📊 Quick Take: SoftBank’s Comeback with a Catch

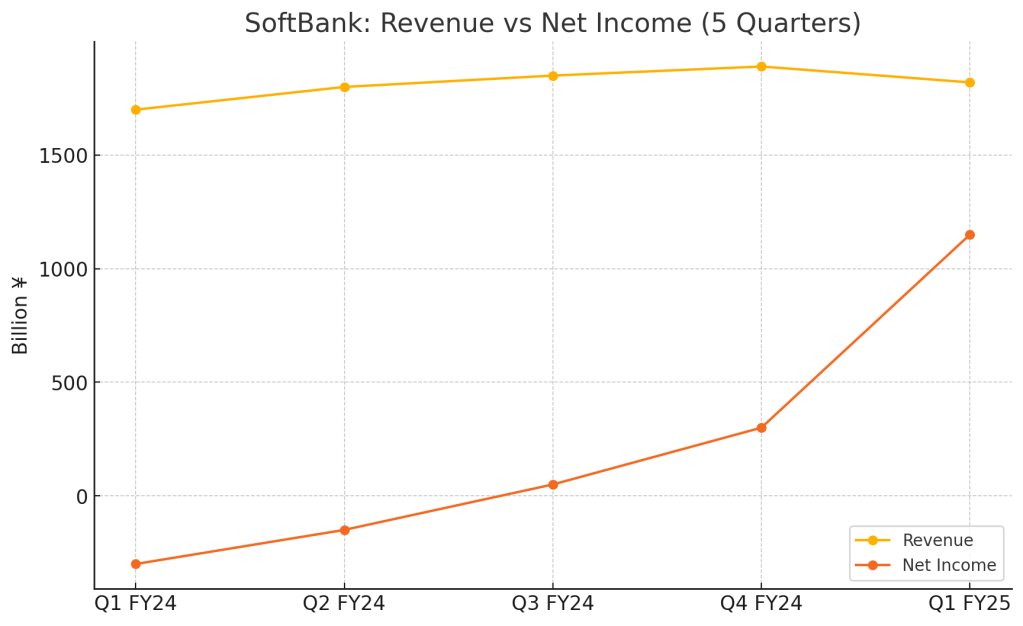

SoftBank (TYO: 9984) just reported its first annual profit in four years, driven by gains in its Vision Fund 1 and a bold AI investment strategy. But Vision Fund 2 is still dragging, and debt remains high. For investors who look at the numbers, the stock looks slightly undervalued—but only if the company delivers on its big promises.

📎 Inside the Numbers: What Drove SoftBank’s FY2025 Profit

SoftBank Group posted a net profit of ¥1.15 trillion for the fiscal year ended March 31, 2025. This was a sharp turnaround from a ¥227.6 billion loss in the previous year. Revenue came in at ¥7.24 trillion, up 7.2% year-over-year, with Vision Fund 1 showing strong gains thanks to holdings like ByteDance and Coupang.

Management emphasized a shift from defense to offense: investing aggressively in AI and semiconductors. That includes a $6.5 billion acquisition of Ampere and plans to invest up to $40 billion in OpenAI via a syndicated structure.

