TL;DR Summary

Amazon delivered a strong Q3 with accelerating AWS growth, booming advertising revenue, and expanding retail margins. While heavy AI infrastructure investments continue to shape near-term cash flow, management’s commentary signals high confidence in long-term returns. Our fair value sits around $215/share, anchored by official financials and steady earnings momentum.

Quarter Recap

Amazon’s Q3 2025 results highlighted a business firing on multiple cylinders. Revenue came in at $180.2 billion, rising 12% year over year on a constant-currency basis. AWS saw renewed momentum with 18% growth, driven by AI training and inference workloads scaling beyond early pilot phases. The advertising segment grew an impressive 20%, outperforming other major digital-ad platforms and reinforcing Amazon’s strength as a retail media leader. Retail profitability continued improving as the company expanded its regionalized fulfillment model, which has meaningfully reduced transportation costs and enabled record levels of fast delivery. Operating income climbed 29%, powered by both AWS leverage and ongoing logistics efficiencies. Management emphasized that AI infrastructure demand is “stronger than supply,” setting the stage for sustained cloud growth into 2026.

Key Highlights

- Revenue reached $180.2B, up 12% YoY ex-FX.

- AWS accelerated to 18% YoY growth.

- Advertising expanded 20% YoY, outpacing Meta and Alphabet.

- Operating income rose 29% YoY on stronger margins.

- Trailing 12-month operating cash flow grew 18% YoY.

- Capex elevated due to AI chips and datacenter expansion.

- Retail logistics efficiencies strengthened North America margins.

- Management signaled strong Q4 momentum entering the holiday season.

SWOT Analysis

Amazon’s Q3 performance reaffirmed its dual identity as both an AI-infrastructure builder and a highly efficient global retailer. While AWS and Advertising push margins higher, AI-related capex introduces near-term cost pressure. Below is the structured SWOT summary with estimated price-impact ranges for each factor.

🟩 Strengths (+5% to +12%)

- AWS growth re-accelerated to 18% YoY, confirming strong AI workload demand.

- Retail logistics efficiency continues improving margins through regional fulfillment.

- Advertising surged 20% YoY, expanding Amazon’s high-margin revenue mix.

- Strong operating cash flow (+18% TTM) supports massive AI infrastructure build-out.

🟥 Weaknesses (–4% to –9%)

- AI infrastructure capex remains very high as Trainium2 and datacenter expansion scale.

- International segment profitability still lags despite solid revenue growth.

- Growing analyst concerns that margins may peak in late 2026.

- Limited disclosure on AWS margins keeps long-term leverage uncertain.

🟦 Opportunities (+8% to +15%)

- AI chips (Trainium2, Inferentia) strengthen Amazon’s competitive position in cloud AI.

- Prime Video’s ad-tier ramp unlocks a fast-growing high-margin ad channel.

- Enterprise AI adoption transitioning from pilots to deployment boosts AWS utilization.

- “Buy with Prime” and logistics-as-a-service expand total addressable market.

🟨 Threats (–7% to –14%)

- Cloud pricing pressure from Microsoft and Google intensifying around AI workloads.

- Regulatory scrutiny across antitrust, advertising, and marketplace operations.

- Global supply-chain constraints could slow AWS datacenter build-out.

- Retail macro uncertainty may limit unit growth into 2026.

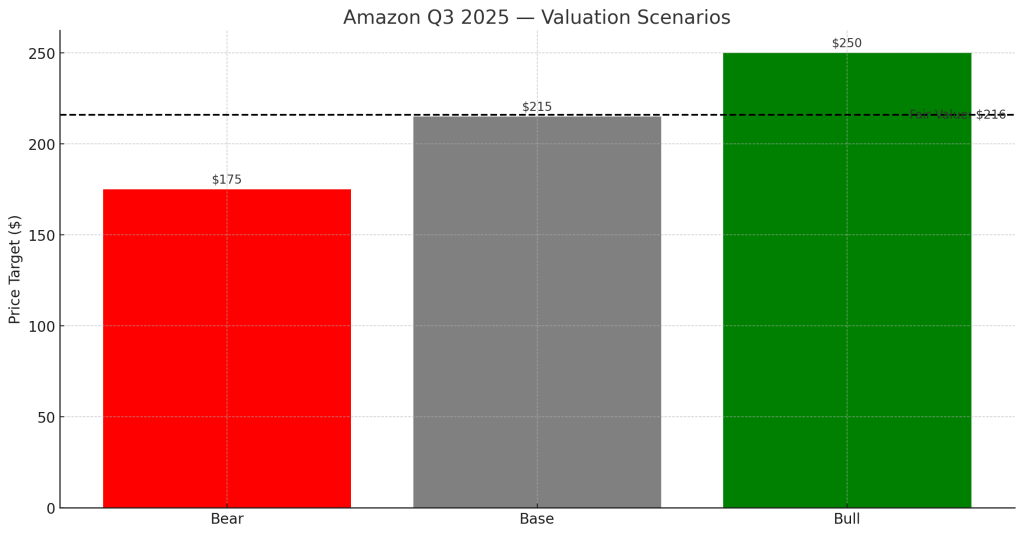

Valuation Scenarios

Using Amazon’s official Q3 results and management commentary, these valuation scenarios outline how earnings and multiples may evolve as AWS, Advertising, and Retail continue driving profitability. All calculations anchor to FY2026 earnings potential and Amazon’s historical valuation range during similar growth regimes.

🔴 Bear Case — $175/share (20%)

- AWS slows toward 12% YoY growth in 2026.

- Retail margin expansion stalls due to cost inflation.

- Applying 22× on ~$8.00 FY26 EPS → ~$176.

⚪ Base Case — $215/share (55%)

- AWS grows 15–17% YoY, supported by AI infrastructure demand.

- Advertising scales as a third core profit engine.

- Retail margins continue gradual improvement.

- Applying 27× on ~$8.00 FY26 EPS → ~$216.

🟢 Bull Case — $250/share (25%)

- AWS accelerates above 20% YoY from enterprise AI deployment.

- Prime Video advertising outperforms expectations.

- Retail unit economics exceed guidance.

- Applying 30×+ on ~$8.30 FY26 EPS → ~$249.

⭐ Probability-Weighted Fair Value

20% × 175 + 55% × 215 + 25% × 250 = ~216

Final fair value estimate: ~$216/share

Verdict

Amazon’s Q3 results reinforce the company’s position as a long-term compounder powered by AI infrastructure, high-margin advertising, and increasingly efficient retail operations. AWS re-acceleration, combined with sustained cash-flow growth, provides strong visibility into earnings through 2026. While elevated capex and regulatory pressure remain risks, Amazon’s foundational drivers appear robust. At ~mid-$190s pre-earnings levels, the stock offered a compelling setup toward our ~$216 fair value.

Call to Action

If you want more breakdowns of mega-cap tech earnings, SWOT analyses, and fair-value models, follow SWOTstock for updates ahead of the next major reporting cycle.

Disclaimer

This analysis is for informational purposes only and is not investment advice. All estimates reflect public information from Amazon’s official financial results and management commentary.