What Long-Term Investors Should Take From Apple’s Latest Earnings Report

If you’re building a long-term portfolio, Apple likely has a place in it. But with the stock near $183 and the company posting record earnings in Q2 2025, the question becomes: is Apple still a smart hold—or has most of the upside already been priced in?

Let’s break it down clearly and factually using Apple’s own numbers from its earnings report and investor call.

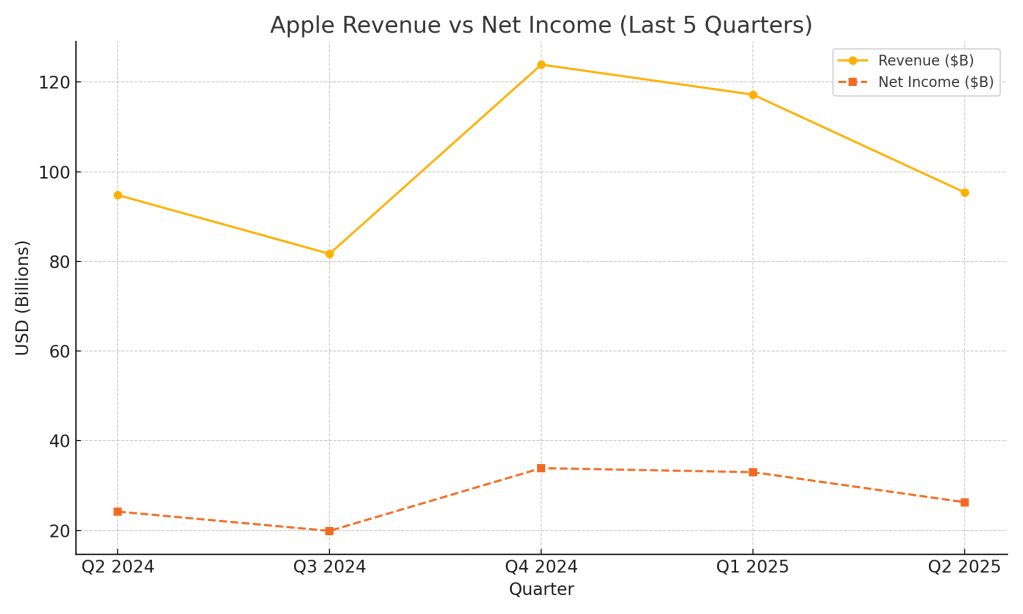

Consistency You Can Count On: Apple’s Q2 2025 in Context

Apple reported $95.4 billion in revenue, a 5% increase year-over-year, and delivered an EPS of $1.65, up 8%—the highest ever for a March quarter. The company also continued returning capital to shareholders at scale: $29 billion was distributed this quarter through buybacks and dividends.

For long-term holders, this quarter shows why Apple remains one of the most reliable compounders in the market:

- Services revenue hit a new record at $26.6B, growing 12% YoY.

- Mac and iPad sales both grew, reversing previous softness.

- iPhone revenue held steady, up 2%, despite global macro pressures.

- A new $100 billion buyback program was authorized, further enhancing shareholder value.

These are not flashy numbers—they’re the kind of consistent results that build wealth over time.

