TL;DR Summary

Autodesk delivered a solid Q3 FY2026 with 11% ARR growth, stable margins, and a clearer AI roadmap that finally met investor expectations. Management reaffirmed full-year guidance and highlighted momentum in Autodesk Platform Services (APS) and generative design workflows. The market reacted positively: shares moved from $294.43 to $312.50 after hours right after the report, reflecting confidence that Autodesk is entering an early multi-year upcycle. Our fair value stands at $305, with upside tied to AI monetization and the pace of cloud platform adoption.

Quarter Recap

Autodesk reported Q3 FY2026 results on November 25, 2025, delivering an encouraging mix of growth and visibility. Revenue reached $1.44B (+10% YoY), supported by strong subscription trends and resilient renewal rates. ARR increased 11% YoY to $6.0B, outpacing expectations and stabilizing concerns around construction end markets.

Margins remained healthy, with non-GAAP operating income near $480M and EPS landing above consensus due to cost discipline and efficient R&D leverage. Free cash flow guidance was reaffirmed, and management emphasized their confidence in both APS and the early rollout of AI-assisted design features.

Key Highlights

- ARR +11% YoY, ahead of expectations and supported by stable renewal trends.

- Revenue +10% YoY, demonstrating resilience across AEC and manufacturing.

- EPS beat driven by stronger margins and operating efficiency.

- AI roadmap clarified, with early generative design and automated drafting features highlighted.

- APS gaining traction, boosting attach rates and pricing power.

- Mixed macro in construction, but not deteriorating.

- Post-earnings reaction: stock jumped +6.1% after hours, reaching $312.50.

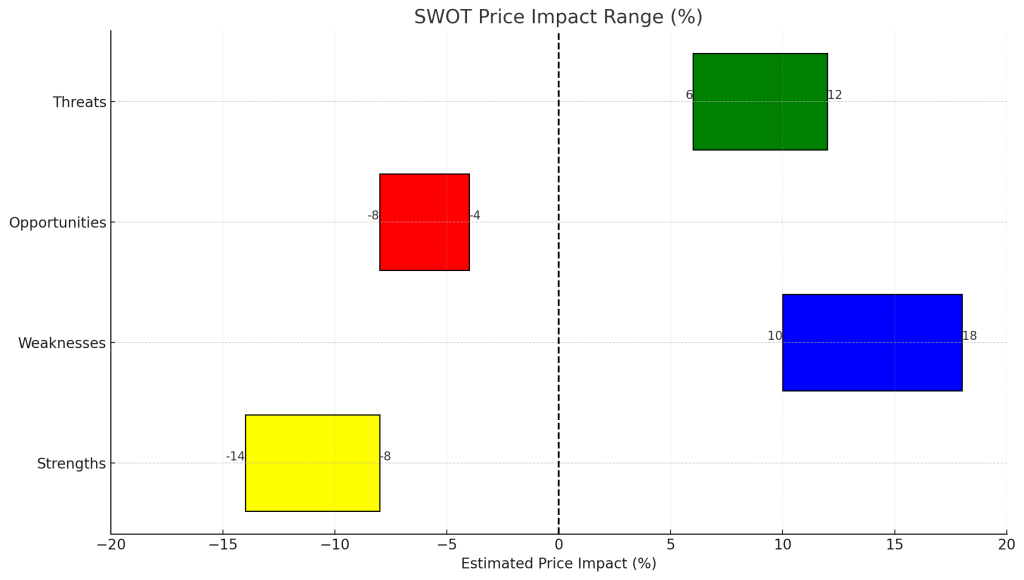

SWOT Analysis

Autodesk heads into 2026 with improving visibility, a stronger ARR engine, and a clearer AI monetization path. The market rewarded the company for delivering above-expectation ARR growth and reinforcing confidence in APS. Risks remain tied to construction cycles, platform migration complexity, and the pace of AI adoption across design workflows.

Strengths (+6% to +12%)

- Strong ARR growth (+11%) underpins recurring revenue durability and valuation support.

- Clearer AI roadmap with generative design, automated drafting, and simulation automation.

- APS platform adoption improves attach rates and expands monetization layers.

- EPS upside from disciplined cost structure and stable margins.

- High switching costs across AEC and manufacturing keep retention rates above 100%.

Weaknesses (–3% to –7%)

- Slight billings deceleration may temper short-term revenue acceleration.

- AI monetization still early; revenue uplift remains modest for FY2026.

- AEC macro remains mixed, affecting forward demand visibility.

