Quarter Recap: Disney Delivers a Comeback Quarter

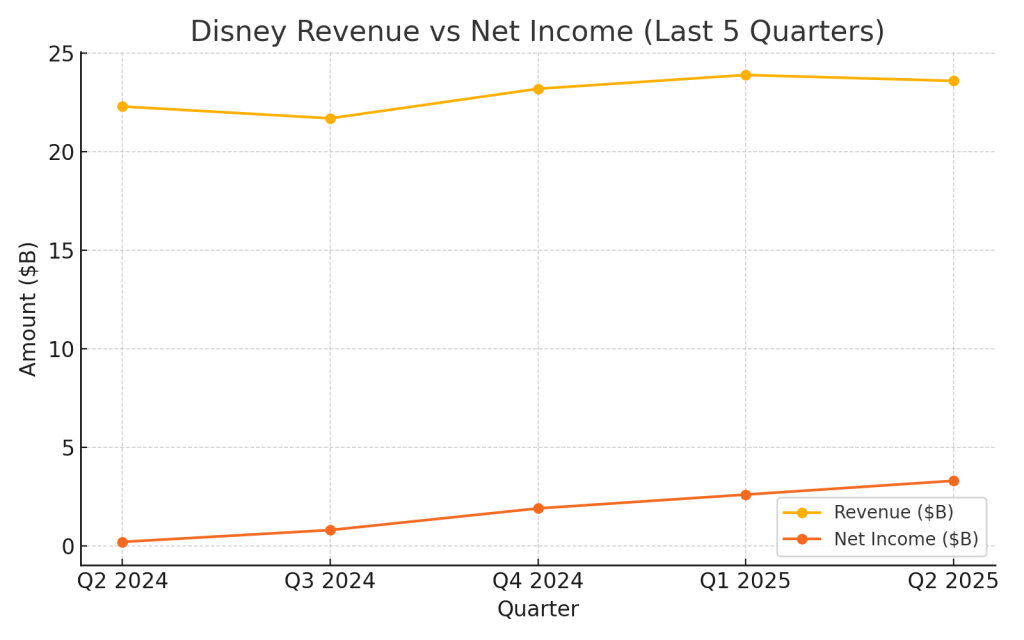

Disney’s (NYSE: DIS) Q2 2025 numbers show it’s more than just nostalgic IP. Revenue came in at $23.6 billion, up 7% from last year. Adjusted EPS hit $1.45—up 20%. Net income surged to $3.3 billion, a massive rebound from the prior year.

Investors liked what they saw. Disney stock jumped nearly 10% after the report dropped, reflecting growing confidence that the company’s turnaround is real.

Two major wins stood out:

- Streaming operations posted positive income.

- The Experiences segment (parks, cruises) delivered another strong quarter.

Segment Breakdown: Who’s Pulling the Weight

Streaming (Disney+, Hulu, ESPN+)

- Turned a profit this quarter

- Subscriber growth continued, though at a steadier pace

- Bundling and cost control drove the improvement

Experiences (Parks & Cruises)

- Revenue: $8.9 billion

- Strong demand in both U.S. and international parks

- Cruise occupancy and ticket yields improved

Linear Networks (TV/Cable)

- Continues to shrink

- Revenue and ad sales declined

Strategic Moves: Where the Magic’s Going

Disney’s not sitting still. Management is investing heavily—planning $60 billion over 10 years to expand its Experiences segment. That includes international projects like a new theme park in Abu Dhabi, upgrades to existing resorts, and cruise capacity expansion.

Streaming is also evolving. A standalone ESPN platform is on the way—positioning Disney to reach sports fans directly without traditional cable. Combined with cost discipline and cross-platform synergy, this is Disney trying to play offense again.

