TL;DR

SAP’s Q2 2025 delivered 24% YoY cloud growth, 83% free cash flow surge, and margin expansion, yet the stock dropped ~6%. For growth‑minded investors, this may be an opportunity to accumulate, as SAP pushes deeper into AI‑driven enterprise solutions and China expansion, though macro and FX risks remain.

Quarter Recap: Why This Matters to Growth Investors

SAP posted Q2 revenues of €9.43B, driven by cloud revenue of €5.13B (+24% YoY) and a backlog increase of 22%. Operating margin rose to 27.2% (+1.8pp), while free cash flow surged 83% to €2.36B.

So why did shares drop ~6%? The market zeroed in on slowing backlog growth, macroeconomic uncertainty, and FX drag, which overshadowed the otherwise strong report.

Why you should care: SAP’s fundamentals still point to a cloud‑first, AI‑powered transformation with improving profitability — a combination attractive for growth investors with a mid‑term horizon.

Key Highlights

- Cloud revenue: €5.13B (+24% YoY)

- Total backlog: +22% YoY

- Operating margin: 27.2% (+1.8pp YoY)

- Free cash flow: €2.36B (+83% YoY)

- Share buyback: Up to €5B, supporting EPS

AI: More Than a Buzzword — What SAP Is Building

SAP is embedding generative AI into its Business AI platform, integrating tools across ERP, procurement, and HR. It’s also expanding AI‑as‑a‑service offerings, giving customers access to pre‑built, domain‑specific AI models.

CEO Christian Klein emphasized that AI is “not just an add‑on but core to SAP’s next‑generation enterprise software.” This positions SAP to capture higher‑margin, stickier revenue as clients adopt AI‑enhanced workflows.

Peer Comparison: How Does SAP Stack Up?

- SAP: Cloud +24%, margin 27.2%, P/E ~24x

- Oracle: Cloud +20%, margin ~41%, P/E ~30x

- Microsoft (Intelligent Cloud): +21%, margin ~42%, P/E ~35x

SAP trades at a relative discount while maintaining competitive growth — a point for long‑term investors to watch.

SWOT Analysis: Price Impact on the Table

SAP’s Q2 shows resilience in cloud, growing AI initiatives, and geographic diversification, offset by backlog sensitivity and macro risk.

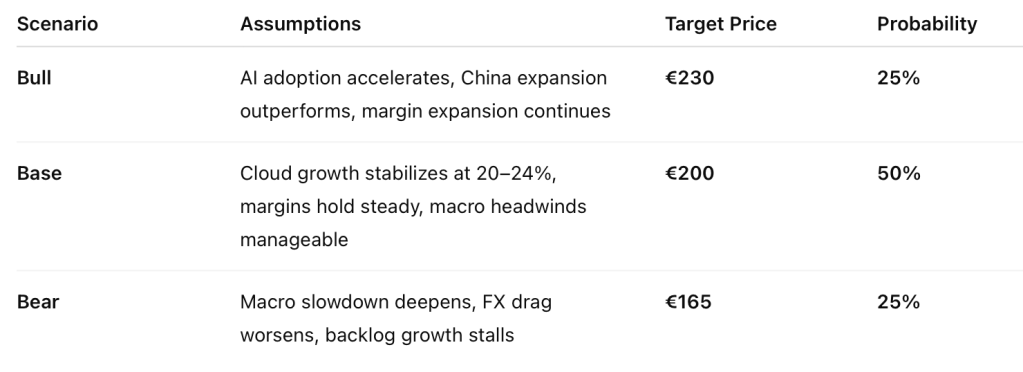

Valuation Scenarios: Where Could the Stock Go?

Probability‑Weighted Fair Value:

(0.50 × 200) + (0.25 × 230) + (0.25 × 165) = €198.75 (~€199).

Verdict: An Attractive Mid‑Term Entry for Growth Investors

SAP is cheaper than its peers, with comparable growth and a clear AI‑driven roadmap. The post‑earnings dip brings it within our fair value range (€195–205), offering a tactical entry for investors who believe in its AI and China growth story.

Call to Action: Should You Buy?

Before adding SAP, ask yourself:

- Do you believe AI integration will drive higher‑margin growth?

- Are you comfortable with China exposure amid global trade uncertainty?

- Does SAP’s valuation vs. Oracle/Microsoft justify a position in your portfolio?

Join the conversation: What’s your take on SAP’s AI pivot? Share your thoughts in the comments and explore more at SWOTstock.com.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. All analysis is based solely on SAP’s official Q2 2025 financial statements, earnings call transcript, and management commentary.

Leave a comment