TL;DR Summary

ASML just reported record bookings driven by AI-related semiconductor demand, reinforcing its role as the critical infrastructure supplier to advanced chip manufacturing. However, the stock is already trading well above our calculated fair value, meaning future returns now depend on High-NA EUV adoption and sustained AI capex growth exceeding already-lofty expectations.

Quarter Recap

ASML delivered a strong Q4 2025 report, with revenue reaching €9.7B and gross margins holding above 52%, a rare level of profitability for capital equipment companies. The headline number was bookings: €13.2B in new orders, more than doubling expectations and pushing backlog to nearly €39B. Management guided 2026 revenue to €34–39B, signaling continued demand from AI-driven chip investments.

This quarter confirmed that ASML is no longer a purely cyclical semiconductor equipment supplier; it is increasingly viewed as a structural AI infrastructure enabler.

Key Highlights

• Record quarterly bookings driven by EUV demand

• Strong margin stability above 50%

• Backlog provides multi-quarter revenue visibility

• 2026 guidance above prior expectations

• Services and installed base growing as recurring revenue stream

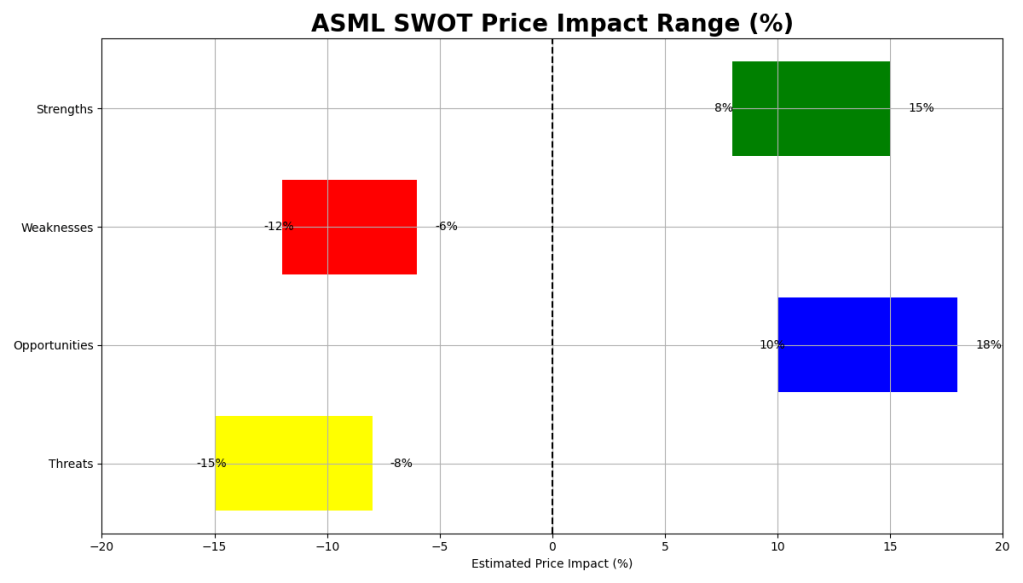

SWOT Analysis

ASML sits at the center of the AI semiconductor supply chain. The business shows structural strengths, but valuation risk is becoming more relevant as expectations rise.

Strengths

• EUV monopoly with pricing power → +8% to +15% price impact

• Record bookings visibility → +6% to +10%

• High gross margins (~52%) → +4% to +7%

• Large backlog reducing cyclical risk → +5% to +9%

Weakness

• Heavy reliance on few mega customers → –5% to –9%

• Long lead times cause revenue timing swings → –3% to –6%

• Elevated valuation multiples → –6% to –12%

Opportunities

• High-NA EUV adoption cycle → +10% to +18%

• AI data center chip demand → +7% to +14%

• Services growth from installed base → +4% to +8%

Threats

• China export restrictions → –7% to –13%

• Semiconductor capex downturn risk → –8% to –15%

• Geopolitical supply chain risks → –4% to –8%

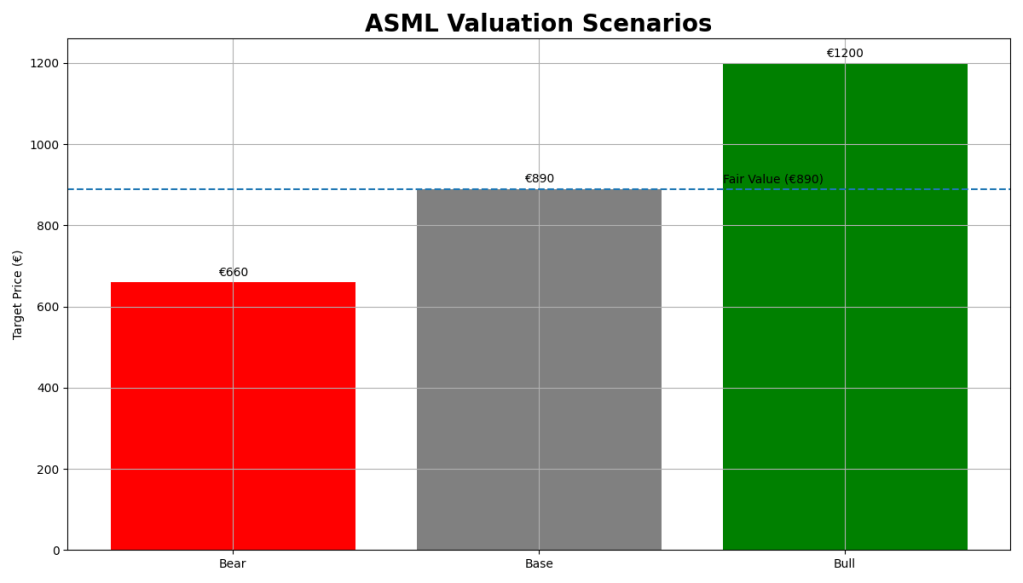

Valuation Scenarios

ASML’s valuation reflects its position as a toll collector on advanced chip manufacturing rather than a traditional cyclical equipment maker.

Bear Case

AI spending slows, High-NA adoption delayed, and multiples compress.

→ –20% to –30% downside

Base Case

Steady AI demand, gradual High-NA ramp, stable margins.

→ +10% to +18% upside

Bull Case

Accelerated AI infrastructure buildout and faster High-NA adoption.

→ +30% to +45% upside

Probability-weighted expected return: ~+10–12%

Verdict

ASML remains one of the most strategic companies in the global technology supply chain. However, with shares trading well above our fair value estimate of €880–900 (≈ $1,040–1,065), the stock appears priced for a strong AI expansion scenario. Investors are now paying for execution perfection.

Call to Action

Follow SWOTstock for structured, fundamentals-driven breakdowns that cut through earnings hype and focus on valuation, risk, and long-term positioning.

Disclaimer

This analysis is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consider risk tolerance before making investment decisions.