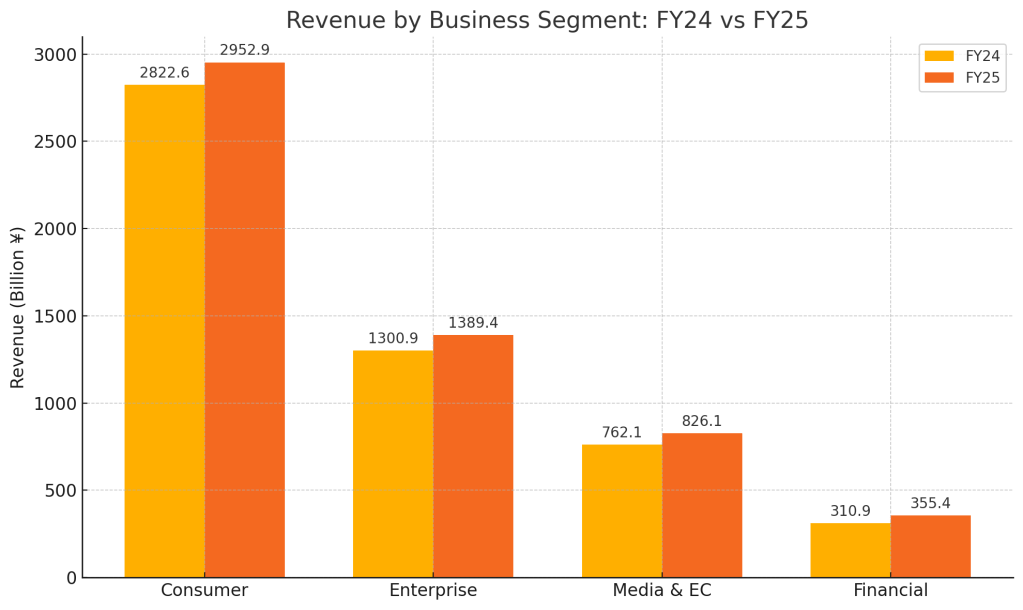

Core segment performance also showed solid growth:

- Consumer Segment: ¥2,952.9B revenue (+4.6% YoY) — growth in mobile and device sales

- Enterprise Segment: ¥1,389.4B revenue (+6.8% YoY) — strong digital transformation demand

- Media & EC: ¥826.1B revenue (+8.4% YoY) — profitability from LY Group

- Financial Segment: ¥355.4B revenue (+14.4% YoY) — PayPay turned profitable

Retail investors who like to dig into financials should take note: the company is pivoting hard into high-risk, high-reward territory.

✔️ FY2025 Financial Snapshot: Key Metrics

- Revenue: ¥7.24 trillion (+7.2% YoY)

- Net Profit: ¥1.15 trillion (vs. ¥-227.6B last year)

- Operating Income: ¥989 billion (+12.9% YoY)

- Vision Fund 1: ¥940B gain

- Vision Fund 2: ¥526B loss

- Debt: ¥20 trillion gross

- New Bets: $6.5B Ampere deal, $40B OpenAI initiative

- Milestone: PayPay turned a profit

🔄 SoftBank SWOT Breakdown: What Matters for the Stock Price

Let’s look at what’s working, what isn’t, what could go right, and what could go wrong.

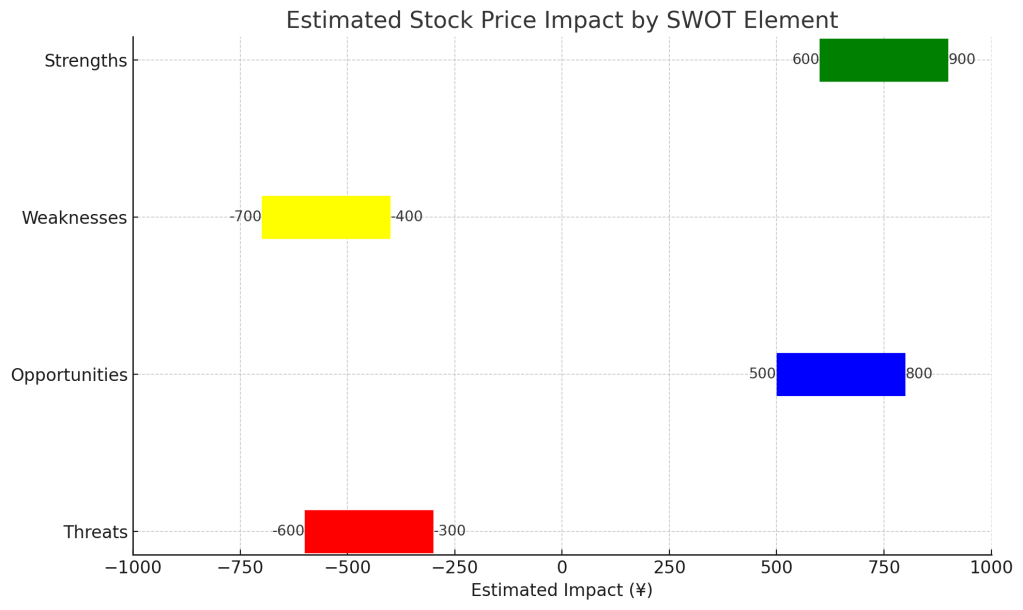

✅ Strengths (Estimated Impact: +¥600 to +¥900/share)