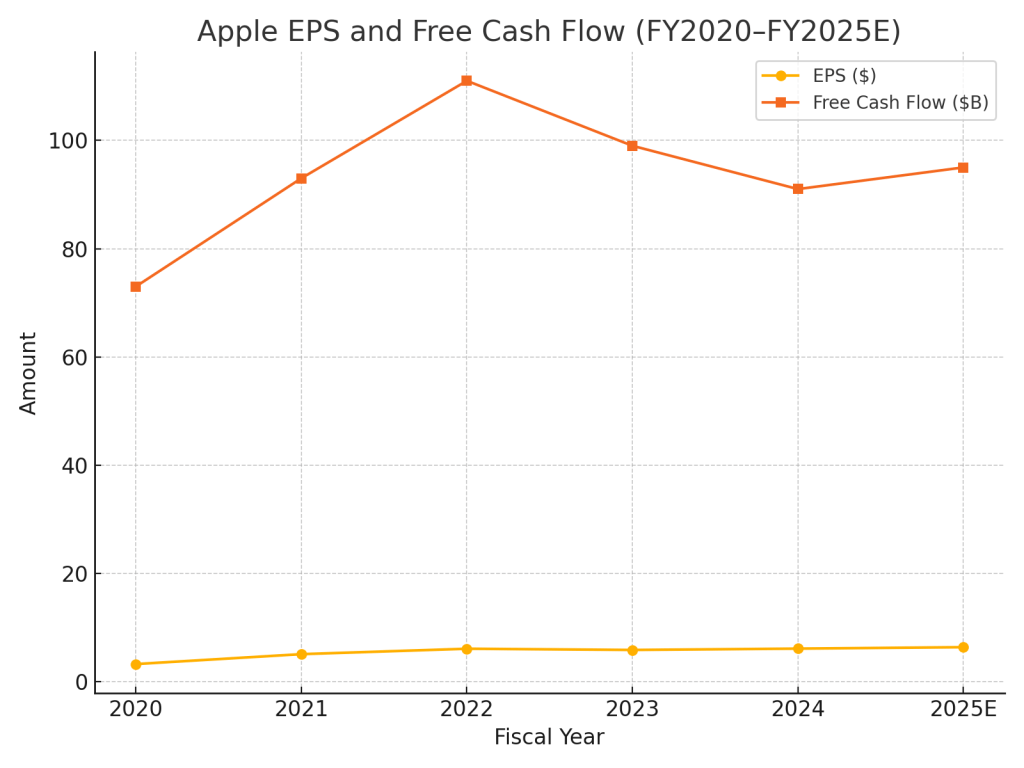

Long-Term Growth in Action: What the Last 5 Years Say

Apple’s steady growth is no accident. EPS has grown from $3.28 in FY2020 to an expected $6.40 in FY2025, nearly doubling in five years—despite global challenges.

Free cash flow has remained consistently above $90 billion annually, allowing for uninterrupted buybacks and dividend growth. This consistency is why Apple continues to anchor many long-term portfolios.

