TL;DR Summary

JPMorgan Chase (JPM:NYSE) delivered another strong quarter, reinforcing its position as the most durable banking franchise in the U.S. While headline earnings were affected by higher reserves, underlying profitability, capital strength, and return metrics remain exceptional. At around $313 per share, the stock is no longer cheap — but it is not mispriced. JPM is now valued as a benchmark financial compounder, where upside depends on regime stability rather than re-rating.

Quarter Recap

JPMorgan Chase reported solid Q4 results that once again highlighted the strength of its franchise. Adjusted earnings remained resilient despite reserve builds tied to the Apple Card portfolio, while net interest income continued to demonstrate durability even as rate expectations evolved. Markets and trading provided meaningful support, offsetting continued softness in investment banking fees.

Management reiterated confidence in the resilience of the U.S. consumer and emphasized ongoing productivity gains from technology and AI investments. At the same time, expense growth and regulatory uncertainty remained important considerations heading into 2026.

Key Highlights

- Adjusted earnings remained strong despite higher reserves

- Net interest income continued to show structural resilience

- Trading and markets performance offset weaker investment banking activity

- Capital levels remained robust, preserving flexibility for buybacks and dividends

- Regulatory and policy risks emerged as a more visible medium-term consideration

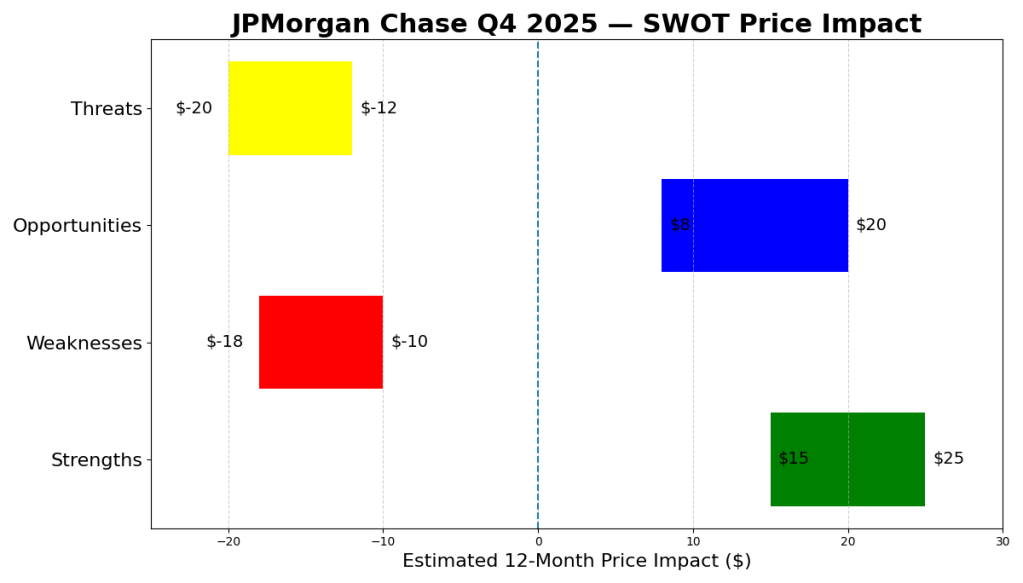

SWOT Analysis

JPMorgan’s Q4 results reinforce a familiar conclusion: this is not simply the strongest bank in the system — it is increasingly the reference point by which other financial institutions are judged.

Strengths

JPMorgan continues to generate industry-leading returns, with ROE and ROTCE far exceeding peers. Its fortress balance sheet, diversified revenue base, and disciplined risk management provide earnings durability across cycles. Technology and AI investments are already contributing to efficiency and control, reinforcing long-term competitiveness.

Estimated price impact: +$15 to +$25

Weaknesses

Rising expenses and reserve builds weighed on reported earnings, and investment banking activity remains below cycle peaks. Deposit costs have risen faster than loan yields, signaling that net interest income growth may plateau rather than accelerate.

Estimated price impact: −$10 to −$18

Opportunities

Continued share gains in payments, wealth management, and consumer banking offer long-term growth optionality. Efficiency gains from AI and automation could sustain mid-single-digit EPS growth through 2026, while capital returns remain a powerful support for shareholder value.