SoftBank’s biggest strength this year is its return to profitability after four years of net losses. The ¥1.15 trillion net income was driven by a rebound in Vision Fund 1, with standout contributions from ByteDance and Coupang. This recovery not only boosts confidence in SoftBank’s asset management capabilities but also reinforces the company’s ability to generate liquidity without resorting to fire-sale asset divestments. Combined with a still-strong balance sheet and monetizable assets like Arm, this foundation supports SoftBank’s ability to take bold bets while weathering downturns. If this profit trend continues and Vision Fund 1 remains stable, the stock could see an upside of ¥600 to ¥900.

❌ Weaknesses (Estimated Impact: –¥400 to –¥700/share)

SoftBank’s structural complexity continues to weigh on investor confidence. Vision Fund 2 posted another ¥526 billion in losses, underscoring ongoing difficulties in picking and scaling private tech companies. Furthermore, SoftBank’s gross debt remains high—hovering around ¥20 trillion—which raises concerns about financial leverage, especially in an uncertain macro environment. Transparency remains a challenge too, with limited visibility into how SoftBank values its private holdings. These factors contribute to a persistent NAV discount and could drag the stock down by ¥400 to ¥700 if not addressed.

🌱 Opportunities (Estimated Impact: +¥500 to +¥800/share)

The company’s aggressive pivot toward AI infrastructure is its most exciting growth lever. Its $6.5 billion acquisition of chip designer Ampere and the $40 billion OpenAI syndicate initiative could position SoftBank as a foundational player in the next generation of AI compute platforms. Additionally, further monetization or appreciation of its Arm stake could catalyze a narrowing of the NAV discount. If these initiatives gain traction—especially if SoftBank manages to translate AI exposure into realized profits—the stock could gain ¥500 to ¥800.

⚠️ Threats (Estimated Impact: –¥300 to –¥600/share)

However, execution risk remains substantial. SoftBank’s exposure to China through holdings like ByteDance continues to invite regulatory and geopolitical scrutiny. A negative revaluation of its private tech holdings—especially in Vision Fund 2—could quickly erode book value. Moreover, AI investments are capital-intensive and long-dated, and success is far from guaranteed. If investor sentiment turns bearish due to underperformance or macro risks, these threats could lead to a ¥300 to ¥600 drop in valuation.

