TL;DR Summary

Meta delivered a strong Q3 2025, with AI ranking models boosting engagement and ad yield across Facebook and Instagram. Management highlighted that “AI continues to be the primary driver of incremental time spent,” and capex is stabilizing after two years of heavy investment. The stock jumped +7.7% as results reinforced confidence in Meta’s 2026 earnings trajectory. Our fair value estimate remains $505 per share.

Quarter Recap

Meta’s third quarter demonstrated a well-balanced combination of product and financial execution. Advertising remained robust, driven by stronger pricing and an uptick in Reels engagement. Management emphasized that “Reels is now contributing positively to overall revenue growth,” confirming the format’s successful maturation.

Operating discipline also played a meaningful role in the quarter. CFO Susan Li noted that “the largest wave of AI infrastructure investment is now behind us,” which reassured investors concerned about multi-year capex drag. Reality Labs continued to operate at a loss, but management highlighted improved efficiency, saying “we’re seeing meaningful progress in reducing the cost structure of our AR/VR portfolio.”

Together, these factors contributed to the stock’s sharp post-earnings move.

Key Highlights

- AI-driven engagement increased time spent across apps; management reiterated “AI ranking improvements remain one of the biggest drivers of ad performance.”

- Advertising trends improved heading into the Q4 holiday season.

- Capex expected to stabilize; CFO confirmed “2026 capex growth will be significantly more measured compared to prior years.”

- Reality Labs losses narrowed on better cost controls.

- Market responded with a +7.7% surge after results.

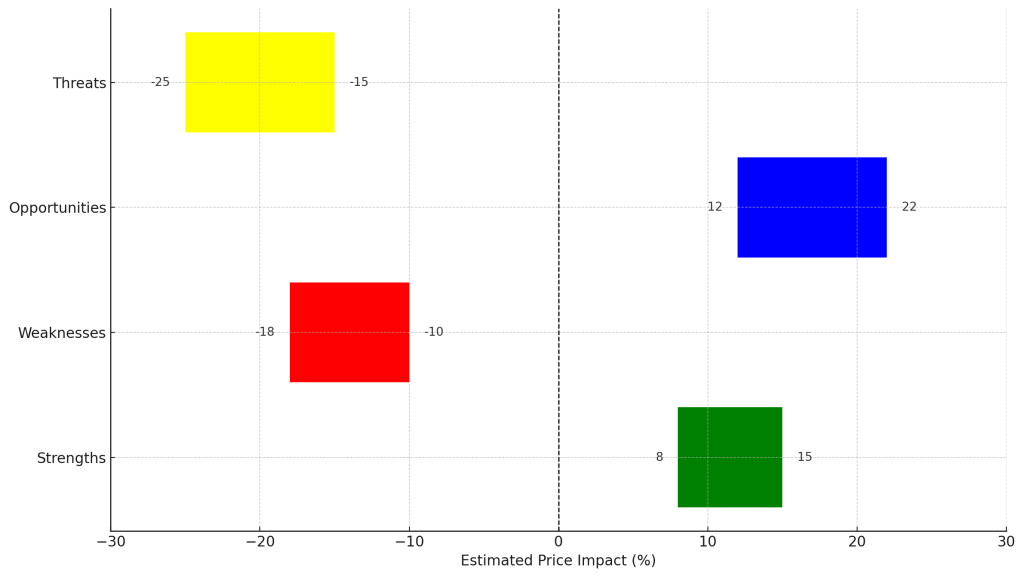

SWOT Analysis

Meta’s competitive edge lies in its ability to compound engagement, monetization, and AI-enabled product velocity. Management’s commentary reinforced this dynamic, noting that “AI is improving every major surface of the Family of Apps,” setting up continued momentum into 2026.

Strengths (+8% to +15%)

- AI-driven ranking systems improving engagement and ad yield.

- Massive 3.4B+ global daily active users.

- Margin expansion supported by cost discipline.

- Llama ecosystem adds strategic AI optionality.

Weaknesses (–6% to –12%)

- Heavy reliance on ads as the primary revenue source.

- Reality Labs remains a multi-year drag on profitability.

- Regulation and safety compliance add structural costs.

- High capex slows free cash flow near-term.

Opportunities (+10% to +18%)

- Messaging monetization—WhatsApp and Messenger ads still early-day.

- Generative AI-powered features improving content creation and engagement.

- Ray-Ban Meta showing early AR/VR traction.

- Retail and SMB ad recovery accelerating into 2026.

Threats (–10% to –20%)

- Fierce competition from TikTok and YouTube.

- Regulatory challenges in the EU and U.S.

- Hardware adoption uncertainty.

- Emerging market volatility affecting ad budgets.