- SMB customers remain rate-sensitive, limiting seat expansion.

- FX remains a drag on international results.

Opportunities (+8% to +15%)

- AI-assisted design could enable multi-year ARPU expansion across core products.

- Cloud platform transition (APS) unlocks higher-margin service layers.

- Manufacturing automation demand supports Fusion 360 growth.

- Global infrastructure digitization gives long-term AEC tailwinds.

- Enterprise bundling increases deal sizes and contract duration.

Threats (–8% to –14%)

- High valuation sensitivity: small ARR misses can lead to multiple compression.

- AI-first CAD/BIM startups could challenge Autodesk’s pricing power.

- Regulatory constraints around AI training data may slow product rollout.

- Construction downturn risk could reduce seat expansions.

- APS migration execution risks could create customer friction.

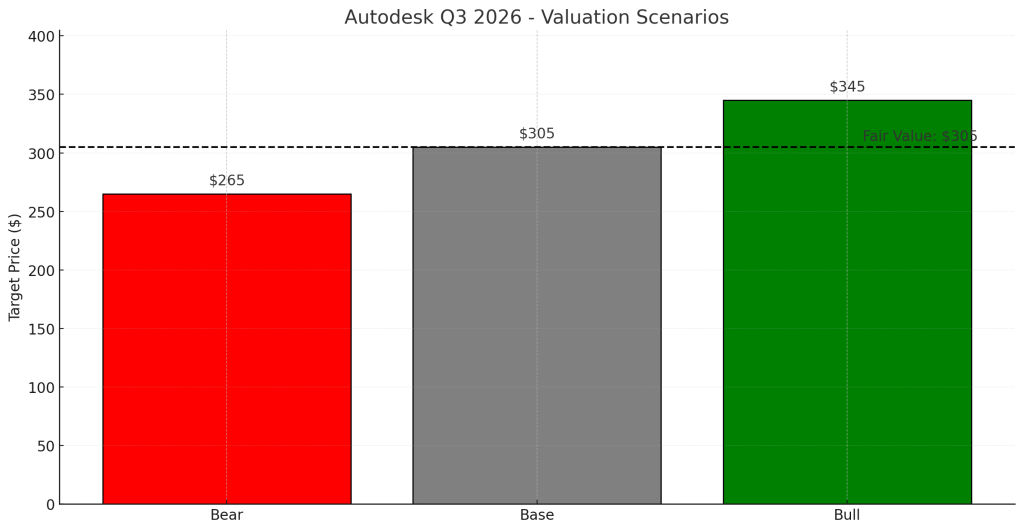

Valuation Scenarios

Autodesk’s valuation depends on the sustainability of ARR growth and the degree to which AI-enabled workflows improve ARPU. With APS adoption and AI clarity increasing, the base case assumes solid recurring revenue momentum and steadily improving free cash flow.

Bear Case — $265

- ARR slows to 8%.

- AI monetization slips into late 2027+.

- Billings decelerate further.

- Market rerates ADSK to a lower FCF multiple (20–22×).

- FCF $1.9B × 22× = $265

Base Case — $305

- ARR maintains 10–11% growth.

- APS adoption remains strong.

- Early AI features support modest 2026 ARPU uplift.

- Market assigns a 24–25× FCF multiple.

- $2.1B × 24.5× = $305

Bull Case — $345

- AI tools drive meaningful ARPU expansion.

- ARR accelerates to 12–13%.

- Margins expand through automation and bundling.

- FCF grows to $2.3B at a 27× multiple.

- $2.3B × 27× = $345

Fair Value

= (0.25×265) + (0.50×305) + (0.25×345)

= $305 fair value

Verdict

Autodesk is transitioning into a higher-visibility, AI-enhanced software platform. Q3 FY2026 showcased the strength of its recurring model and provided the clearest AI roadmap yet. With ARR reaccelerating and APS gaining momentum, ADSK deserves a premium valuation — but near-term upside depends on the pace of AI adoption and the execution of platform migration.

At $305 fair value, Autodesk looks fairly priced with balanced risk-reward. Growth investors should monitor AI feature launches and renewal behavior as the key catalysts for FY2027 upside.

Call to Action

If you found this analysis useful, follow SWOTstock for more earnings breakdowns, valuation scenarios, and AI-driven insights tailored for long-term investors. New posts drop every week covering tech, AI infrastructure, and software compounding names.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. All analysis is based on publicly available information from Autodesk’s official Q3 FY2026 financial report and earnings call. Investors should perform their own due diligence before making investment decisions.