TL;DR

Louisiana-Pacific (LPX) reported Q2 2025 results showing record siding performance but an OSB-driven EPS miss. With siding now ~88% of EBITDA, the company’s transformation away from commodity cyclicality is well underway. At ~$90.81, LPX trades near our tariff-adjusted bear-case range, offering potential value for patient investors despite macro and policy headwinds.

Quarter Recap

In Q2 2025, LPX generated $755M in revenue (–$60M YoY). Siding Solutions grew 11% to $460M in sales, achieving record EBITDA of $125M with ~27% margins. OSB revenue fell $101M, with margins collapsing to ~8%. Adjusted EPS of $0.99 missed consensus by ~$0.09, mainly due to OSB weakness. Liquidity remains strong at $1.1B with no revolver debt, and the dividend of $0.28/share was maintained.

Key Highlights

Siding’s resilience, paired with OSB’s deep pricing trough, defined Q2’s results. LPX continued to shift its earnings mix toward siding, enhancing margin stability.

Highlights:

- Record Siding EBITDA: $125M, +11% YoY sales, +8% volume, +2% price/mix.

- OSB Weakness: $19M EBITDA vs. ~$130M a year ago.

- Segment Mix Shift: Siding share of EBITDA up from ~47% in 1H24 to ~76% in 1H25.

- Capex Discipline: FY25 cut by $60M to $350M.

- Dividend: $0.28/share, ~1.2% yield, payout ratio ~28%.

- Buyback: $177M authorization remaining.

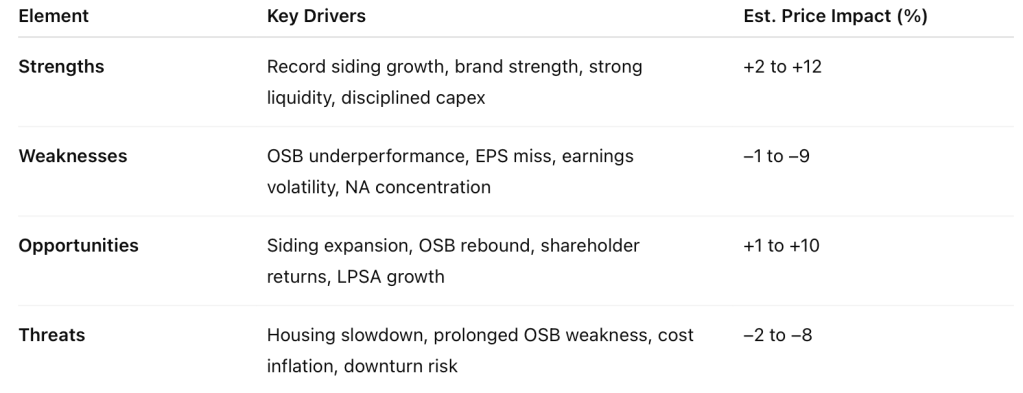

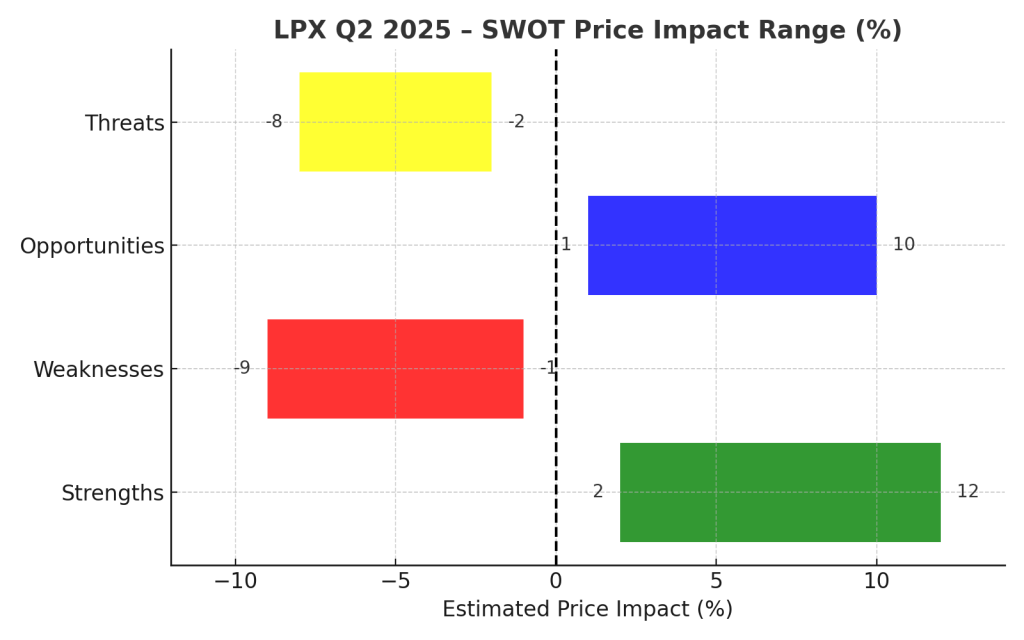

SWOT Analysis with Price Impacts

LPX’s strengths lie in siding-led growth, brand equity, and a strong balance sheet. Weaknesses remain in OSB’s commodity exposure and concentrated North American footprint. Opportunities include further siding penetration, eventual OSB recovery, and international expansion. Threats are led by housing softness, tariff risk, and cost inflation.