📊 SWOT Summary Table

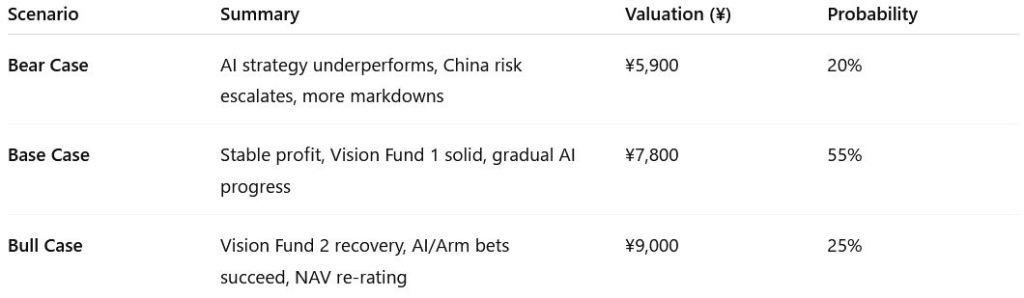

📈 SoftBank Valuation Outlook: What the Scenarios Say

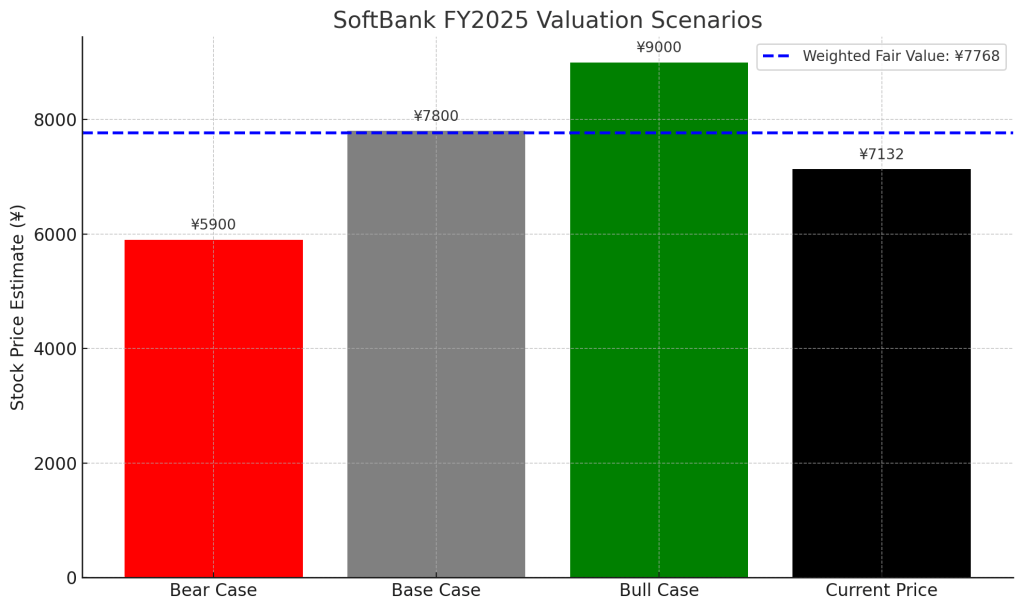

🟢 Bull Case – ¥9,000/share (25% probability)

In the most optimistic scenario, SoftBank’s AI strategy delivers early wins: Ampere gains market traction, OpenAI collaboration creates monetizable infrastructure, and the Vision Funds return to consistent profitability. With key portfolio holdings like Arm appreciating further and public market sentiment improving, SoftBank’s NAV discount begins to narrow. If earnings stabilize and the market applies a 0.9x multiple to net asset value (up from the current 0.6x), the stock could reach ¥9,000. This case reflects investor confidence in SoftBank evolving into a key AI ecosystem enabler—and we assign it a 25% probability.

⚪ Base Case – ¥7,800/share (55% probability)

The base case assumes steady execution across SoftBank’s core holdings. Vision Fund 1 remains profitable, and Vision Fund 2 stabilizes but still underperforms. AI investments progress but require time to show returns. The company continues monetizing assets like Arm while maintaining financial discipline. We apply a 0.75x NAV multiple to a stable book value, yielding a target price of ¥7,800. This scenario reflects the most likely trajectory based on current guidance and investment pacing.

🔴 Bear Case – ¥5,900/share (20% probability)

In the downside case, Vision Fund 2 continues to post significant losses, and macro/geopolitical headwinds—particularly China exposure—impact SoftBank’s tech-heavy portfolio. AI investments struggle to gain traction or consume more capital than expected. If NAV contracts and the market applies a more conservative 0.55x multiple, the stock could decline to ¥5,900. While less probable, this scenario reflects the risk of execution delays and external shocks, especially in the global tech sector.

🎯 Weighted Probability Valuation

(¥9,000 x 0.25) + (¥7,800 x 0.55) + (¥5,900 x 0.20) = ¥7,768

Current price: ¥7,132 (as of May 13,2025)

Upside: ~+9%

📝 Final Take: Is SoftBank Stock Worth It?

If you trust the numbers and think SoftBank can execute its AI strategy, the stock looks modestly undervalued. But it comes with real risks. This isn’t a set-it-and-forget-it stock—you’ll want to watch each quarter closely.

📢 Stay Ahead: Get More Stock Breakdowns Like This

Want more plain-English stock breakdowns like this? Subscribe now and get the next one before the headlines hit.

⚠️ Disclaimer

This analysis is based only on SoftBank’s official financial report and earnings call. It is not investment advice. Always do your own research before investing.

Leave a comment