Key Metrics That Matter

| Metric | Q2 2025 Result | YoY Change |

|---|---|---|

| Revenue | $95.4B | +5% |

| EPS | $1.65 | +8% |

| Free Cash Flow | $24B | Steady |

| Services Revenue | $26.6B | +12% |

| iPhone Revenue | $46.8B | +2% |

| Dividend | $0.26/share | +4% |

| Buyback Authorization | $100B | New |

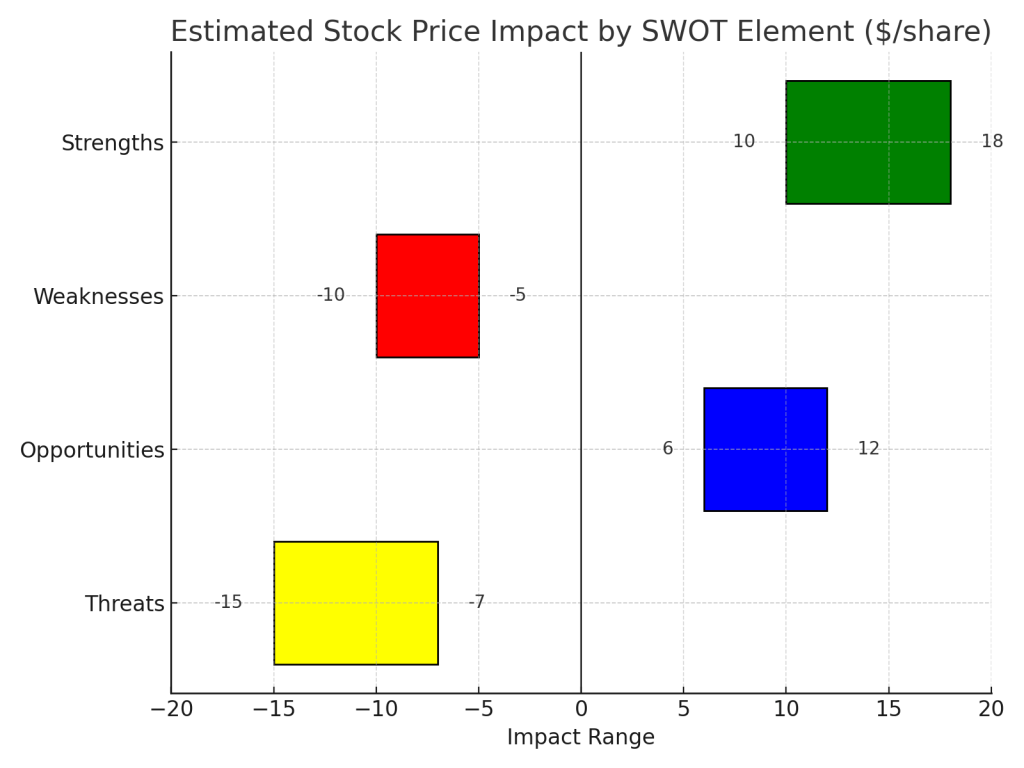

What Could Move the Stock: SWOT Breakdown

Understanding the strengths and risks from Apple’s own disclosures can help investors evaluate where the stock might go from here.

Strengths – Durable Growth and Massive Capital Returns

Apple is a cash machine. Record EPS, strong services performance, and a $100B buyback point to continued shareholder value creation.

Stock Price Impact Estimate: +$10 to +$18

- Recurring high-margin revenue from services

- Growing installed base across all regions

- Buyback program supports share price

Weaknesses – Margin Pressure and Regional Slowdowns

Gross margins dipped this quarter, and revenue in China declined slightly. Wearables also underperformed against last year’s strong launch cycle.

Stock Price Impact Estimate: –$5 to –$10

- FX and input cost headwinds

- Gross margin contraction (down 340 bps)

- Regional weakness in China and wearables

Opportunities – AI, Global Scale, and Supply Chain Shift

Apple Intelligence and Siri upgrades may drive the next hardware upgrade cycle. At the same time, Apple is shifting production for U.S. sales to India and Vietnam to reduce risk.

Stock Price Impact Estimate: +$6 to +12

- Growth in international services markets

- Supply chain resilience reduces geopolitical risk

- New AI features deepen ecosystem loyalty

Threats – Tariffs and Legal Scrutiny

Apple faces $900M in tariff costs in the next quarter and is still navigating legal risks around its App Store practices.

Stock Price Impact Estimate: –$7 to –$15

- Near-term margin hit from trade policy

- Long-term impact from regulatory rulings

- FX volatility in key markets

SWOT Summary

| Category | Key Drivers | Est. Stock Impact |

|---|---|---|

| Strengths | Record EPS, services growth, $100B buyback | +10 to +18 |

| Weaknesses | Gross margin pressure, China softness | –5 to –10 |

| Opportunities | AI integration, global services, supply chain shift | +6 to +12 |