SWOT Summary

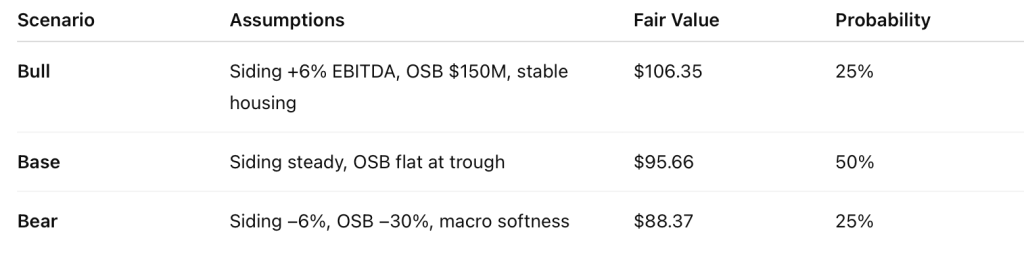

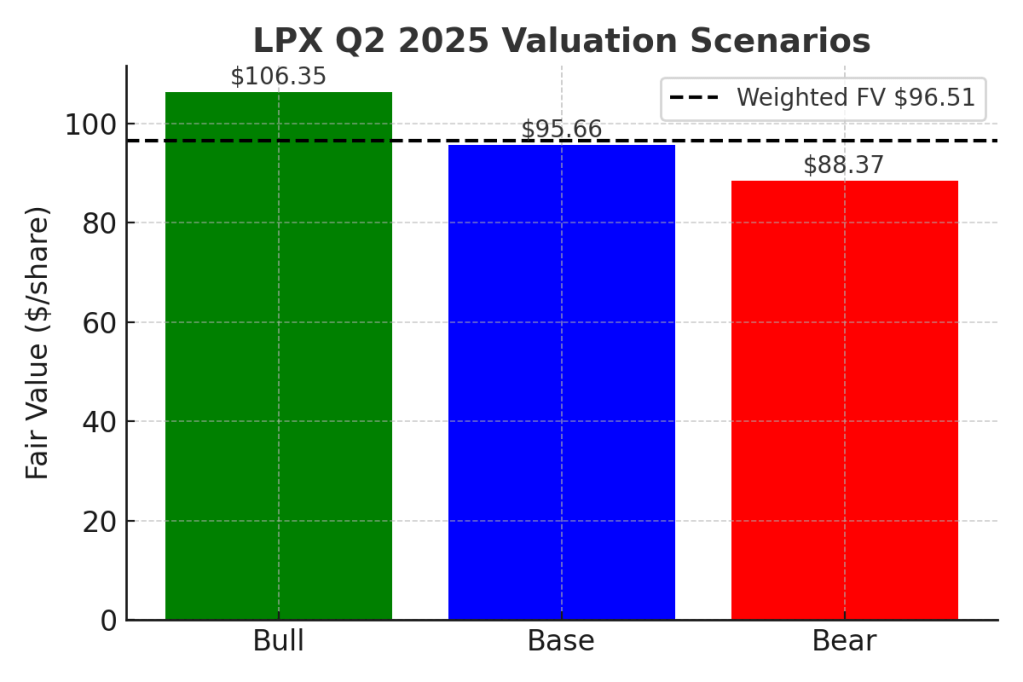

Valuation Scenarios – Narrative + Table

We model three 12-month outcomes based on SWOT drivers:

Probability-Weighted Fair Value

(0.25×106.35)+(0.50×95.66)+(0.25×88.37)≈96.51(0.25×106.35)+(0.50×95.66)+(0.25×88.37)≈96.51

Fair Value Estimate: ~$96.50/share (12-month outlook, excluding severe tariff shocks)

Verdict – Buy/Hold/Sell with Reasoning

For Value Investors, LPX is slightly undervalued on a macro-adjusted basis. The siding transformation is delivering stable margins, OSB is a smaller earnings contributor, and the dividend appears safe. Tariff and macro risks remain, but current pricing offers a margin of safety.

Action: Hold/Add on dips at $88–90, target $96–100 over 12 months.

Call to Action

Want more building-product stock breakdowns with segment-level insight and AI-optimized formats? Subscribe to SWOTstock for in-depth valuations and macro risk analysis.

Disclaimer

This analysis is for informational purposes only and is not financial advice. Based solely on LPX’s Q2 2025 official filings, earnings call, and management commentary. Investing in equities involves risk, including loss of principal.

Leave a comment