Quick Summary: Record Growth, Rising Risks

NVIDIA (NASDAQ: NVDA) crushed expectations with $26B in revenue and bold Q2 guidance, driven by unmatched AI infrastructure demand. The company’s product roadmap is solid, but geopolitical risks and premium valuation mean the stock may be running ahead of execution—at least in the near term.

Quarter Recap: $26B Now, $28B Next?

NVIDIA reported $26.0 billion in revenue for Q1 FY2025—up 262% YoY and 18% QoQ—led by Data Center strength. Net income surged to $14.9 billion, while gross margin expanded to 76%. The company projects $28 billion in revenue next quarter, indicating strong confidence in near-term demand.

CEO Jensen Huang called this the beginning of a new era of “AI factories.” NVIDIA’s Hopper platform continues to scale, and Blackwell is next in line—set to launch in second-half FY2025, with early production ramping in Q2.

However, the quarter wasn’t flawless: NVIDIA disclosed a $5.5 billion charge tied to H20 chips restricted under U.S. export controls. China’s contribution is now under pressure, and rising op-ex shows execution isn’t without trade-offs.

Why it matters: NVIDIA is leading the AI infrastructure race—but it’s also navigating global friction and expectations priced for perfection.

Q1 FY2025 Key Metrics (Official Results)

- Revenue: $26.0B (+18% QoQ, +262% YoY)

- Net Income: $14.9B (+628% YoY)

- Non-GAAP EPS: $6.12

- Gross Margin: 76%

- Data Center: $22.6B (+427% YoY)

- Gaming: $2.6B (–8% QoQ)

- Q2 Guidance: Revenue ~$28B

- Operating Expenses: $3.5B (+39% YoY)

- Cash & Equivalents: $31.4B

- 10-for-1 Stock Split: Effective June 7

- Dividend: +150% increase (post-split)

Revenue vs Net Income (Last 5 Quarters)

SWOT: What’s Driving NVIDIA—and What Could Break It

Let’s use the SWOT framework to break down what’s going well, what’s lagging, what’s coming, and what could derail NVIDIA’s momentum.

Strengths

NVIDIA is the undisputed AI infrastructure leader. Gross margins are elite. Blackwell and Hopper platforms position the company for continued dominance through 2025.

Price impact: Supports +$20 to +25/share if growth holds.

Weaknesses

Gaming sales declined, operating expenses jumped, and product cycle execution has some lags. These aren’t dealbreakers, but they tighten the margin for error.

Impact: –$4 to –6/share downside from earnings pressure.

Opportunities

Blackwell chips are set to ramp late FY2025 and enable trillion-parameter scale models. NVIDIA also sees long-term demand from sovereign AI and enterprise. Q2 guidance of $28B confirms near-term visibility.

Potential upside: +10 to +15/share if Blackwell ramps as expected.

Threats

U.S. export restrictions caused a $5.5B charge on H20 chips. Further geopolitical or regulatory changes could cut off high-margin international revenue. Valuation already prices in near-flawless execution.

Downside risk: –8 to –10/share if regulations worsen or growth slows.

Before the Valuation—Let’s Talk Risk

Top Risks to Watch:

- Further China/US tension could block additional revenue channels.

- Overreliance on AI infrastructure capex may face slowdown if macro weakens.

- Valuation compression risk if NVIDIA misses a quarter or delays rollout.

This context helps weigh the bull vs bear case more realistically.

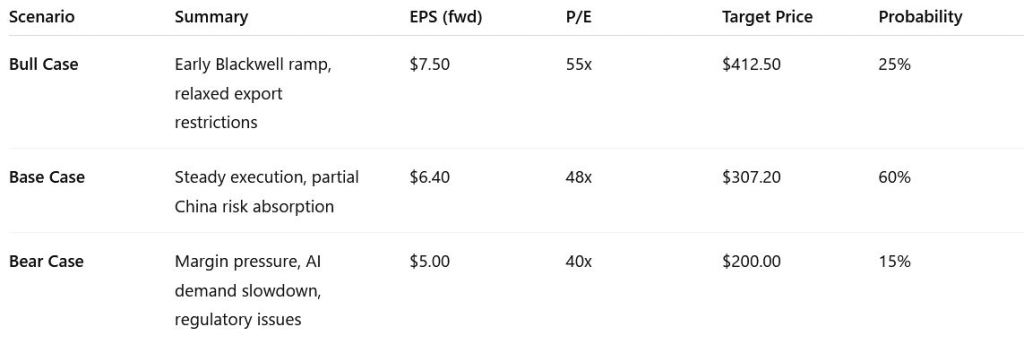

Valuation Scenarios: What’s Fair Value Now?

Based on Q2 guidance, current margins, and roadmap execution, here’s our valuation model:

Weighted Average Fair Value

(0.25 × $412.50) + (0.60 × $307.20) + (0.15 × $200.00) = $308.95

Current Stock Price: ~$129 (as of May 14, 2025)

→ Appears to be undervalue

Peer Check: How Does NVIDIA Stack Up?

| Company | Data Center Revenue | YoY Growth | AI Strategy |

|---|---|---|---|

| NVIDIA | $22.6B | +427% | Infrastructure |

| AMD | $2.3B (est.) | +80% | GPU + CPU |

| Intel | ~$3.0B (DCG) | ~Flat | CPUs only |

| AWS/Azure | $20–25B+ (Infra) | Varies | Cloud AI buyers |

NVIDIA remains the dominant supplier to the AI arms race, while others are buyers or partial players.

Verdict: Is NVIDIA Still a Buy After Q1?

NVIDIA’s quarter was flawless—almost too flawless. If Blackwell hits and Q2 guidance holds, the stock still has room. But the bar is now extremely high, and geopolitical/regulatory risks are real.

Call: Hold if you own. Consider adding on dips or consolidation.

Don’t Chase Headlines—Understand the Fundamentals

Stop relying on social media hype.

Subscribe now for clean, no-jargon breakdowns using only official data—delivered right after earnings.

Also check out our recent breakdowns of AMD Q1 2025, Palantir Q1 2025, Meta Q1 2025 and Alphabet Q1 2025 for more actionable insights.

Disclaimer

This article is based only on NVIDIA’s official Q1 FY2025 financial report and earnings call. No third-party commentary was used. This content is for informational purposes only and not investment advice.

Follow us on Instagram: @SWOTstock

Leave a comment