| Threats | Tariffs, legal pressure, FX risks | –7 to –15 |

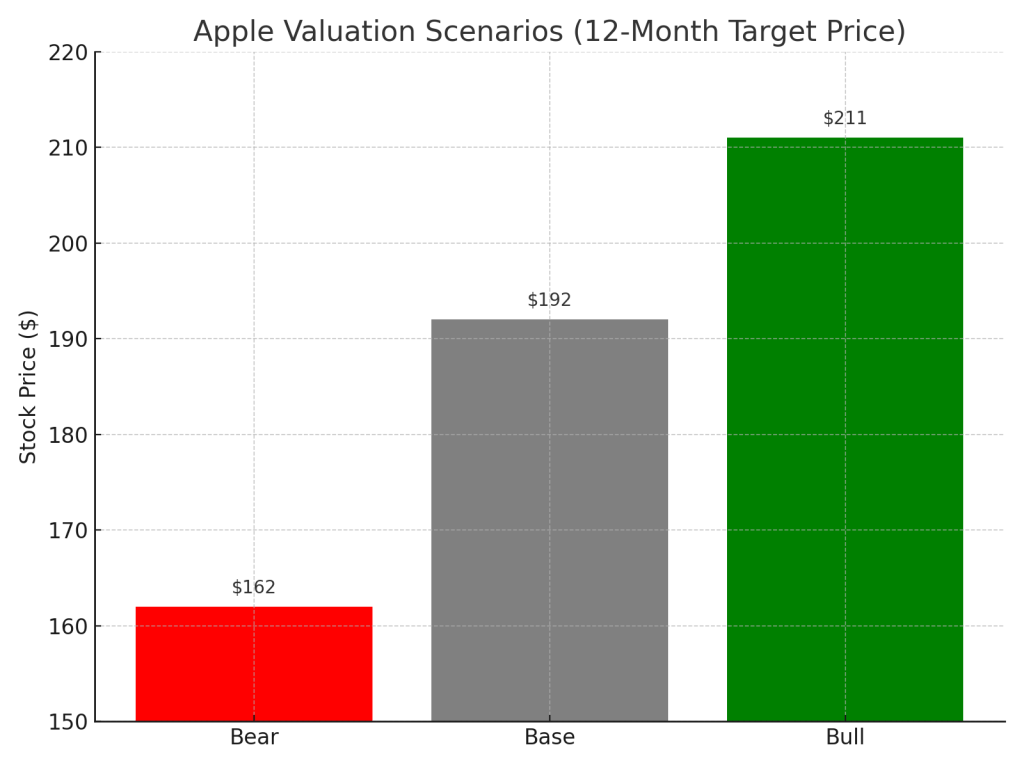

Valuation Scenarios: What’s the Long-Term Fair Value?

Apple’s fundamentals suggest a forward EPS of $6.40. Using long-term average P/E multiples, here are three valuation outcomes:

| Scenario | EPS | P/E | Target Price | Probability |

|---|---|---|---|---|

| Bull | 6.75 | 31.3 | $211 | 30% |

| Base | 6.40 | 30.0 | $192 | 50% |

| Bear | 6.10 | 26.5 | $162 | 20% |

Weighted Fair Value: ~$191.7/share

At the current price of ~$183, Apple appears slightly undervalued, with 4–5% upside in the base case. For long-term investors, this aligns with steady, risk-adjusted growth—not hype-driven returns.

Should You Wait for a Better Entry?

At around $183, Apple trades near its weighted fair value of ~$191.7. That suggests limited short-term upside, but not overvaluation.

If you’re building a position or adding, a price closer to $175 may offer a more attractive risk-reward ratio, based on:

- Base case fair value estimate of $192

- Recent support levels and volatility range

- Tariff risks temporarily weighing on sentiment

This doesn’t mean you need to wait—but it provides a disciplined approach if you’re cost-sensitive.

Final Take: Still a Core Holding for Long-Term Portfolios

Apple remains a model of long-term stability. It won’t double overnight, but it doesn’t need to. With strong cash flow, deep ecosystem loyalty, and AI expansion ahead, it’s a smart hold or buy-on-dips candidate for any long-term portfolio.

Want More No-Nonsense Stock Breakdowns?

We focus on what matters: financial results, strategy, and stock implications—without spin.

Subscribe to SWOTstock for clean, clear earnings analysis. Or follow us on Instagram @SWOTstock for mobile-friendly snapshots and updates.

Disclaimer

This blog is based solely on Apple’s official Q2 2025 financial report and earnings call. It is not investment advice. Always evaluate your own risk before investing.

Leave a comment