Estimated price impact: +$8 to +$20

Threats

Regulatory intervention — particularly around consumer credit — represents the most significant structural risk. Basel III Endgame requirements and macro volatility could also pressure returns if conditions deteriorate meaningfully.

Estimated price impact: −$12 to −$20

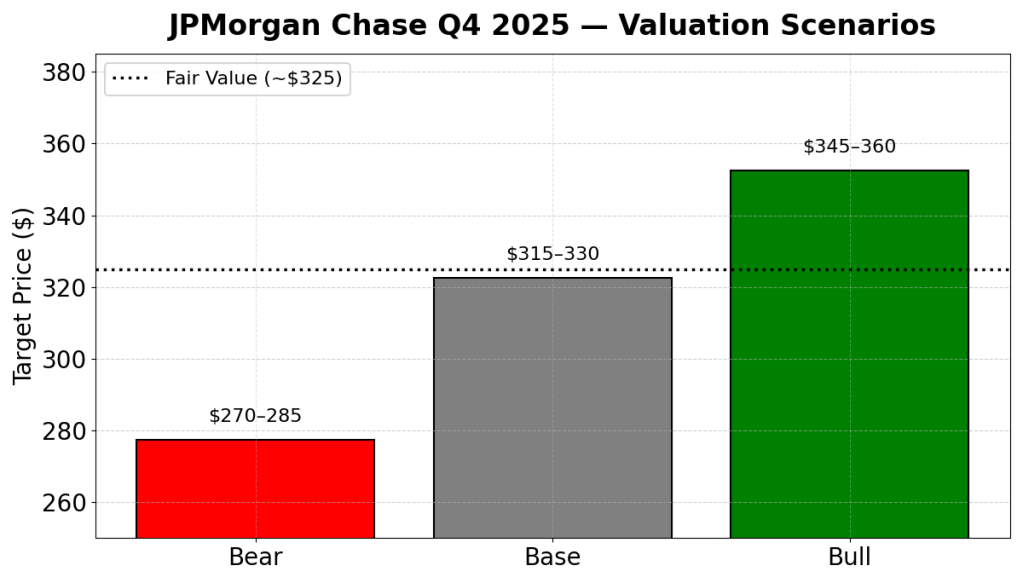

Valuation Scenarios

JPMorgan should not be valued using a generic mid-cycle bank framework. Its sustained high returns, capital strength, and systemic importance justify a premium valuation anchored to returns on equity rather than mean reversion.

Bear Scenario

This scenario assumes a meaningful regulatory or policy shock that compresses consumer banking profitability and forces a re-rating toward lower multiples.

- Assumptions: Credit-card regulation intensifies; ROE compresses; valuation reverts toward traditional bank levels

- Implied value: ~$270–285

Base Scenario

This reflects the current market view: JPMorgan sustains high-teens returns, credit normalizes gradually, and regulation remains manageable.

- Assumptions: Stable ROE near 18–20%; continued capital returns; no structural disruption

- Implied value: ~$315–330

Bull Scenario

This scenario assumes continued earnings durability, strong capital returns, and benign regulation that allows JPM to further differentiate itself from peers.

- Assumptions: EPS growth supported by efficiency gains and capital return; premium valuation sustained

- Implied value: ~$345–360

Probability-Weighted Fair Value

Taking these scenarios together, JPMorgan’s fair value clusters around:

~$320–330 per share

Verdict

JPMorgan has evolved beyond being simply a fortress bank. It is now a benchmark asset within financials — valued not for upside surprise, but for durability, discipline, and resilience.

At current levels, the stock offers limited re-rating potential but remains highly attractive as a long-term compounder for investors seeking stability, capital preservation, and steady returns. The primary risk is no longer execution, but regime risk: regulatory or political shifts that could challenge the premium valuation.

For long-term value investors, JPMorgan remains a cornerstone holding — not because it is cheap, but because few institutions can match its consistency when conditions become uncertain.

Call to Action

If you hold JPMorgan, the question is no longer whether it is well run — that is already proven. The real question is whether its valuation regime remains intact. For investors building resilient portfolios, this remains one of the highest-quality financial assets available.

Disclaimer

This analysis is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider your financial situation before making investment decisions.