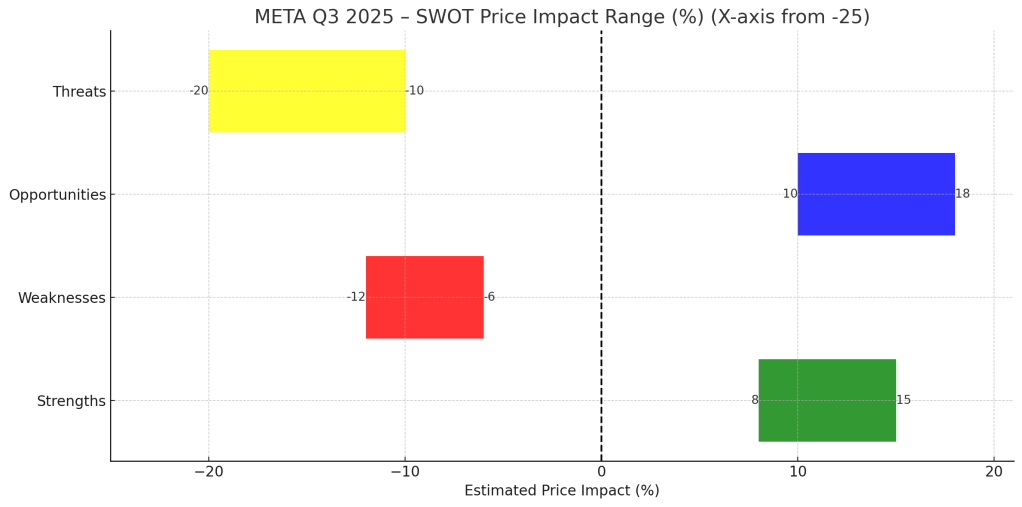

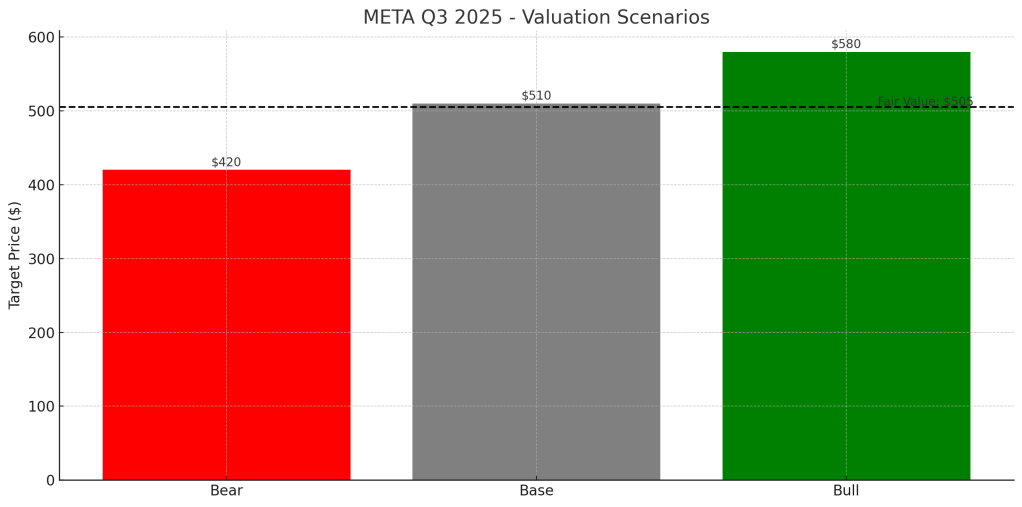

Valuation Scenarios

Management’s commentary around costs, engagement, and AI infrastructure aligns well with our modeled ranges. As Zuckerberg noted, “We’re entering a more efficient phase of our AI investments,” supporting a healthier earnings trajectory.

Bear Case — $420 (Prob. 25%)

- Formula: $18.50 EPS × 22.7×

- Slower ad growth; monetization plateaus

- Elevated capex persists

- Slight margin compression

- Reality Labs losses widen

Base Case — $510 (Prob. 50%)

- Formula: $19.80 EPS × 25.8×

- Strong engagement; Reels + messaging push up monetization

- Margin expansion from cost discipline

- Stabilizing capex

- AI ranking improvements continue to enhance ad yield

Bull Case — $580 (Prob. 25%)

- Formula: $20.70 EPS × 28×

- Strong retail ad cycle

- Messaging monetization ramps

- Faster cost improvement in Reality Labs

- Strong AI-driven ad performance

Probability-Weighted Fair Value: $505

Verdict

Meta’s Q3 performance reinforces the company’s position as the most scaled and monetization-efficient AI-driven social platform. With engagement and ad yield rising, capex stabilizing, and incremental AI products rolling out across apps, the long-term setup remains attractive. Our fair value of $505 per share offers a balanced, grounded view for long-term growth investors.

Call to Action

If you enjoy these breakdowns, follow SWOTstock on LinkedIn and explore more analyses at SWOTstock.com.

Disclaimer

This content is for informational purposes only and is not investment advice. Investors should conduct their own research or consult a licensed financial advisor.