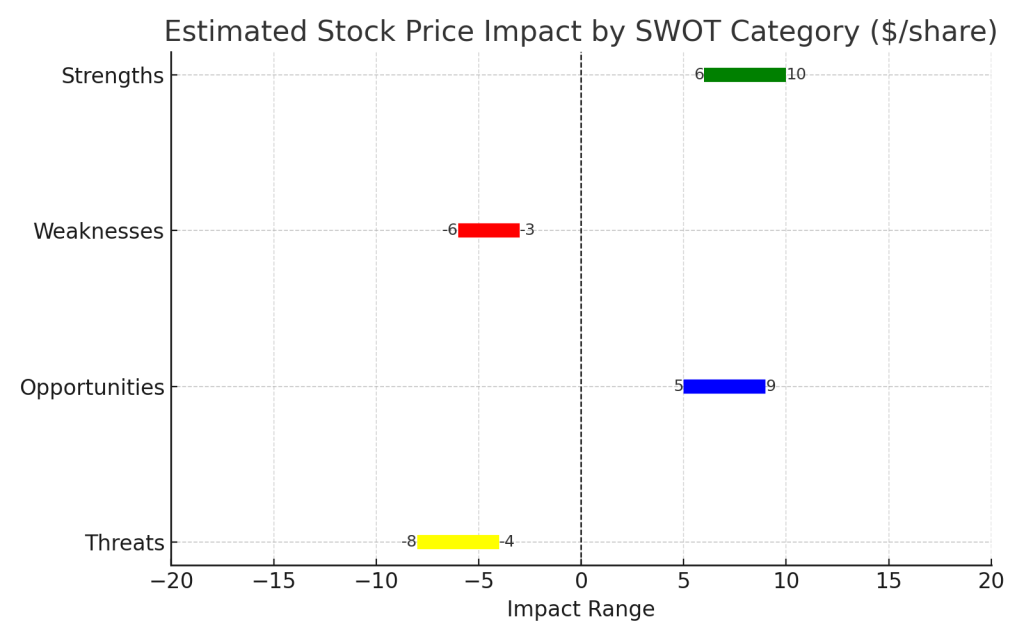

SWOT Analysis: What Could Move the Stock Next

Strengths: Streaming Turnaround and Park Momentum

Disney is now running a profitable streaming business while theme parks continue to print cash. Add global brand power and unmatched IP—this is a combo few can replicate.

Stock Impact Estimate: + $6 to $10

Weaknesses: Old Media Drag and Content Costs

Linear TV’s decline is structural. Meanwhile, content creation isn’t cheap—especially with high production expectations for Marvel, Star Wars, and beyond. That’s still weighing on margins.

Stock Impact Estimate: – $3 to $6

Opportunities: Global Expansion, ESPN+, IP Leverage

Disney is one of the few entertainment giants that can build both digital and physical experiences. ESPN’s direct-to-consumer rollout and international park projects are growth levers that haven’t fully priced in yet.

Stock Impact Estimate: + $5 to $9

Threats: Macro, Competition, and Saturation

High inflation, consumer fatigue, and stiff competition from Netflix, Amazon, and Apple TV+ are risks. Streaming growth isn’t unlimited, and pricing power may be tested.

