TL;DR:

Tesla reported record Q3 revenue of $25.2 B (+7.8 %) and net income of $2.1 B (+11 %), but margin recovery remains shallow.

The fair value sits near $227/share — reasonable for holders, not yet a bargain for new buyers.

📊 Quarter Recap

• Revenue $25.2 B (+7.8 %)

• Gross Profit $5.65 B (+13 %)

• Operating Income $2.17 B (+29 %)

• Free Cash Flow $1.47 B (+61 %)

• Auto Gross Margin 19.6 % (↑ 1.3 pts YoY)

Margins have stabilized after two years of price cuts — but at ~19 %, still far below the 25 % peak of 2022.

Each 1 pt margin shift ≈ $1 B impact to net income.

💬 Management Tone

“We’re entering the autonomy era — vehicle hardware is ready.” – Elon Musk

“Capex will rise into 2026 as we ramp Optimus and Dojo.” – CFO

Translation: positive cash flow continues, but the AI and robotics push keeps capex heavy. Patience required.

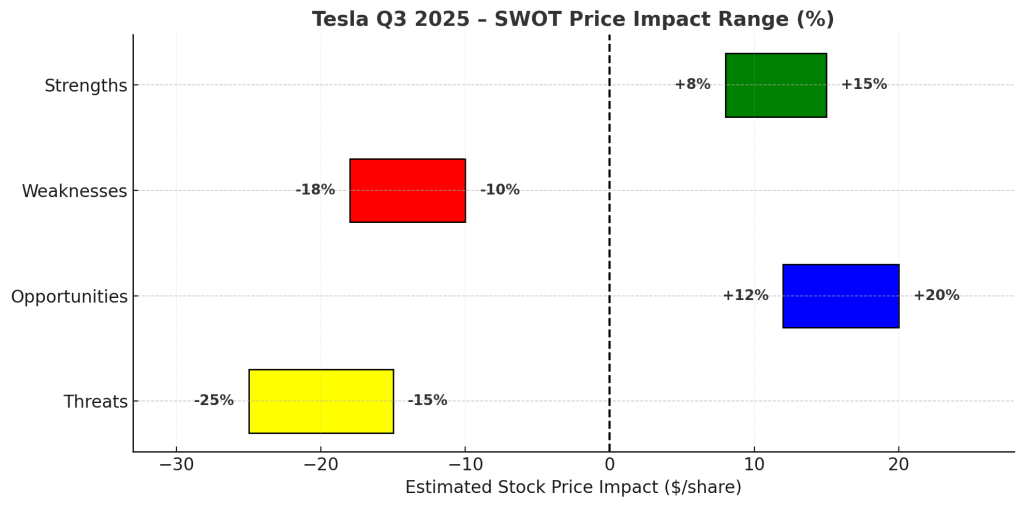

🧩 SWOT Summary (Price Impact Ranges)

Strengths (+8 – 15 %)

– Vertically integrated EV + AI ecosystem

– $25 B net cash cushion

– Sequential margin recovery

Weaknesses (–10 – 18 %)

– Margins well below 2022 levels

– Tariff + mix pressure

– Energy unit still small

Opportunities (+12 – 20 %)

– FSD subscriptions and Dojo compute could add 1–2 pts to margin

– Energy backlog extending beyond 2026

Threats (–15 – 25 %)

– BYD and Hyundai competition

– Capex overshoot risk

– Governance noise around Musk pay

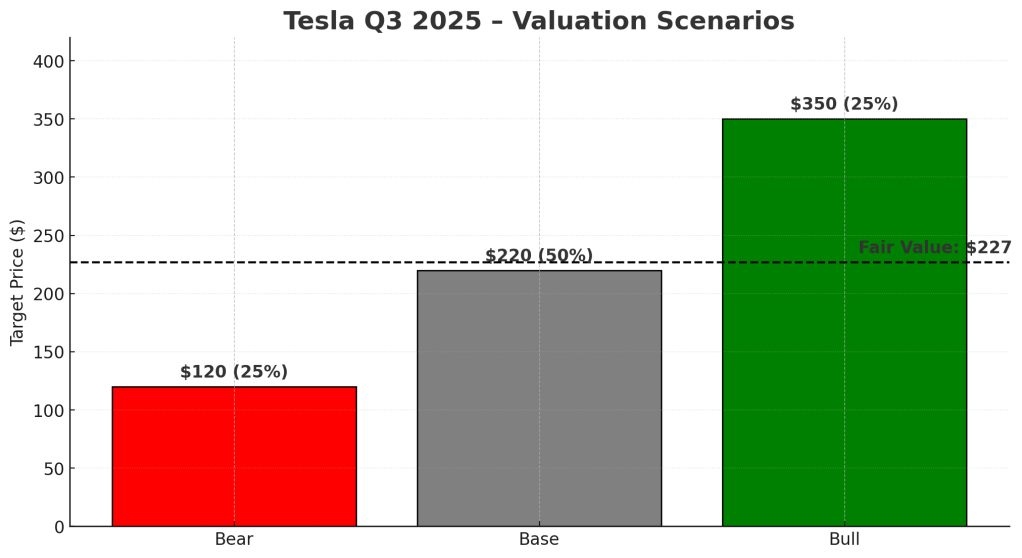

🎯 Valuation Scenarios

(Baseline price $235 pre-earnings)

• Bull ($350) — Autonomy success & 22 % margins → 25 % probability

• Base ($220) — 19 % margins & steady FCF → 50 %

• Bear ($120) — Margin < 17 %, flat cash flow → 25 %

➡ Fair Value ≈ $227/share

Buy Zone $180–190 | Hold $200–250 | Trim/Avoid > $260

🧮 Value-Investor Checklist

✅ Auto margin ≥ 19 % → base case safe

⚠️ Capex > $3 B/qtr → cash pressure

🚗 FSD revenue traction → bull trigger

📉 China ASP trend → bear signal

Verdict — HOLD (Fair Value ≈ $227)

Tesla remains a great company at a reasonable price, not a clear bargain.

Investors seeking 20 %+ margin of safety should target $180–190.

Patience beats momentum — cash and discipline will define returns.

Call to Action

📈 Subscribe to SWOTstock for AI-driven SWOT breakdowns of Tesla and other AI-era leaders — turning official filings into investor-ready insights.

Disclaimer

Based solely on Tesla Inc.’s official Q3 2025 10-Q and management remarks. Not investment advice. Do your own due diligence.