency initiatives continue to bear fruit. At the same time, property and equipment spending surged as Amazon accelerates AI infrastructure buildout.

The key story is investment phase vs monetization phase — the same pattern Amazon followed in prior cloud and logistics expansion cycles.

Key Highlights

• AWS revenue grew strongly, with segment operating income reaching $12.5B in the quarter

• North America retail operating income rose significantly, showing structural efficiency gains

• International profitability remains modest compared to domestic performance

• Operating cash flow continues to expand, but free cash flow declined due to heavy infrastructure spending

• AI-driven capex is the central strategic theme

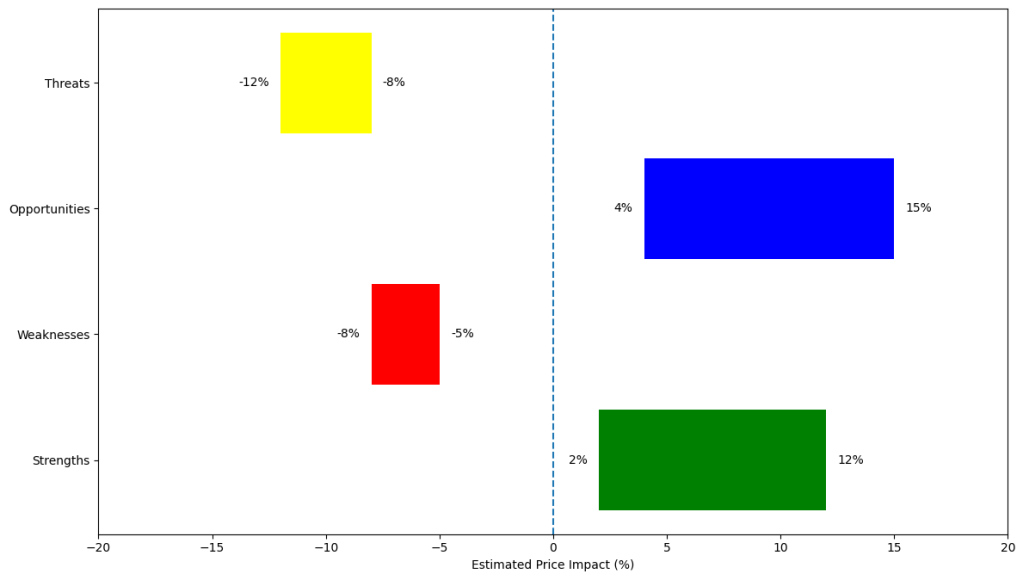

SWOT Analysis

Amazon is transitioning from a retail-led growth company to a cloud + AI + ecosystem platform company with retail acting as a distribution moat.

Strengths

• AWS remains the dominant earnings driver with strong revenue growth and margin contribution

Estimated price impact: +8% to +12%

• North America retail operating leverage improving through logistics optimization

Estimated price impact: +4% to +7%

• High-margin advertising and ecosystem monetization layered on top of Prime and retail traffic

Estimated price impact: +3% to +5%

Weaknesses

• Free cash flow compression due to aggressive AI and infrastructure investment

Estimated price impact: –5% to –8%

• International retail profitability still uneven

Estimated price impact: –2% to –4%

Opportunities

• AI demand cycle could trigger a multi-year AWS acceleration similar to early cloud growth

Estimated price impact: +10% to +15%

• Logistics network creates durable competitive moat supporting ecosystem monetization

Estimated price impact: +4% to +6%

Threats

• Capex shock risk if AI infrastructure ROI lags expectations

Estimated price impact: –8% to –12%

• Cloud competition and AI infrastructure pricing pressure

Estimated price impact: –4% to –6%

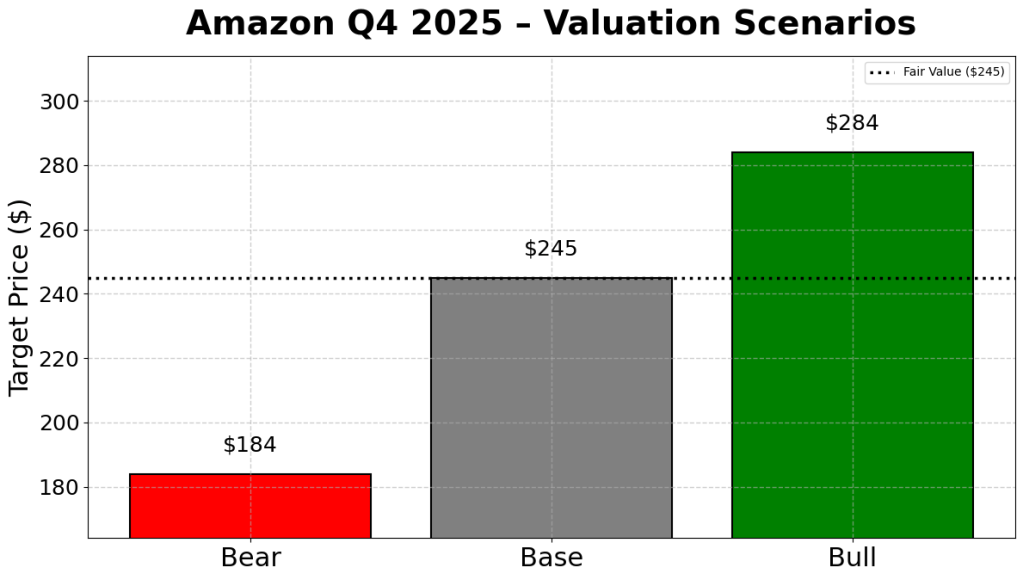

Valuation Scenarios

Amazon’s valuation now depends on whether the AI investment cycle produces margin expansion or becomes a prolonged cash drain.

Bear Scenario

• AI infrastructure monetization slower than expected

• Free cash flow remains suppressed

• AWS growth moderates

Price outcome: –15% to –20%

Base Scenario

• AWS growth sustains around current pace

• AI workloads drive gradual margin expansion

• Retail margins remain stable

Price outcome: ~+10%

Bull Scenario

• AI cycle mirrors early cloud boom

• AWS re-accelerates strongly

• Advertising and Prime ecosystem margins expand

Price outcome: +25% to +30%

Probability-weighted fair value:

Amazon appears worth ~8–12% above current trading levels

Verdict

Amazon remains a long-term platform compounder, but it is currently in a heavy reinvestment phase. This is not a short-term margin story — it is an infrastructure cycle story. For tech-savvy growth investors, Amazon represents AI infrastructure exposure with ecosystem protection, but patience is required while cash flow is absorbed by buildout.

Call to Action

If you follow platform companies transitioning into AI infrastructure leaders, Amazon is a key case study. Follow SWOTstock for more structured earnings breakdowns focused on real valuation drivers.

Disclaimer

This analysis is for educational purposes only and is not financial advice. Investors should conduct their own research and consider risk tolerance before making investment decisions.