Stock Impact Estimate: – $4 to $8

SWOT Summary

Strengths

- Streaming profitability, parks growth, brand power

- Impact: +$6 to +$10

Weaknesses

- Content cost, TV decline, capex pressure

- Impact: –$3 to –$6

Opportunities

- Park expansion, ESPN DTC, franchise bundling

- Impact: +$5 to +$9

Threats

- Inflation, competition, platform fatigue

- Impact: –$4 to –$8

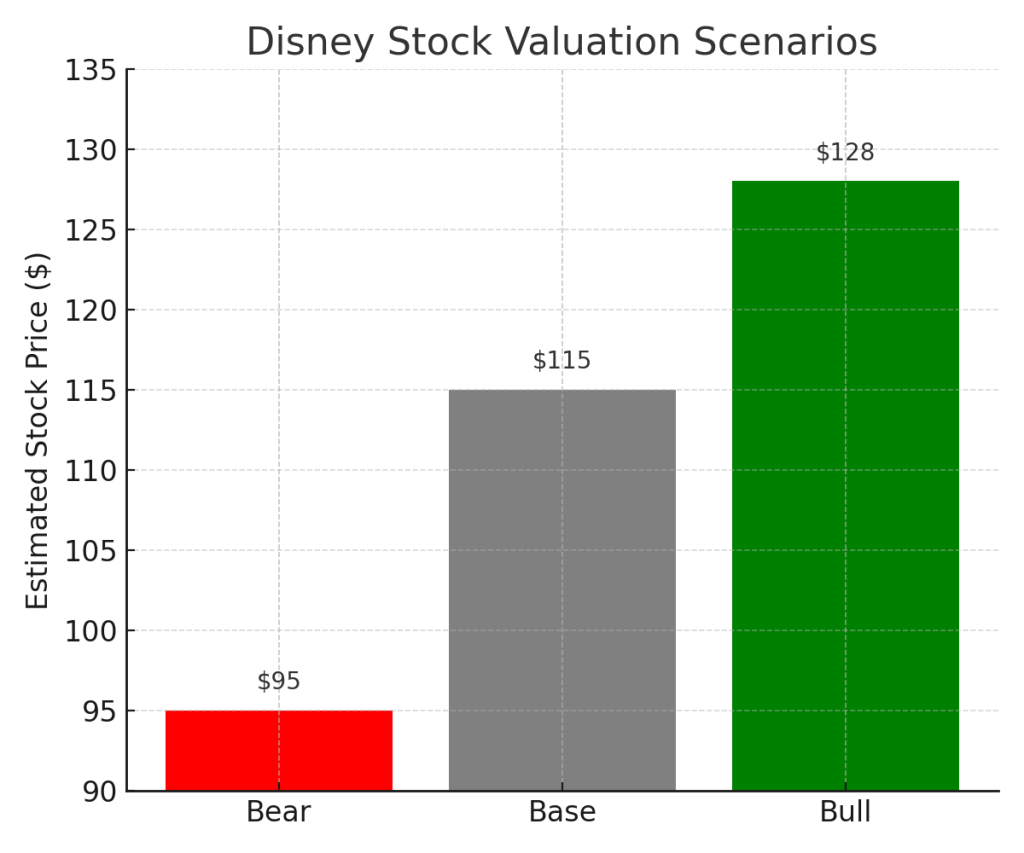

Valuation Scenarios: Is the Stock Still Undervalued?

| Scenario | Target Price | Assumptions | Probability |

|---|---|---|---|

| Bull | $128 | Streaming accelerates, parks outperform | 30% |

| Base | $115 | Solid execution, steady growth | 50% |

| Bear | $95 | Macro slows demand, investments lag | 20% |

Weighted Fair Value Estimate: $114.90

Current Price: ~$108

(Stock popped ~10% post-earnings but still under fair value)

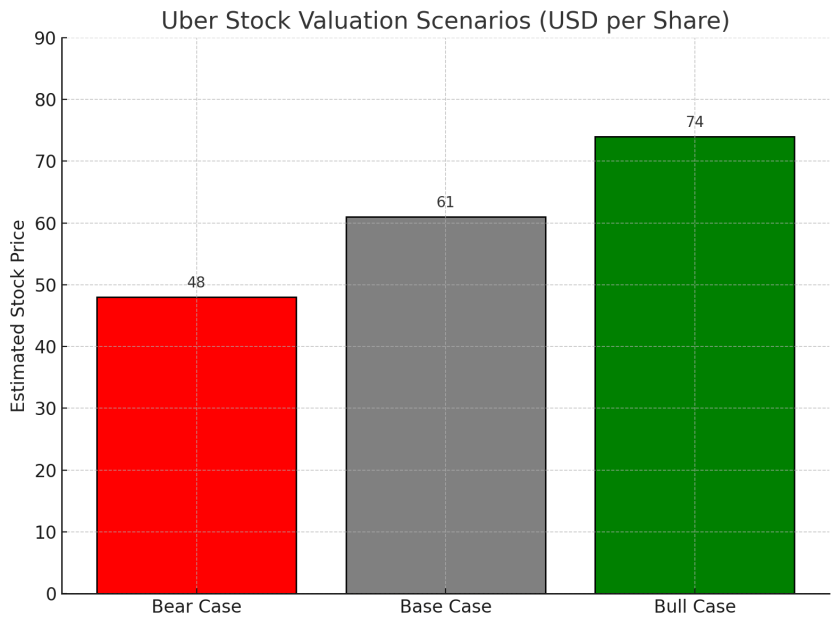

How Disney Stacks Up vs Rivals

- Netflix: Still bigger in subscribers, but less diversified—no theme parks or physical cash engines

- Amazon & Apple: Use streaming to support other businesses. Disney is the content and experience business

- Comcast: More reliant on cable; Disney’s pivot to DTC looks stronger

Final Verdict: Is Disney Stock Still a Buy?

This was a strong quarter. Disney showed it can run a leaner, smarter business while building for the future. Streaming works. Parks are growing. And IP monetization across content, sports, and experiences is just getting started.

The stock is no longer a bargain—but it’s also not overpriced. At ~$108, it’s trading slightly below our fair value estimate. For investors who want long-term exposure to a globally integrated content company, Disney looks like a smart hold with upside.

What to Watch Next

- ESPN Standalone Launch: Could attract new DTC revenue

- Subscriber Churn: Especially outside U.S.

- Next Park Announcement or Capex Update

- Profitability Trends: Are margins expanding or flatlining?

Call to Action

Like this breakdown?

Follow @SWOTstock on Instagram for real earnings analysis—no hype, no jargon.

And subscribe to stay ahead of the next big earnings move.

Disclaimer

This post is based exclusively on Disney’s official Q2 2025 earnings report and conference call. It does not use analyst projections or third-party commentary. Please do your own research before making investment decisions.

Leave a comment